The False Comfort of Deregulation

Wealth Management

JUNE 3, 2025

The SEC's off-channel communication probe resulted in $1.8B Learn why deregulation doesnt mean relaxed compliance for financial firms.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 3, 2025

The SEC's off-channel communication probe resulted in $1.8B Learn why deregulation doesnt mean relaxed compliance for financial firms.

Indigo Marketing Agency

JULY 5, 2025

5 Compliance Tips From a Financial Advisor Marketing Consultant Whether you’re creating a new website , publishing a blog post , or sharing content on social media, a financial advisor marketing consultant will tell you that compliance should always be top-of-mind. Build a compliance policy. Keep organized records.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

JUNE 18, 2025

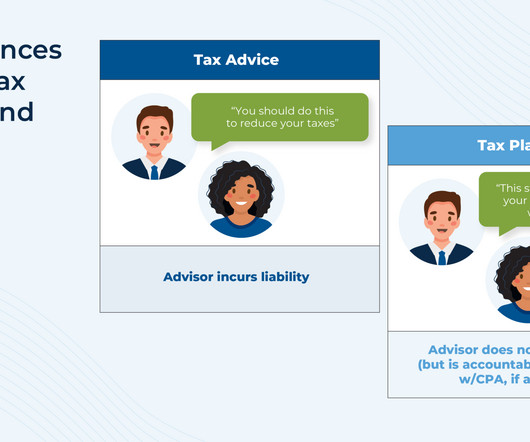

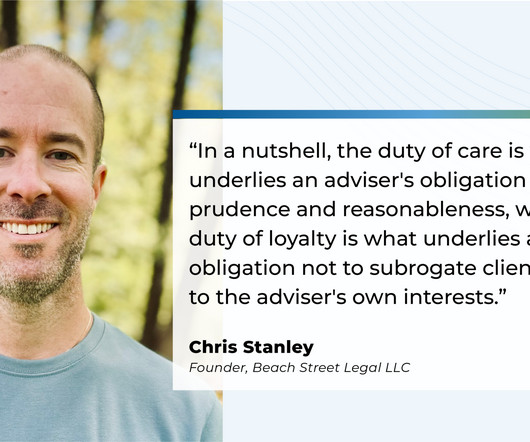

The broader concern is that giving actionable tax advice can expose advisors to legal and financial liability, especially since RIA compliance policies and E&O insurance typically only cover investment advice. But it also demands new considerations in how those strategies are presented. Read More.

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

FMG

MAY 30, 2025

This communication gap is costing you clients, opportunities, and competitive advantage. Meanwhile, other advisors are winning business by meeting clients where they actually communicate. Leadership worried about advisor resistance, compliance complexity, and client acceptance. The result?

Nerd's Eye View

MARCH 24, 2025

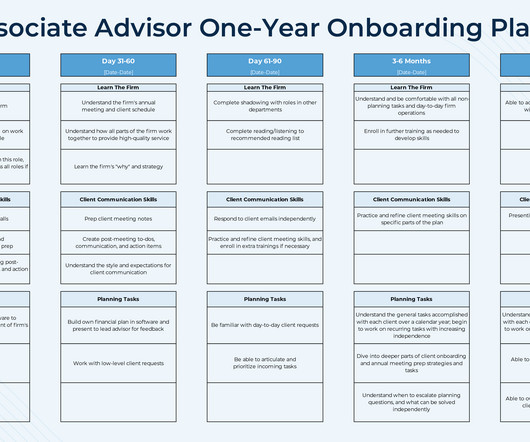

We have provided an onboarding plan template for advisors to download, which breaks up the skills list into two primary categories: 1) client communication skills (e.g., meetings, email communication, and phone calls), and 2) technical skills (e.g., building an initial financial plan). Read More.

Wealth Management

JULY 18, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Resonant Capital Advisors CEO and President Benjamin Dickey RIA $2.2B Number 8860726. It was this confluence of things,” Brown said.

Wealth Management

JULY 2, 2025

Younger Gen Xers tend to be more akin to millennials, preferring shorter, more frequent digital communication from their advisors. Number 8860726.

Midstream Marketing

DECEMBER 7, 2024

This helps the right communications reach clients at the right time. The integration provides workflows that are automatic, along with digital marketing and compliance tools. AdvisorStream’s effective compliance tools help make this task simpler. These features support advisors in boosting client engagement.

Wealth Management

JUNE 20, 2025

We have a serious communication problem in the industry, and it can be really hard to get hold of clients,” he said, noting that with his technology, advisors can see their clients go to the app every day. Number 8860726.

Wealth Management

JULY 2, 2025

One system talks to another—if an API exists, if someone maintains it, if both systems support bidirectional communication. Number 8860726. Use Case 2: Agentic AI Between Disconnected Systems Today, most firms are burdened by the tyranny of software silos. Agentic AI eliminates this dependency. No problem.

Midstream Marketing

DECEMBER 26, 2024

Key strategies include leveraging up-to-date resources and personalizing client communications for better engagement. This platform helps enhance client communication, improve advertising efforts, and support business growth. Compliance-Approved Materials: The tool’s resources are checked by compliance professionals.

Wealth Management

JUNE 17, 2025

Mariner launched its independent channel in 2020, offering back-office support, practice management, marketing, investment and compliance to affiliated advisors. In addition to financial and business reporting, he has worked in media relations and corporate communications for tech firms and Fortune 500 companies. Number 8860726.

Wealth Management

JULY 7, 2025

As communications become more dynamic and digital interactions more complex, static captures are increasingly out of step with the needs of modern compliance and the expectations of U.S. regulators.

Wealth Management

JUNE 27, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Marc Schechter RIA Q&A: What Was Behind Schechter’s Decision to Sell to Arax? Number 8860726.

Wealth Management

JUNE 10, 2025

Top-tier RIAs are also using technology to scale more personalized client experiences, communicating to clients that their personal plans remain resilient, despite the daily ups and downs in the markets. Kerr holds a bachelor’s degree in communications and her Series 7, 9, 10, 24, and 63 registrations. Number 8860726.

Midstream Marketing

OCTOBER 30, 2024

Clear communication is key. Work on better communication and teamwork. Compliance and Ethics in RIA Marketing RIAs manage their clients’ money. Having good compliance policies and procedures is very important. Making personal connections through direct communication helps to build and maintain relationships.

Steve Sanduski

OCTOBER 27, 2024

However, if each piece of your tech stack isn’t integrated to communicate with the other pieces of your tech stack, you could end up with a fragmented infrastructure that complicates your processes rather than streamlining them. As your firm grows, adding more technology might seem like a logical step.

Wealth Management

JULY 18, 2025

Podcasts & Videos CE Webinars Research Newsletters Subscribe Subscribe News Related Topics RIA IBD Wirehouse RPA Insights & Analysis Regulation & Compliance Career Moves Recent in News See all Resonant Capital Advisors CEO and President Benjamin Dickey RIA $2.2B Number 8860726.

Wealth Management

JULY 15, 2025

Mosaic Pacific, founded in 2014, will grow Creative Planning’s footprint in the Pacific region and bring on board about six more advisors, along with compliance and support staff. In addition to financial and business reporting, he has worked in media relations and corporate communications for tech firms and Fortune 500 companies.

Midstream Marketing

DECEMBER 6, 2024

Compliance and Security for RIAs Compliance and data security matter a lot in the financial services industry. By focusing on compliance and security, you can earn your clients trust. They like communication that is tailored just for them. A lot of clients use these devices. Doing so can harm your business.

Don Connelly & Associates

NOVEMBER 18, 2024

And, with the increasing complexity of financial markets and compliance requirements, advisors must spend more time on data entry, paperwork, and compliance at the expense of more client-facing activities.

Midstream Marketing

NOVEMBER 26, 2024

These methods include using technology, content marketing, and strategies that follow compliance rules. This includes using content marketing and sticking to compliance rules. They interact with different clients and have their own rules for compliance. By partnering with compliance experts, they can lower risks.

Wealth Management

JUNE 10, 2025

In addition to financial and business reporting, he has worked in media relations and corporate communications for tech firms and Fortune 500 companies. Number 8860726.

Midstream Marketing

OCTOBER 31, 2024

Compliance and Regulatory Advertising Standards The financial services industry has many rules. Great Communication and Teamwork Skills: Good communication and teamwork are key for a strong consultant-client relationship. Choose a consultant who values clear communication. Businesses must follow these advertising rules.

Harness Wealth

MARCH 14, 2025

Without a secure system in place, firms face the risk of hacked email accounts, lost or misplaced documents, and even compliance violations with the IRS and financial regulations. Taxpayers often find email-based requests confusing and may forget to attach all necessary documents, leading to frustrating back-and-forth communication.

Midstream Marketing

JANUARY 19, 2025

Regular and honest communication on social media can boost your online presence and help create lasting connections with your audience. Compliance and Ethical Considerations in Digital Marketing While looking into the wide world of digital marketing, it’s very important for financial advisors to follow the rules of the industry.

FMG

APRIL 30, 2025

These AI-powered assistants help streamline your workflow and enhance communication. How do these tools help with compliance? Most of these marketing tools for advisors don’t directly ensure compliance, but FMG and Zocks are built for easy compliance integration. Which video editing tool should I start with?

Wealth Management

JULY 10, 2025

In addition to financial and business reporting, he has worked in media relations and corporate communications for tech firms and Fortune 500 companies. Number 8860726.

Harness Wealth

APRIL 17, 2025

Technology deductions extend beyond basic communications to encompass computer equipment, software licenses, and various technology subscriptions essential for business operations. Understanding these limitations and planning accordingly can help maximize QBI benefits while maintaining compliance with IRS regulations.

The Big Picture

JULY 23, 2025

And you do have to spend money on compliance to make sure that you’re threading the needle of all the various rules that apply depending on the various stock plan that you choose to, to employ. Barry Ritholtz : What are the disadvantages from a corporate perspective? Joey Fishman : They are complex to administer. It’s a beast.

Wealth Management

JULY 15, 2025

In addition to financial and business reporting, he has worked in media relations and corporate communications for tech firms and Fortune 500 companies. Number 8860726.

Advisor Perspectives

JUNE 18, 2025

As communications become more dynamic and digital interactions more complex, static captures are increasingly out of step with the needs of modern compliance and the expectations of U.S. regulators.

Wealth Management

JUNE 25, 2025

In addition to financial and business reporting, he has worked in media relations and corporate communications for tech firms and Fortune 500 companies. Number 8860726.

Nerd's Eye View

MAY 2, 2025

Also in industry news this week: A majority of financial advisory clients feel reassured by their advisor in the current market environment, according to a recent survey, with advisors pursuing a mix of 'high touch' and 'low touch' communication methods A FINRA proposal that purports to streamline regulatory obligations regarding outside business activities (..)

Wealth Management

JULY 22, 2025

Related: Rise Growth-Backed Bleakley Rebrands to OnePoint BFG Wealth Partners Wood had previously advised on client assets of about $502 million and said communication and planned moves for those clients were going well so far. Number 8860726. Summit Financial Adds Four Firms Totaling $1.2B

Hubly

JULY 15, 2025

The Bigger Picture While NIGO errors may not trigger fines, theyâre often tied to broader compliance issues, particularly in recordkeeping. million for failing to maintain and preserve electronic communications. Non-Compliance With Regulations Account opening must meet strict regulatory standards.

Wealth Management

JUNE 12, 2025

Infrastructure includes communications, data centers, utilities, satellites, transportation and energy pipelines. Tyler Rosenlicht, a senior vice president at Cohen & Steers, said infrastructure and natural resources were two examples that illustrate where active management can add value.

Trade Brains

JUNE 15, 2025

It offers a comprehensive range of HR services, including staffing solutions (temporary and permanent), payroll processing, regulatory compliance, vocational training, and assessments. percent stake in the company, reflecting strong domestic investor confidence.

Carson Wealth

JANUARY 6, 2025

Nevertheless, even expectations of higher inflation can actually cause inflation and the Trump administration will have to be careful about how it communicates policy. Compliance Case # 02582021_010625_C The post Market Commentary: Some Favorite Charts from 2024 and a New Congress Is Sworn In appeared first on Carson Wealth.

Midstream Marketing

NOVEMBER 5, 2024

Understand why compliance, engagement, and tracking success are vital for your social media efforts. Think of your social media channels as spaces for two-way communication. This approach creates a sense of community. They also help build a sense of community among your followers.

Nerd's Eye View

NOVEMBER 20, 2024

These 2 communications suggested that advisers have differing responsibilities depending on whether they are responsible for selecting broker-dealers and executing client trades, which suggests that advisers that have not accepted the responsibility to select custodial broker-dealers on behalf of the client (e.g.,

Trade Brains

JULY 8, 2025

All documentation, signatures, and communications are digital, which contributes to a sustainable and eco-friendly banking experience. Digital Wallet Services: The slice bank accounts can also be linked to any of the UPI applications such as Google Pay, PhonePe, or Paytm, in order to make fund movements more efficient. Why Bengaluru?

Carson Wealth

JANUARY 28, 2025

Planning for risk involves due diligence in researching the companies youre considering supporting, care in structuring your philanthropic activities, and transparent and effective communication among donors, professional advisors, and grantees.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content