Ten Economic Questions for 2025

Calculated Risk

DECEMBER 22, 2024

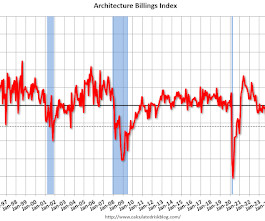

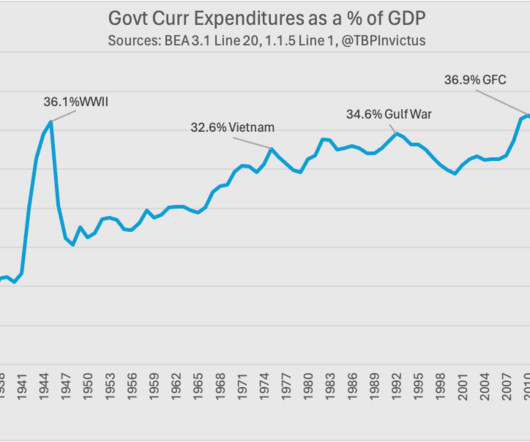

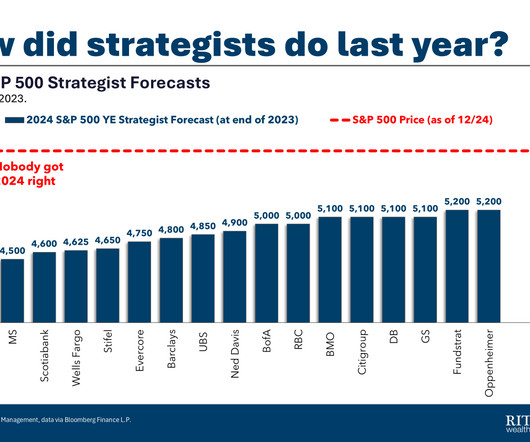

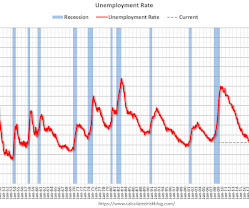

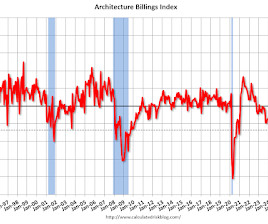

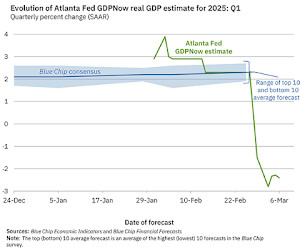

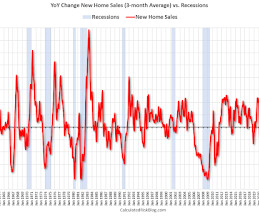

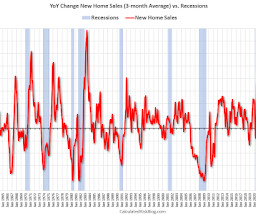

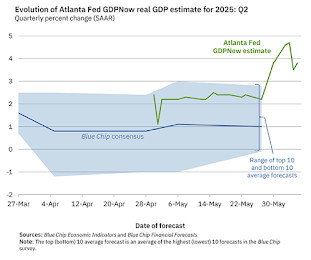

Here is a review of the Ten Economic Questions for 2024. 1) Economic growth: Economic growth was probably close to 2.8% 8) Residential Investment: Residential investment (RI) was slightly positive through the first three quarters of 2024. The purpose of these questions is to provide a framework of how the U.S.

Let's personalize your content