Weekend Reading For Financial Planners (November 2–3)

Nerd's Eye View

NOVEMBER 1, 2024

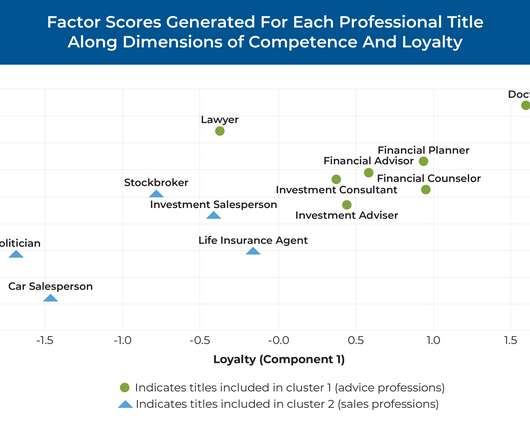

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that SIFMA, which represents broker-dealers, investment banks, and asset managers, released a white paper that argues that CFP Board "increasingly functions as a de facto private regulator for CFP certificants" and proposes that CFP (..)

Let's personalize your content