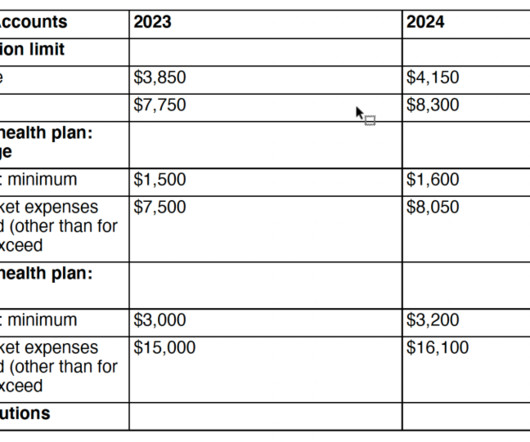

2024 Key Numbers for Health Savings Accounts

Ballast Advisors

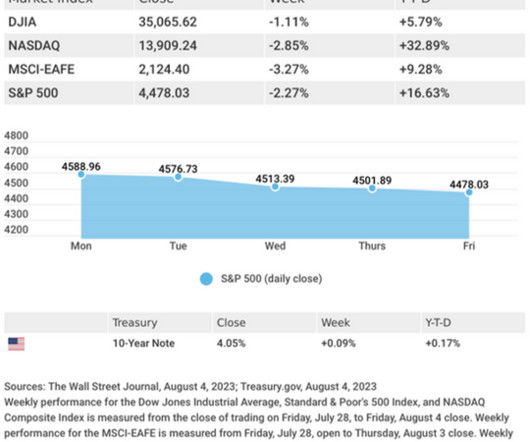

AUGUST 16, 2023

An HSA is a tax-advantaged account that enables you to save money to cover health-care and medical costs that your insurance doesn’t pay. The funds contributed are made with pre-tax dollars if you contribute via payroll deduction or are tax deductible if you make them yourself using after-tax dollars.

Let's personalize your content