Weekly Market Insights – January 8, 2024

Cornerstone Financial Advisory

JANUARY 8, 2024

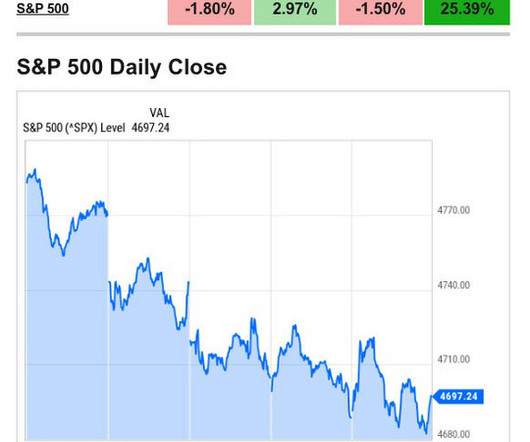

Weekly Market Insights : New Years Blues Stocks retreated in the first trading week of 2024, struggling a bit after a celebratory end to last year as investors second-guessed Fed signals and fretted over lingering inflation concerns. Source: YCharts.com, January 6, 2024. News of unemployment remaining steady at 3.7% Treasury Statement.

Let's personalize your content