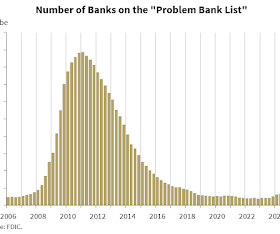

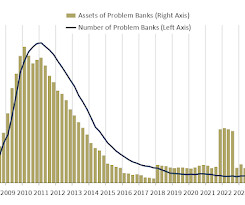

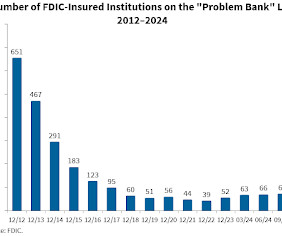

FDIC: Number of Problem Banks Decreased in Q4 2024

Calculated Risk

FEBRUARY 25, 2025

The aggregate return-on-assets ratio (ROA) increased 3 basis points to 1.12 Asset Quality Metrics Remained Generally Favorable, Though Weakness in Certain Portfolios Persisted Past-due and nonaccrual (PDNA) loans, or loans 30 or more days past due or in nonaccrual status, increased 7 basis points from the prior quarter to 1.60

Let's personalize your content