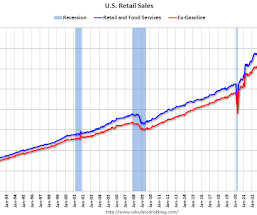

Fed's Beige Book: "Economic activity increased slightly to moderately"

Calculated Risk

JANUARY 15, 2025

Fed's Beige Book Economic activity increased slightly to moderately across the twelve Federal Reserve Districts in late November and December. The nonfinancial services sector grew slightly overall, with Districts highlighting growth in leisure and hospitality and transportation, notably air travel. Vehicle sales grew modestly.

Let's personalize your content