ATM: Valuation is an Exercise in Faith with Aswath Damodaran

The Big Picture

OCTOBER 9, 2024

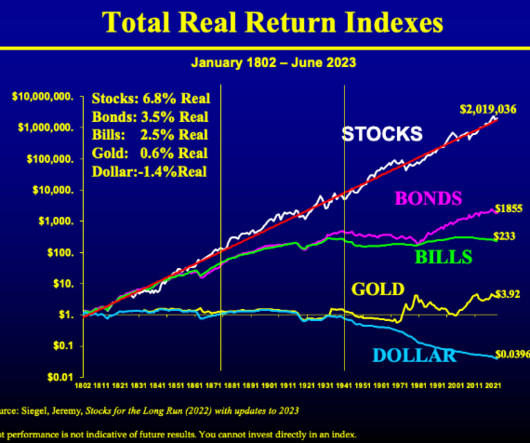

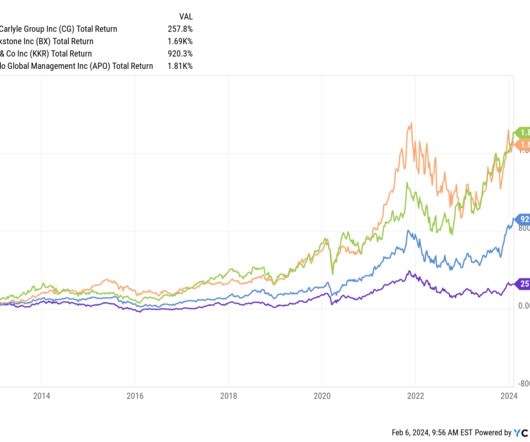

ATM: Valuation is an exercise in faith with Aswath Damodaran. How much faith do you have that any stock or market will eventually return to its intrinsic value? He has written numerous books on valuation and finance. Nowhere is understanding value more important than in the stock market. Traders live on pricing.

Let's personalize your content