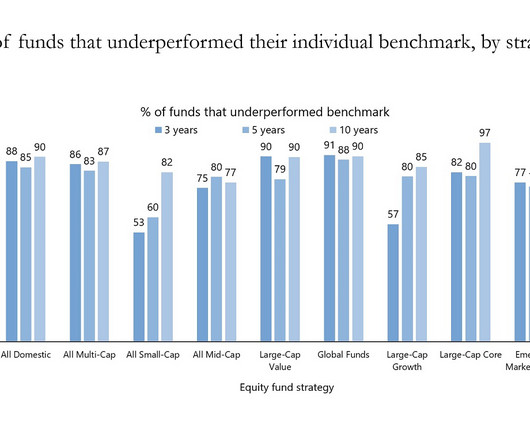

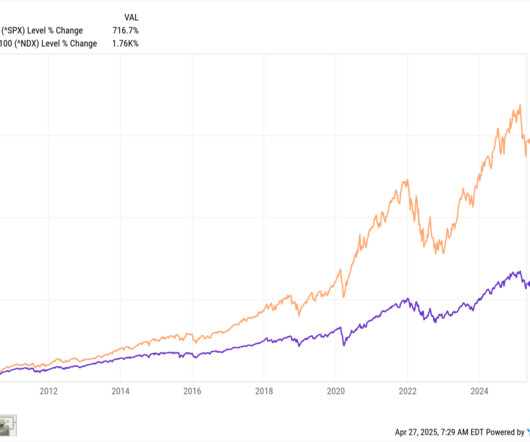

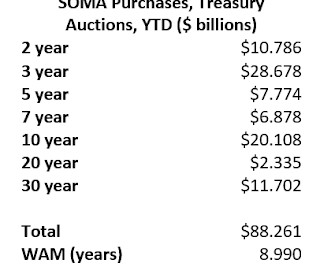

The Data on Active Large Cap Underperformance

The Big Picture

MAY 29, 2025

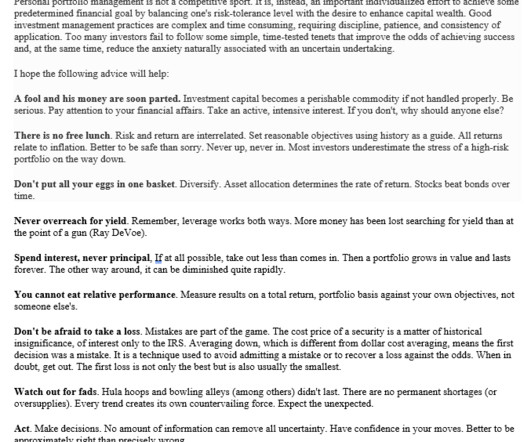

The probabilities make it clear that a broad index should be the core of your portfolio; if you want to put your own spin on it, feel free to try. But the key takeaway remains this: Portfolios cannot achieve Alpha if they are not at least getting out with Beta. ~~~ Do you need help with your assets?

Let's personalize your content