Weekend Reading For Financial Planners (June 14–15)

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

JUNE 13, 2025

Other key findings from the survey included a gap between long-term investment return expectations of investors and advisors (12.6%

Nerd's Eye View

JULY 4, 2025

million next year) to $15 million in 2026, and raising the limit on the deductibility of State And Local Taxes (SALT) to $40,000 (though this measure is scheduled to revert to the current $10,000 in 2030 and begins to phase out for consumers with more than $500,000 of income), among many other measures.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

MARCH 7, 2025

stocks has outpaced the rest of the market by so much that the number of companies categorized as “large cap” has shrunk from nearly 500 to only around 150 over the last 15 years Amid fears that U.S. equities underperforming international stocks over the next 10 years Why today’s high U.S.

Nerd's Eye View

OCTOBER 16, 2024

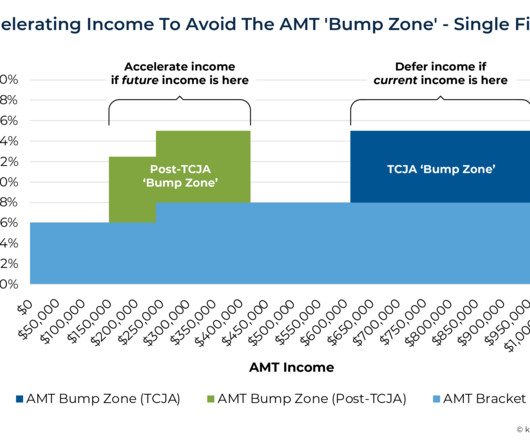

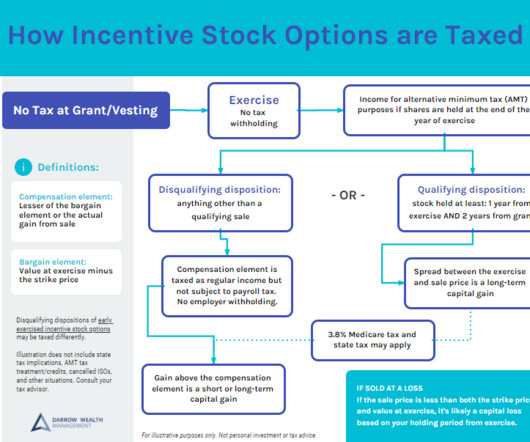

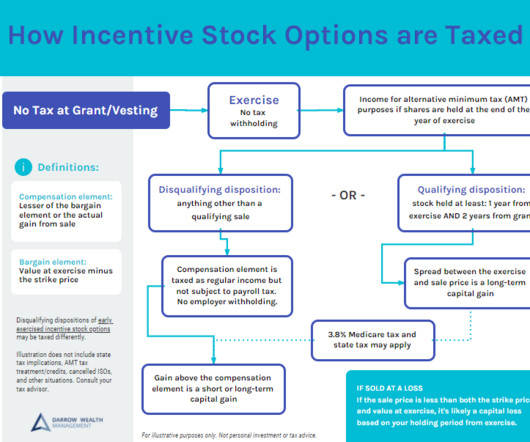

Since the Tax Cuts & Jobs Act (TJCA) was passed in 2017, few households have been subject to the Alternative Minimum Tax (AMT), which TCJA restructured so that it applied mainly to a select number of upper-income households.

Nerd's Eye View

JULY 10, 2024

From an advisor's perspective, TCJA's impending expiration raises the importance of planning for clients who will potentially be impacted, which, given the law's broad scope, could be nearly every client. elections. Read More.

Nerd's Eye View

MARCH 3, 2025

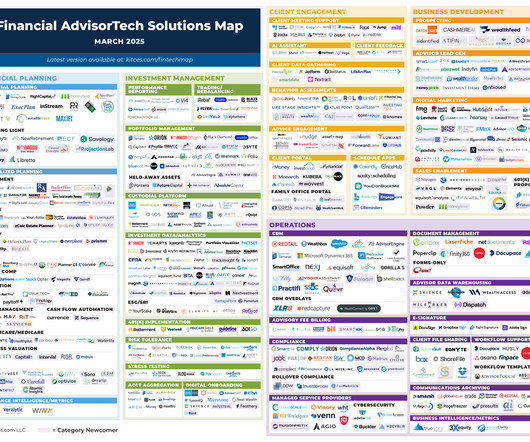

Welcome to the March 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Abnormal Returns

MAY 8, 2023

kitces.com) Practice management Why succession planning is important to firm owners whether they plan to sell or not. kitces.com) How personality traits affect estate planning decisions. thinkadvisor.com) A number of tax provisions will sunset in 2026 including the lifetime exclusion amount. investmentnews.com)

Nerd's Eye View

SEPTEMBER 2, 2022

Also in industry news this week: How enforcement of FINRA Rule 4111 could further the decline in the number of broker-dealers and registered representatives. From there, we have several articles on investments: How Morningstar plans to simplify its rating system amid continued concerns about its effectiveness.

Darrow Wealth Management

JULY 1, 2024

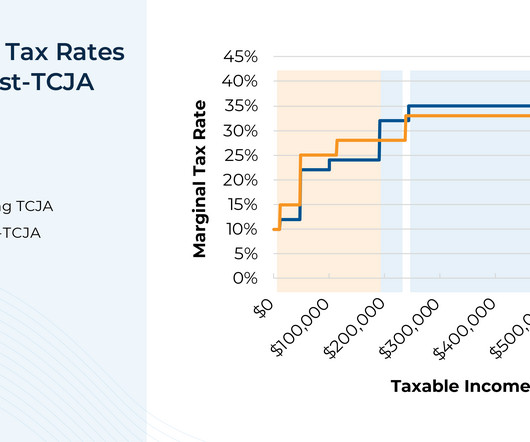

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

Nerd's Eye View

SEPTEMBER 6, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the Treasury Department has finalized rules requiring most SEC-registered RIAs to implement risk-based Anti-Money Laundering and Countering the Financing of Terrorism programs, including a requirement to report suspicious (..)

Nerd's Eye View

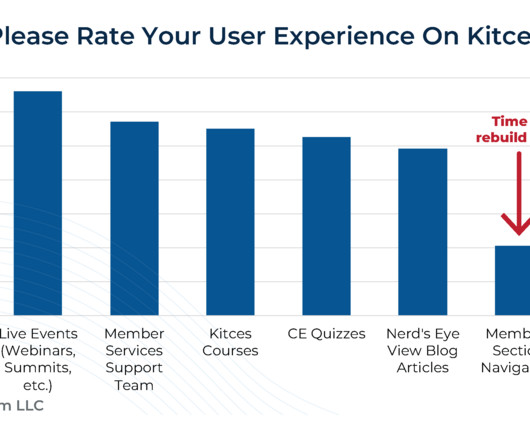

JANUARY 13, 2025

With another strong year in the markets, most advisory firms are near or at record highs for their revenue, their numbers of clients, and the headcounts of their teams. And also make it easier for us to redesign the Nerd's Eye View blog side of the website as well, in 2026!)

WiserAdvisor

JULY 4, 2025

The numbers you saw on your 2024 return probably will not be the same in 2025. Health flexible spending cafeteria plans So, how can you take advantage of these new 2025 tax brackets and other changes? Estate tax credits and gift tax exclusion Let’s talk estate planning for a moment. But let’s be honest. million in 2024.

Financial Symmetry

APRIL 9, 2025

Tax planning might not top everyone’s list of leisure activities, but in the middle of tax season, theres a hidden opportunity. These rates aren’t just static numbers; they should be assessed within the context of your financial future. Analyze whether your tax rate will rise or fall in the coming years.

Harness Wealth

MAY 2, 2025

Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect. How will the 2026 tax brackets be affected if the TCJA expires? How will the 2026 tax brackets be affected if the TCJA expires? tax-paying arena.

Darrow Wealth Management

JULY 1, 2024

Although a number of these provisions will negatively impact taxpayers starting in 2026, there a few changes that will be positive. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. In 2026, this is all expected to change (again).

Trade Brains

JUNE 6, 2023

A highlight of the future plans of both the companies and a summary conclude the article at the end. billion in value by 2026. NFIL has been debt free for a number of years. The chemicals maker is planning to set up an integrated battery chemicals facility which shall demand a large CAPEX in the coming quarters.

Trade Brains

NOVEMBER 22, 2023

The sector is expected to grow at a CAGR of 16% doubling its capacity by 2026. The Ministry of New and Renewable Energy (MNRE) has outlined a wind-specific renewable purchase obligation (RPO) plan for 2030 with a target of 8 GW onshore wind tender every year between 2023 and 2030. The Government has allocated a budget of Rs.

Good Financial Cents

JANUARY 26, 2023

But while it’s possible to retire at 50 and have plenty of time left in life to have new experiences, it takes careful planning and a will of steel. That means understanding the stock market, planning for debt and savings, and investing in yourself through education or entrepreneurial ventures. Your retirement plan shouldn’t be.

Brown Advisory

NOVEMBER 1, 2019

2019 Year-End Planning Letter. Each year, we send a letter to clients to help guide year-end planning discussions and to offer ideas for them to consider with their other advisors. Market conditions may be volatile, but our planning efforts are, as always, focused on stability and consistency. Fri, 11/01/2019 - 13:44.

Cordant Wealth Partners

AUGUST 16, 2024

Most recently, Intel announced layoffs impacting 15% of the workforce with a plan to cut $10 billion in total costs. Income Typically, Intel offers a certain number of weeks of salary, plus a payout of earned benefits and bonuses as part of a layoff package. Tax planning for a transition out of Intel is critical.

Harness Wealth

MAY 2, 2025

Unless Congress intervenes, the TCJAs sunset will usher in a swathe of tax increases in 2026, with analysts estimating that over $4 trillion worth of tax hikes could take effect. How will the 2026 tax brackets be affected if the TCJA expires? How will the 2026 tax brackets be affected if the TCJA expires? tax-paying arena.

Trade Brains

AUGUST 1, 2024

Edited excerpts: The company expanded its operation across the Middle East and Russia last year, are there any specific markets or regions where Sealmatic plans to expand its presence in the coming years? Is the company planning any capital expenditures (capex) in the next 3 to 5 years? If yes, how much is the company aiming to invest?

James Hendries

DECEMBER 11, 2022

It is a time to compile data, review the numbers, evaluate strengths and weaknesses, and determine growth opportunities for the future. Tax Planning – Have necessary steps been taken toward filing required business and individual tax returns, so they get filed on time? This act is set to expire January 1, 2026.

Darrow Wealth Management

MARCH 29, 2024

Taxpayers pay whichever number is higher: their tax due under AMT or the regular system. These higher limits are scheduled to sunset in 2026. Tax and financial planning with stock options Not every individual with incentive stock options will have tax planning options to consider. There are two AMT tax rates: 26% and 28%.

Trade Brains

DECEMBER 20, 2023

The characteristics & applications of amines allow for a number of industrial uses and new product development. Promoter Holdings 71.96% 53.07% FII Holdings 2.92% 4.52% Dividend Yield 0.46% 0.51% Future Plans Alkyl Amines – To continue sustainable growth by increasing market share & by introducing new products.

Trade Brains

JULY 23, 2023

A highlight of the R&D spending, future plans and a summary conclude the article at the end. billion by 2026. This can be gauged from the fact that the nation accounts for the most number of DMFs applied in the United States at 15%. In the process, we’ll also read about its scale of operations and business segments.

Carson Wealth

JUNE 9, 2025

Congrats again to the Dow on an amazing run and to all the investors over the years who have benefited by sticking to their investment plans. If you’re well above this number, you can be fairly sure job growth is positive. Any bets on when it breaks 100k? The “statistical significance at the 90 percent confidence level” is 136,000.

Trade Brains

SEPTEMBER 10, 2024

million, forecasted to reach 5-7% of GDP by 2026, creating 3.2 Chetak Business Unit (Electric Vehicles) The Chetak electric scooter has climbed to the number three position in the market, up from sixth or seventh at the start of the year. Future Outlook Of Bajaj Auto The company plans to launch its Brazilian plant by June.

Carson Wealth

JUNE 17, 2024

Short-term earnings growth is important, but long-term earnings growth means even more for financial planning. They do have “catch-up” cuts in 2025 and 2026, eventually landing at the same interest rate for 2026 that they indicated in March. Headline inflation is running at a 2.8% That is not a typo. First up, shelter.

Darrow Wealth Management

MARCH 24, 2024

Here are six tax planning strategies to consider when exercising and selling ISOs in 2024: Exercise early in the year Exercise late in the year Exercise unvested ISOs Tax planning around AMT exemptions, phase outs, and tax deductions Ways to accelerate AMT credits Exercise ISOs when regular income is already high 1.

Trade Brains

SEPTEMBER 15, 2024

The rising number of cancer cases, both domestic and international, creates immense opportunities for pharmaceutical companies specializing in oncology treatments. Future Outlook: Beta Drugs plans to broaden its product portfolio as it is planning to launch 25 new products by 2026. crores in FY24.

Trade Brains

OCTOBER 21, 2023

The Indian API industry, which produces these intermediates, was worth INR 798 billion in 2020 and is forecasted to reach INR 1,307 billion by 2026, at a CAGR of 8.57%. -As With plans to enhance operational efficiency and expand production capacity, the company aims to meet growing customer demand.

Darrow Wealth Management

MARCH 24, 2024

Here are six tax planning strategies to consider when exercising and selling ISOs in 2024: Exercise early in the year Exercise late in the year Exercise unvested ISOs Tax planning around AMT exemptions, phase outs, and tax deductions Ways to accelerate AMT credits Exercise ISOs when regular income is already high 1.

Random Roger's Retirement Planning

MARCH 19, 2023

It laid out the threat and dug in with some numbers. in 2025, 8% in 2026, 7.8% Part G Medicare, the one I believe to be the most robust supplemental plan currently costs an average of $1517/yr with projections of 10+% increases over the next few years. Healthview projects that the premium will rise 6.3% in 2024 and 6.2%

Trade Brains

OCTOBER 25, 2023

billion by 2026. The Government aims to make India a global healthcare hub and plans to increase public health spending to 2.5% It plans to offer quaternary care facilities like Organ Transplants and Robotics in the near future. The medical tourism market was worth US$ 2.89 billion in 2020 and is projected to reach US$ 13.42

Darrow Wealth Management

MARCH 29, 2024

Taxpayers pay whichever number is higher: their tax due under AMT or the regular system. These higher limits are scheduled to sunset in 2026. Tax and financial planning with stock options Not every individual with incentive stock options will have tax planning options to consider. There are two AMT tax rates: 26% and 28%.

Trade Brains

FEBRUARY 1, 2024

The Indian automotive sector is projected to achieve a valuation of US$ 300 billion by 2026. Total numbers 1,821,240 2,506,626 -27.3% Bajaj Auto – Future Plans But, throughout the article, you might be wondering why the company acquired the stock at such a high price. Commercial Vehicles 184,284 310,854 -40.7%

Trade Brains

JANUARY 15, 2023

A highlight of the future plans and a summary conclude the article at the end. Presented below are the production numbers from the Society of Indian Automobile Manufacturers (SIAM). Automobile Component Manufacturers Association (ACMA) projects the Indian auto-ancillary sector to touch $ 200 billion in revenues by 2026.

Trade Brains

SEPTEMBER 20, 2024

billion by 2026, up from $2.6 billion by 2027 and the number of online gamers expected to grow to 18.6 The company plans to innovate with cutting-edge gameplay features and explore adjacent sectors like digital entertainment and streaming services. billion in 2023. With India’s online gaming revenue projected to reach $2.03

WiserAdvisor

JUNE 26, 2025

Most professionals approaching retirement know they need a plan. What many underestimate (often drastically) is the size of the piece of that plan that should be devoted to healthcare. If you’re planning smartly for the long haul, this is where your attention should be focused. Healthcare in retirement isn’t a single bill.

Zajac Group

APRIL 1, 2025

You can determine the grant value of a newly issued RSUs by multiplying the number of units granted by the FMV of your companys stock on the grant date. If you believe youll likely owe more at tax time, make a plan for addressing the additional tax liability. Read more about double-trigger RSUs here. Have Questions About Your RSUs?

Zajac Group

NOVEMBER 7, 2024

Creating wealth that can provide financial security for generations to come is an incredible feat, and it requires careful planning, consideration, and communication among family members. Here’s a big bonus: the annual gifting limit is per beneficiary—and there’s no limit on the number of beneficiaries you can gift to.

The Big Picture

JULY 8, 2025

What was the original career plan? Kind of a weird marketing decision on that part, but you know, the, the, the business started to change and a number of the partners like broke off and started Silver Oak, which focused on leverage buyout firms. Barry Ritholtz : So let’s put some numbers, some flesh on the bone.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content