Financial planning transparency is FINALLY upon us (whoo hooo!!!!!!!!!!!!)

Sara Grillo

JANUARY 9, 2023

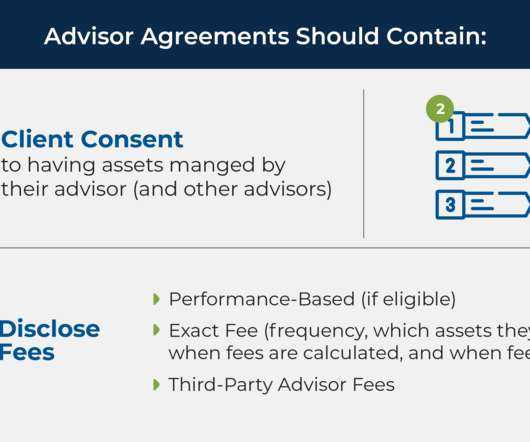

As the move to transparency in financial planning takes hold, regulations are changing in Colorado and other states. Here’s the triumph of virtue that financial planning transparency will (FINALLY) bring to planners across the country and the benefits to clients that come along with it. What should financial advisors do?

Let's personalize your content