#FASuccess Ep 419: Attracting Clients Who Want To Align Their Investments With Their Values With A Sustainable Investing Approach, With Peter Krull

Nerd's Eye View

JANUARY 7, 2025

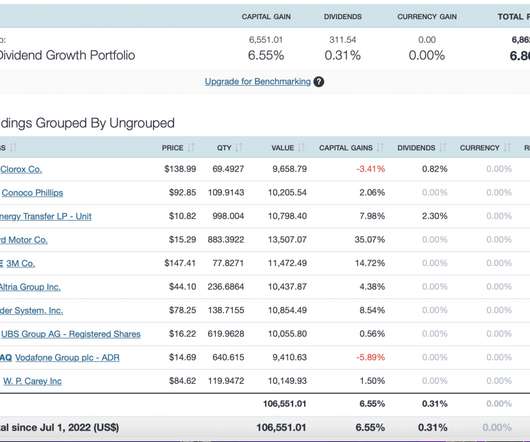

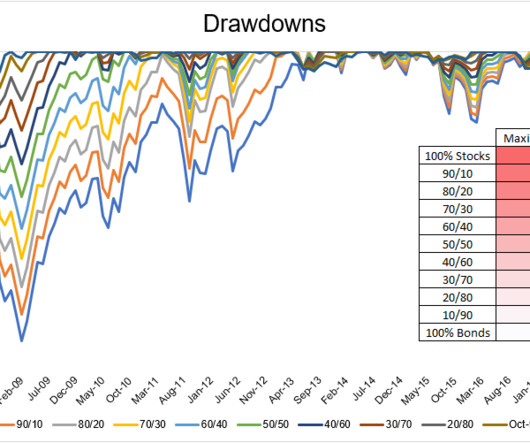

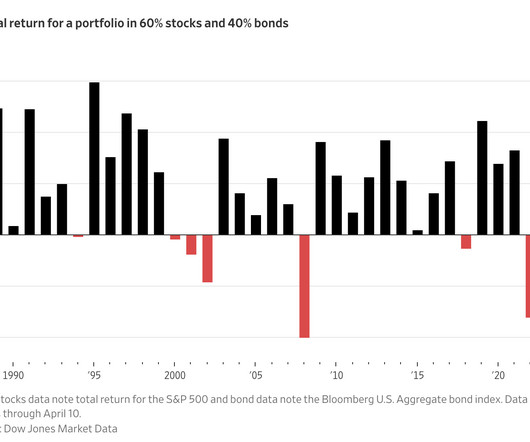

What's unique about Pete, though, is how he has grown his firm by exploring with clients how they can align their portfolios with their own personal values, effectively allowing their investments to become an expression of the types of businesses they want their capital to support… while still ensuring their overall portfolio is still well-diversified, (..)

Let's personalize your content