Takeaways From Day 1 of Wealth Management EDGE

Wealth Management

JUNE 10, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 10, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Wealth Management

JUNE 10, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

JUNE 10, 2025

But similar to the Great Financial Crisis of 2008, fiduciary advisors can use this opportunity to assert their value and give clients confidence that their broader financial plans aren’t as negatively impacted as they may think, given the daily doom-and-gloom market headlines. Registered in England and Wales. Number 8860726.

Wealth Management

JUNE 10, 2025

Are you battling compliance friction or is bureaucracy slowing you down? • Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726. However, objectively evaluating your environment is essential for long-term success. Is your brand aligned with the clients you want to attract?

Wealth Management

JUNE 11, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Wealth Management

JUNE 11, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

AdvicePay

MAY 22, 2024

Earlier this year, we released our 2024 Fee-for-Service Industry Trend Report , showcasing data from over 380,000 fee-for-service financial planning transactions processed through our platform in 2023. We are excited to share some of the top questions from the webinar.

AdvicePay

JUNE 22, 2022

Powered by innovative technologies, the financial planning business model is rapidly evolving into a sustainable fee-based revenue stream. The financial services enterprise companies that have already empowered their advisors to implement the latest approaches demonstrate powerful growth and are driving incremental revenues to scale.

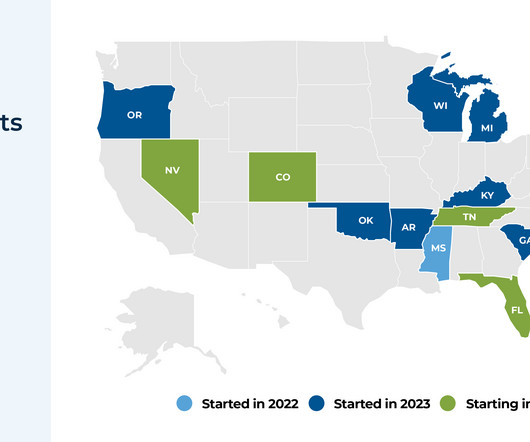

Nerd's Eye View

JULY 19, 2023

In this post, Senior Financial Planning Nerd Ben Henry-Moreland discusses how IARs can determine whether they’re required to complete CE and, if so, how to go about it – since with the adoption of the Model Rule ramping up among states, more and more IARs will be subject to the new CE requirements.

Wealth Management

JUNE 12, 2025

Lynn O'Shaughnessy , Columnist: College Planning June 12, 2025 4 Min Read 12875116/iStock/Getty Images Plus When I took on this task years ago, it was challenging to figure out the itinerary for a 12-day trip that included nine private liberal arts colleges in Massachusetts, New York and Pennsylvania. Registered in England and Wales.

Midstream Marketing

DECEMBER 26, 2024

One major benefit of Forefield is its dedication to providing the latest trends and insights in financial services. With regular updates, webinars, and reports, advisors can learn about market changes, new rules, and developing financial planning methods. This makes sure all shared content meets industry rules.

Indigo Marketing Agency

SEPTEMBER 6, 2022

We’re happy to announce that Indigo Marketing Agency was featured in Bob Veres’s August 2022 issue of Inside Information , a go-to resource for financial planning, financial advisor, and investment advisor professionals. Watch Our Webinars About the Testimonial Program. That’s where we come in. .

Midstream Marketing

DECEMBER 10, 2024

Share important articles, industry news, and useful tips on financial planning. Always follow the rules for sharing financial information on social media. You might also offer free guides or webinars to draw in people. You can offer educational webinars and online workshops. Follow a regular posting schedule.

Indigo Marketing Agency

APRIL 23, 2020

Marketing In A Crisis For Financial Advisors (Free Webinar). The hardest part of getting new clients as a financial advisor is the lack of urgency that people have when it comes to their financial plan. Space is limited for this time-sensitive webinar, so save your seat today! About Your Presenter.

Indigo Marketing Agency

SEPTEMBER 28, 2024

Get Started Check Out Our Related Video Content How Advisors Can Use Video To Stand Out (Webinar) Whether you’re a beginner or looking to improve your existing video marketing efforts, this webinar is designed to provide actionable insights and practical tips to make your videos a success.

Indigo Marketing Agency

MAY 5, 2020

And I work with 165 top independent financial advisor clients, where we do their marketing for them. And we do everything from run their website, create their content, help them create webinars, do all of their social media postings. Also very attractive from a financial planning perspective and a net new asset gathering perspective.

Midstream Marketing

NOVEMBER 5, 2024

Explore different social media platforms that financial advisors can use, like LinkedIn, Twitter, Instagram, and Facebook. Understand why compliance, engagement, and tracking success are vital for your social media efforts. It is helpful for financial advisors. You might also want to talk to a compliance expert.

Midstream Marketing

NOVEMBER 6, 2024

Video Marketing: Engaging Your Audience Visually Incorporating video marketing into your plan helps you connect more with your audience. You can hold webinars, share updates about the market, or explain investment ideas. You can give early access to webinars. It is important to manage compliance and regulatory issues well.

Indigo Marketing Agency

DECEMBER 18, 2019

That’s why top advisors outsource their marketing to proven professionals that understand our industry and compliance. . But which marketing companies for financial advisors will help you grow your assets under management (AUM) and which are a waste of money? Twenty Over Ten is a website platform built for the modern financial advisor.

Indigo Marketing Agency

FEBRUARY 12, 2020

The financial advisor technology tools your firm uses can make or break the client experience. A slow website, complicated financial planning software, irrelevant emails—these can all leave a sour taste in your clients’ mouths and leave them searching for someone else. . Financial Planning Software: eMoney or MoneyGuidePro.

Indigo Marketing Agency

DECEMBER 13, 2024

Webinars and online events: Hosting virtual events can showcase your expertise and attract potential clients. According to Kitces.com , advisors with a niche focus spend 28% more time on client-facing activities and generate 20% higher standalone planning fees, demonstrating the benefits of targeted marketing efforts.

Indigo Marketing Agency

DECEMBER 17, 2024

Convert 5% of webinar attendees into paying clients. Using the SMART framework (Specific, Measurable, Achievable, Relevant, Time-bound) ensures your marketing plan remains focused and actionable. Webinar Spotlight: How Advisors Can Use Video to Stand Out 4. What are the key components of a successful financial advisor website?

Harness Wealth

MAY 12, 2025

Stereotypes of long hours spent on tedious compliance work tend to overshadow the intellectual challenges, problem-solving opportunities, and the potential for strategic advisory roles within the field. This decline is generally attributed to the demanding curriculum and the rigorous CPA exam requirements, which discourage potential entrants.

Indigo Marketing Agency

JANUARY 25, 2022

Remind clients that you’ve built their financial plan and investment strategy for the long term, with short-term volatility in mind. While a correction can be upsetting, there’s no reason to deviate from their long-term financial plan. Be sure to get it approved by compliance before sending.

Midstream Marketing

APRIL 14, 2025

Make sure to share valuable content through your emails, like newsletters, market updates, tips on financial planning, and invites to webinars or events. Email marketing helps you stay in touch regularly, builds strong client relationships, and shows that you are a trusted source for financial guidance.

AdvisorPR

MAY 13, 2020

Meetings with financial professionals are available via phone, Zoom, Ring Central, Google Hangouts, or whichever platform is readily accessible to the requesting party. And whatever is an approved format with compliance; keep in mind the security and archiving requirements for your communications.) List your platforms here.)

Midstream Marketing

MAY 12, 2025

Explore cost-effective solutions for sustainable growth in financial marketing through expert comparisons. Learn how technology, innovation, and compliance standards shape the decision between an internal team and outsourcing. When they understand rules and financial planning, they can create customized, strategic marketing campaigns.

Sara Grillo

MAY 23, 2022

I am an irreverent and fun marketing consultant for financial advisors. What is an advice-only financial planner? Advice-only financial planning is fee-only comprehensive financial planning without the expectation or even the option to manage any client investments. ” Well, now it is.

Midstream Marketing

NOVEMBER 6, 2024

Financial Goals : They want to save for retirement , manage their money, and pay for education. Pain Points : They face market ups and downs, worries about taxes, and issues in financial planning. Webinars are a way to connect with your audience. Collaborate on content creation, webinars, or interviews.

Midstream Marketing

APRIL 21, 2025

This could be scheduling a consultation, signing up for a webinar, or learning more about your services. Imagine a financial advisor helping a new client find financial security. Just like a personal plan, an email sequence for financial advisors is a set of emails. This journey encourages them to take action.

Wealth Management

JUNE 11, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Midstream Marketing

AUGUST 13, 2024

Introduction In financial services, finding the right clients requires a smart marketing plan. It is important to show your skill in financial planning. When you know what your ideal clients need and like, you can craft a strong marketing plan. This plan can help you gain more clients.

Wealth Management

JUNE 11, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Wealth Management

JUNE 11, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Wealth Management

JUNE 9, 2025

Informa PLC's registered office is 5 Howick Place, London SW1P 1WG. Registered in England and Wales. Number 8860726.

Indigo Marketing Agency

MARCH 24, 2025

AI-powered tools are transforming various facets of advisory businesses, including client engagement, portfolio management, compliance, and more. Saifr: Offers AI-assisted content creation tools designed to ensure compliance with financial regulations. And it is especially relevant in the context of the Great Wealth Transfer.

Harness Wealth

MAY 12, 2025

Stereotypes of long hours spent on tedious compliance work tend to overshadow the intellectual challenges, problem-solving opportunities, and the potential for strategic advisory roles within the field. This decline is generally attributed to the demanding curriculum and the rigorous CPA exam requirements, which discourage potential entrants.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content