Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Dear Mr. Market

DECEMBER 31, 2024

Dear Mr. Market: Ah, the start of a new yearthe smell of fresh planners, gym memberships, and resolutions destined to be abandoned by February. Create or Refresh Your Budget Think of your budget as the foundation of your financial house. Review Investment Allocations Markets evolve, and so should your portfolio.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

MARCH 6, 2025

New financial advisors often start with below-market fees – sometimes to build confidence that prospects will actually pay, other times to attract clients quickly and establish a base. But as the firm grows, so does an advisor's skill set and the demands on their time.

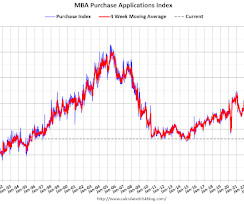

Calculated Risk

JANUARY 15, 2025

The Market Composite Index, a measure of mortgage loan application volume, increased 33.3 and abroad continued to move higher in response to concerns over a sticky inflation outlook and still too-high budget deficits, which pushed mortgage rates higher for the fifth consecutive week. Bond yields in the U.S.

Speaker: Hilary Akhaabi, PhD - Founder, Chief Financial & Operations Officer at Go Africa Global

What You Will Learn: Cutting-Edge Revenue Optimization Techniques 🚀 Discover innovative methods to maximize your company's revenue streams and stay competitive in a dynamic market. Strategic Corporate Budgeting 🎯 Gain insights into creating and maintaining robust budgets that align with your business objectives.

Abnormal Returns

MARCH 14, 2025

How Money & Markets Really Work." podcasts.apple.com) Joe Weisenthal and Tracy Alloway talk about the history of prediction markets with Ryan Isakow. fasterplease.substack.com) Policy Stephen Dubner talks tax myths with Jessica Riedl, a senior fellow in budget, tax, and economic policy at the Manhattan Institute.

Midstream Marketing

OCTOBER 29, 2024

Digital marketing is very important for connecting with this tech-savvy group. You should change your marketing approach to meet the specific financial needs and interests of millennials. Introduction To attract millennial clients, you need new ideas for financial advice and smart marketing strategies.

Midstream Marketing

DECEMBER 6, 2024

Key Highlights Learn why having a clear marketing strategy is important for RIAs, especially in hard markets. Understand the key rules and best practices to keep your marketing activities aligned with industry standards. Find answers to common questions about RIA marketing to help you succeed.

Carson Wealth

JULY 16, 2025

Core Market Investment Terms Bull or bear market? Risk Tolerance Risk tolerance is your comfort level with investment swings—whether you can stomach market dips for potential gains or prefer steady, safer returns. Bull Market A bull market is when prices rise steadily, usually 20% or higher from recent lows.

Abnormal Returns

DECEMBER 1, 2024

Markets The S&P 500 returned 5.87% in November 2024. nytimes.com) Budgeting When you do the math, it's hard to find trillions to save in the federal budget. econbrowser.com) The Department of Veteran Affairs now makes up 5% of the federal budget. on.spdji.com) It's hard to make the math on hedge funds add up.

Midstream Marketing

OCTOBER 31, 2024

Key Highlights In today’s online world, businesses in the financial services industry need financial marketing consultants to succeed. These experts know the challenges of marketing in financial services. Financial marketing consultants provide many services. Financial marketing consultants provide many services.

Midstream Marketing

DECEMBER 28, 2024

Guerrilla Marketing , as stated by Morgan James Publishing, might be just what you need. This unique way of marketing focuses on being creative and making a big impact without a big budget. In this blog, we will look into Guerrilla Marketing, paying special attention to financial advisors.

Abnormal Returns

JANUARY 15, 2025

cnbc.com) Personal finance Why focusing on short term market returns is so dangerous. theatlantic.com) Five insights from Dana Miranada's new book, "You Dont Need a Budget: Stop Worrying about Debt, Spend without Shame, and Manage Money with Ease." (sherwood.news) Direct File is expanding.

The Big Picture

MARCH 10, 2025

But let’s set aside markets and investing strategies entirely. The strangest thing I came to realize was that the market crashes and bear markets that should have mattered the least to me were most terrifying. Here is the full-length Q&A discussion. I grew up lower income.

The Big Picture

JANUARY 15, 2025

My assumption was because this is so much smaller than public markets with so many fewer investors, perhaps there are some inefficiencies that these managers can identify any Truth to that? Ted Seides : It’s entirely a function of, let’s say, a liquidity budget. Unsuccessful ones have underperformed the public markets.

Clever Girl Finance

FEBRUARY 11, 2025

Follow your existing budget : Stick to your pre-planned necessities and nothing extra. Other things to do include: Unsubscribing from marketing emails Deleting shopping apps from your phone Avoiding window shopping or browsing online stores 6. What Is The 70-20-10 Budget? You may even inspire them to join you!

Clever Girl Finance

FEBRUARY 11, 2025

In a low-buy year, you might allow yourself a $100 clothing budget for the year or one new item per season. Unsubscribe from marketing emails, unfollow brands on social media, and delete shopping apps from your phone. What Is The 70-20-10 Budget? For example, in a no-buy year, you wouldnt buy any new clothing.

MainStreet Financial Planning

MARCH 12, 2025

Economic uncertaintywhether it’s due to market volatility, rising inflation, or potential recessionscan feel overwhelming. This ensures you wont need to sell investments when markets are down, protecting your long-term financial plan and providing peace of mind during turbulent times.

Indigo Marketing Agency

AUGUST 11, 2025

Facebook and Google Ads for Financial Advisors: Breaking Through Ad Budget Paralysis to Scale Your Business You understand that Facebook and Google ads for financial advisors can transform your practice, but the question that keeps you stuck is simple: “What should I actually spend?” The good news?

Diamond Consultants

MAY 27, 2025

Here are four benefits of scale: More Capital, More Investment Larger firms have bigger budgets to invest in technology, platforms, and talent. A Buffer for Volatility Whether its regulatory fines, a drop in interest rates, or a market downturn, firms with scale are often better equipped to weather the proverbial storm.

Midstream Marketing

NOVEMBER 5, 2024

Are your clients worried about the market’s ups and downs? For example: Poll: What worries you the most about the changes in the market? Key Performance Indicators (KPIs) to Watch Social media marketing for financial advisors is all about tracking key performance indicators, or KPIs. Surveys provide clear feedback.

Abnormal Returns

JULY 6, 2025

Markets Why we need to remind ourselves about market lessons over and over again. sherwood.news) Trading Dark pools are taking market share and the exchanges are not happy about it. barrons.com) Jane Street has been suspended from trading in India's stock market. In finance, somebody, somewhere, is always dancing."

The Big Picture

JULY 16, 2025

Being flexible with your portfolio withdrawals, where you are taking more, when your balance is up, when the markets are up and you’re taking a little bit less when things are down. How often should they be making changes to their budgets? A lot of the research that’s been done by our team and others points to the value of.

Midstream Marketing

NOVEMBER 8, 2024

Learn to use social media, content marketing, SEO, and more. Introduction In today’s tough market, financial advisors and investment advisors need to find effective lead generation strategies to get their own leads and new clients, often turning to lead generation companies for assistance.

Midstream Marketing

OCTOBER 29, 2024

Key Highlights A strong marketing plan is key for financial advisors. We will look at different parts of digital marketing. This will help you stand out in a busy market. By tracking key performance indicators, you can make sure your marketing efforts lead to real success. But it can also be tough for financial advisors.

Truemind Capital

JULY 18, 2025

Equity Market Insights: Equity markets remain in a positive bias unless some disaster occurs that could break the upside momentum. Policymakers are quick to course correct when markets throw tantrums. We saw some important factors coming together to weigh on the market sentiment during this time. q-o-q and 10.8%

Zoe Financial

DECEMBER 28, 2024

Outcome: Define Your Big Financial Goals Set a Clear Spending Plan Create a budget that prioritizes your values. Opinions expressed by Zoe Financial are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. A spending plan isnt about restrictionits about intentionality.

Validea

APRIL 4, 2025

With the S&P down 4% and markets reacting to recent policy shifts, we bring you insights from our previous interviews with Cullen Roche and Andy Constan to break down these pressing issues. Investment Strategies: Practical advice on staying long-term focused, rebalancing portfolios, and seizing opportunities during market volatility.

Nerd's Eye View

OCTOBER 28, 2024

These discussions can range from talent development and succession planning to how to systematize and scale their marketing alongside their planning and investment services. And as more conferences are announced in the coming months, we'll continue to update the Master Conference List well into the coming year!). Read More.

WiserAdvisor

JULY 2, 2025

This upward trend is expected to continue, with PwC projecting an 8% annual rise in medical costs for the Group market and 7.5% for the Individual market by 2025. Financial advisors help clients identify these potential gaps and incorporate them into the budgeting process to make sure that appropriate funds are available when needed.

Inside Information

JANUARY 31, 2025

This (they believe) is increasingly dysfunctional today, as powerful new tech capabilities (some of them made possible by AI) are coming to market faster than ever before. They have told me that one of the major dysfunctions in the advisor community is that tech adoption tends to be slow and cautious.

Midstream Marketing

NOVEMBER 7, 2024

This includes content marketing, keyword research, and tips to enhance your website for search engines. Introduction In financial planning, it is key to know about search engine optimization (SEO) and search engine marketing (SEM). Digital marketing strategies are crucial for the success of financial planners.

Your Richest Life

FEBRUARY 24, 2025

2025 Markets and Economy Since November, the S&P 500, the Dow Jones Industrial Average and Nasdaq have all hit record highs. We know that market rallies dont last forever, and the potential for tariffs, layoffs and higher inflation in the coming months could lead to more market volatility.

WiserAdvisor

JUNE 13, 2025

By spreading your investments across different asset classes like stocks, bonds, real estate, and alternatives, you reduce the impact of any one market struggling. It’s natural to feel worried when markets fall and tempting to chase fast gains when stocks are soaring. It was one of the fastest declines in market history.

Trade Brains

JULY 1, 2025

It targets budget-conscious consumers through a wide distribution network and strong presence in Tier 2 and Tier 3 cities. With a market capitalization of 805.41 to the current market price of Rs. With a market capitalization of 592.59 to the current market price of Rs. With a market capitalization of 92,028.86

WiserAdvisor

JULY 9, 2025

It can be a learning experience: Self-investing can help you understand how markets work. You will need to research investments, monitor your portfolio regularly, stay updated on market changes, and do your taxes correctly. They adjust your asset allocation based on your needs and market movements. 6. No problem!

Clever Girl Finance

APRIL 22, 2025

Recessions can bring layoffs, reduced hours, and shrinking markets. These are businesses that meet everyday needs, provide essential services, or deliver comfort and value when people are tightening their budgets. Many recession-proof business ideas can be started on a small budget. This is also true for childcare.

WiserAdvisor

JUNE 4, 2025

Comprehensive financial planning involves budgeting, investment planning, tax optimization, debt management , insurance coverage, retirement strategy, and even estate planning. A financial advisor who can deliver that kind of all-in-one support can add immense value to clients and save them time, stress, and potentially money.

Carson Wealth

JUNE 27, 2025

By spreading your investments across different asset classes—stocks, bonds, real estate, and alternative investments—you can help minimize the impact of market volatility. Mass-market insurance may not fit all your needs, so working with an insurance professional who understands the UHNW market is essential. Insurance.

Midstream Marketing

JANUARY 24, 2025

Lower Upfront Costs : The use of pre-existing templates reduces initial expenses, making it a cost-effective option for those who are budget-conscious. Difficulty Standing Out : In a crowded market saturated with templated designs, carving out a distinctive online presence becomes tougher.

Clever Girl Finance

JULY 20, 2025

Once I started surrounding myself with people who valued saving, budgeting, and building wealth, everything changed. Start by automating your savings, even if it’s just $25 per paycheck, and scheduling time each month to review your budget and progress. You don’t need to understand the entire stock market to be successful.

Trade Brains

JUNE 11, 2025

In 2025, budget-friendly Bank stocks under Rs. 100 to watch out for in 2025 IDBI Bank Limited With a market capitalization of Rs. 100 to watch out for in 2025 IDBI Bank Limited With a market capitalization of Rs. Central Bank of India With a market capitalization of Rs. UCO Bank With a market capitalization of Rs.

Yardley Wealth Management

OCTOBER 8, 2024

Include them in age-appropriate conversations about household finances and budgeting. Show them how you budget, save, and avoid unnecessary debt. Teach Budgeting Skills: Budgeting is a skill that everyone should learn. It’s never too early to teach your children how to budget.

MainStreet Financial Planning

MARCH 7, 2025

Why a Fee-Only, Flat-Fee Financial Planner is the Better Choice Transparent & Predictable Costs You know exactly what you’re paying, making it easier to budget for financial planning services. Instead, they provide objective, conflict-free financial advice at a predictable cost.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content