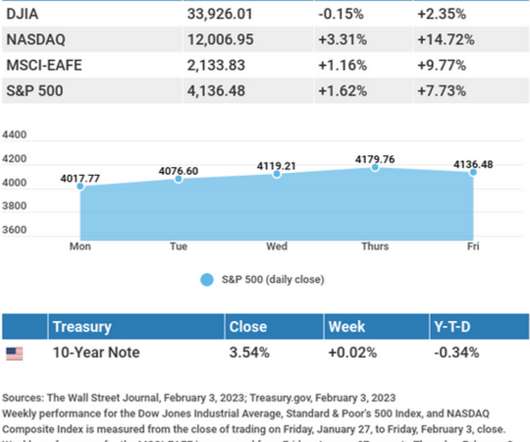

Weekly Market Insights – February 6, 2023

Cornerstone Financial Advisory

FEBRUARY 6, 2023

Another Rate Hike The Federal Reserve raised interest rates by 0.25%, signaling to the financial markets that it would likely hike rates by another 25 basis points at its next meeting in late March. 5 This Week: Key Economic Data Thursday: Jobless Claims. a Registered Investment Advisor.

Let's personalize your content