tru Independence Debuts truView Platform

Wealth Management

MAY 23, 2023

The new tool uses Advyzon as its foundation and Lumiant will support the behavioral finance aspect.

Wealth Management

MAY 23, 2023

The new tool uses Advyzon as its foundation and Lumiant will support the behavioral finance aspect.

Calculated Risk

MAY 23, 2023

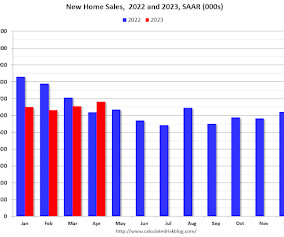

The Census Bureau reports New Home Sales in April were at a seasonally adjusted annual rate (SAAR) of 683 thousand. The previous three months were revised down, combined. Sales of new single‐family houses in April 2023 were at a seasonally adjusted annual rate of 683,000 , according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MAY 23, 2023

The Schwab/TDAI merger is creating opportunities for emerging RIA custodians with more nimble technology, natural language processing tools and automated service.

Nerd's Eye View

MAY 23, 2023

Welcome back to the 334th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Meg Bartelt. Meg is the Founder and Lead Financial Planner for Flow Financial Planning, a virtual RIA serving mid-career women in tech that oversees almost $60 million in assets under management for 60 client households. What's unique about Meg, though, is how, over the span of 7 years since launching her firm, she has evolved the business by repeatedly adapting her niche focus, iterating

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

Wealth Management

MAY 23, 2023

For 13 years beforehand, Yadlapati worked for Focus Financial Partners, most recently as managing director and co-head of M&A.

Abnormal Returns

MAY 23, 2023

Markets What price does Apple ($AAPL) need to hit to get to $5 trillion in market cap? (allstarcharts.com) 30-year mortgage rates are pushing 7% again. (mortgagenewsdaily.com) Good luck trying to predict the future shape of the yield curve. (mailchi.mp) Crypto Prosecutors are pouring through a ton of evidence in the SBF case. (nytimes.com) Coinbase ($COIN) is not sitting back in its fight with the SEC.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

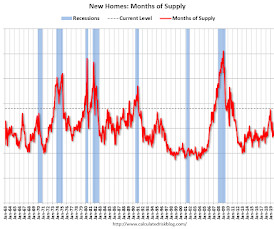

Calculated Risk

MAY 23, 2023

Today, in the Calculated Risk Real Estate Newsletter: New Home Sales at 683,000 Annual Rate in April Brief excerpt: The next graph shows new home sales for 2022 and 2023 by month (Seasonally Adjusted Annual Rate). Sales in April 2023 were up 11.8% from April 2022. As expected, new home sales were up year-over-year. As previously discussed, the Census Bureau overestimates sales, and underestimates inventory when cancellation rates are rising, see: New Home Sales and Cancellations: Net vs Gross Sa

Wealth Management

MAY 23, 2023

Flows, launches and mutual fund conversions have fueled growth of actively-managed ETFs, and one driver could be investors hunting for non-correlated investments.

The Reformed Broker

MAY 23, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Corporate Bonds – “One of Vanguard’s Biggest Credit ETFs Bleeds Record $5.5 Billion” ►52-Week Highs – “the NASDAQ-100 made a new 52-wk high after going at least 6 months without one.

Wealth Management

MAY 23, 2023

XYPN co-founder Michael Kitces and Nitrogen CEO Aaron Klein both said the industry too often puts practitioners into the role of marketing growth engines at the Wealth Management EDGE conference.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Abnormal Returns

MAY 23, 2023

Gold Gold is not portfolio insurance. (alphaarchitect.com) What is Bitcoin worth? (morningstar.com) Trading WFH traders show a lower likelihood of misconduct. (papers.ssrn.com) What can we learn from the meme stock phenomenon? (papers.ssrn.com) Hedge funds An overview of the benefits of a multi-strategy corporate arbitrage strategy. (aqr.com) How should investors rate hedge fund performance?

Wealth Management

MAY 23, 2023

Despite the initial drama, issues were resolved quickly and without court involvement.

Advisor Perspectives

MAY 23, 2023

We must understand our clients’ purposes and how they fit together in their lives. We need to take the initiative when rebalancing is in order.

Wealth Management

MAY 23, 2023

A lot of pressure to move quickly on potential acquisitions has subsided amid higher interest rates and more concerns about property values holding up.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

The Reformed Broker

MAY 23, 2023

Call of the Day: HSBC upgrades Chevron to buy from CNBC. The post Clips From Today’s Halftime Report appeared first on The Reformed Broker.

Wealth Management

MAY 23, 2023

But as with any game of chance, the house usually wins.

Calculated Risk

MAY 23, 2023

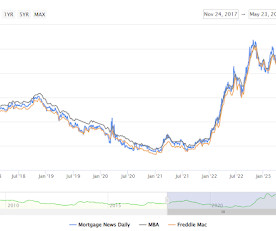

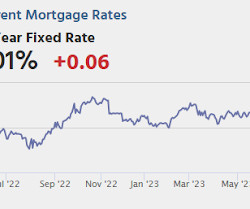

From Matthew Graham at MortgageNewsDaily: Mortgage Rates Move Back Above 7% Today's headline is the most dramatic part of today's story on mortgage rates. The average top tier 30yr fixed rate has been mostly operating in a 6-7% range since September 2022. There were several weeks in the low to mid 7s in Oct/Nov and a few days in early March. Rates were already quite close to 7% yesterday and today merely provided a gentle nudge.

Wealth Management

MAY 23, 2023

RIAs should already be providing more than a portfolio and financial plan, say the heads of Morningstar and Pershing X, but will need to do more to capture trillions of assets expected to transfer in the coming years.

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Calculated Risk

MAY 23, 2023

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • During the day: The AIA's Architecture Billings Index for April (a leading indicator for commercial real estate).

Wealth Management

MAY 23, 2023

Today's retirement challenge: accumulation, decumulation and protection.

The Irrelevant Investor

MAY 23, 2023

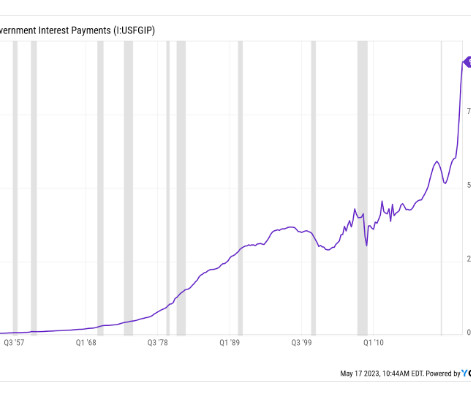

Today’s Animal Spirits is brought to you by YCharts: See here to register for YCharts webinar discussing the scenarios tool with a big emphasis on how it helps streamline the financial planning process for advisors with RWM COO Nick Maggiulli on May 24th at 12:30pm Eastern On today’s show, we discuss: Carl Icahn admits mistake with bearish bet that cost $9B Steve Cohen is ‘pretty bullish’ on markets than.

Wealth Management

MAY 23, 2023

As the indexing trend of recent years shows, replacing smart humans with stupid computers has more downside than upside for markets.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Advisor Perspectives

MAY 23, 2023

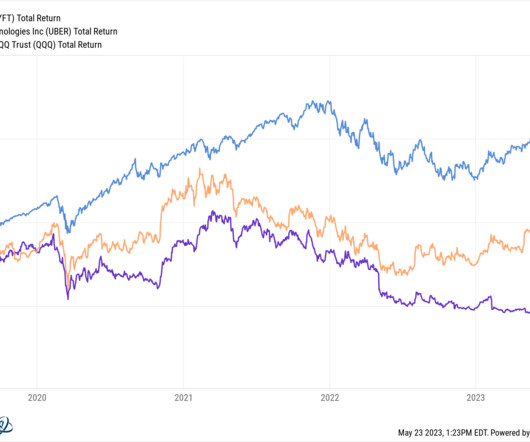

Diversification is a cornerstone of thoughtful, long-term focused investing. Incorporating assets and asset classes that don’t always move in tandem – that is, their returns aren’t strongly correlated – can help temper stock and bond market risk.

Wealth Management

MAY 23, 2023

Access your free CE course catalog.

Trade Brains

MAY 23, 2023

Fundamental Analysis of Laxmi Organic Industries: After listing at a premium of 20% in March 2021, the stock of Laxmi Organic Industries rallied further by 200% in another 7 months. However, the stock has corrected 50% since then. Does this fall make it an attractive company? What can the investors of the company expect in the coming quarters? We’ll try to answer these and many other questions in our fundamental analysis of Laxmi Organic Industries Ltd.

Wealth Management

MAY 23, 2023

Wednesday, June 28, 2023 | 2:00 PM ET

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

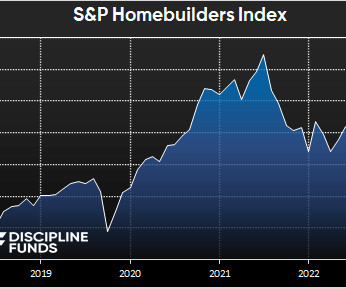

Discipline Funds

MAY 23, 2023

It’s only May, but if I had to pick a chart of the year it would be housing stocks. In fact, housing as a whole has been remarkably resilient this year. If you’d told me that there would be a bank panic and 7% mortgage rates in May I would have predicted that the housing market was cratering. And sure, it hasn’t exactly been a raging bull market.

Wealth Management

MAY 23, 2023

Despite others shelving their SPACs, flyExclusive is moving forward with theirs, valued at $900 million.

Clever Girl Finance

MAY 23, 2023

When I first moved into my first apartment, I had a lot of reality checks. Some I was semi-aware of (why is furniture SO expensive anyway?) and others I wasn't, such as grocery shopping. And so based on my experience, I've gathered 25 of the cheapest meals from around the web, so you can not only dine in style, but you can slash that grocery budget too.

Wealth Management

MAY 23, 2023

BlueRock Capital Market CEO Jeff Schwaber drops a wealth of insight on the real estate market and private credit.

Advertisement

Is your finance team bogged down by endless data requests and disorganized spreadsheets during the month-end close? It’s time to consider a better option – automate with ART! SkyStem’s solution works alongside your ERP to transform the close and account reconciliation process and speed up month-end work. Explore SkyStem’s ART - the award-winning account reconciliation automation platform - and receive a $100 Amazon gift card as a thank you for your time.

Let's personalize your content