Insane Gain After Fed & Ukraine Pain

Investing Caffeine

APRIL 1, 2022

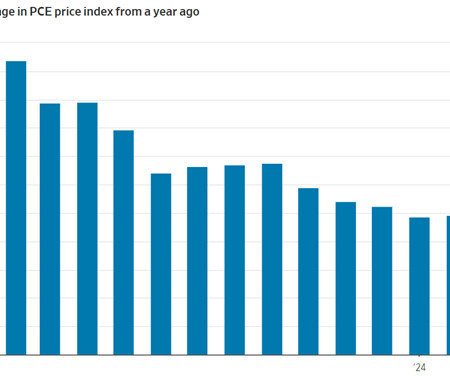

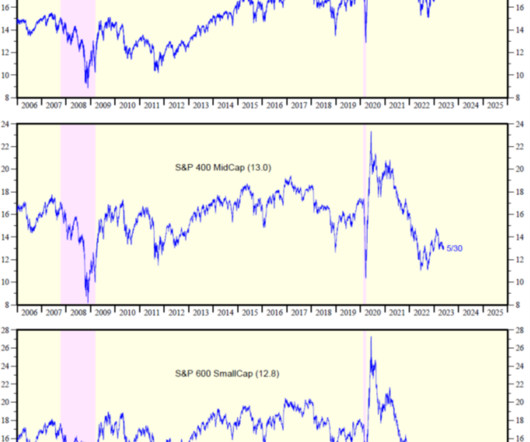

The Fed’s goal is to increase the cost of borrowing, thereby slowing down the economy and reducing inflation. Despite the Fed raising interest rates from 0% to 2.5%, the stock market increased dramatically over that timeframe. The short answer is that companies are making money hand over fist and the economy remains strong (3.6%

Let's personalize your content