Tuesday links: dislocated from reality

Abnormal Returns

SEPTEMBER 26, 2023

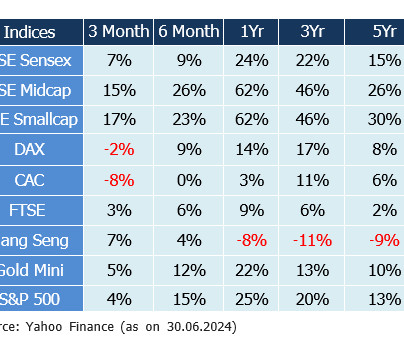

morningstar.com) Alternative assets are not all that alternative. wired.com) Asset allocation How various asset classes performed during a recession. calculatedriskblog.com) The bifurcation between new and existing home sales continues. bonddad.blogspot.com) Economy Economic anxiety isn't going anywhere.

Let's personalize your content