The Latest In Financial #AdvisorTech (February 2023)

Nerd's Eye View

FEBRUARY 6, 2023

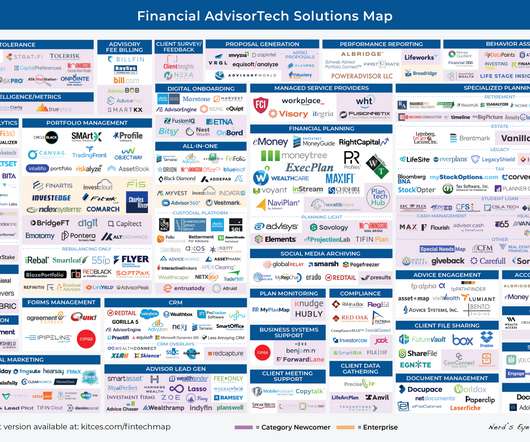

For which Elements has positioned itself as an early leader that is now gaining momentum. And be certain to read to the end, where we have provided an update to our popular “Financial AdvisorTech Solutions Map” (and also added the changes to our AdvisorTech Directory) as well!

Let's personalize your content