Strategic Update – Q4 2023

Discipline Funds

NOVEMBER 8, 2023

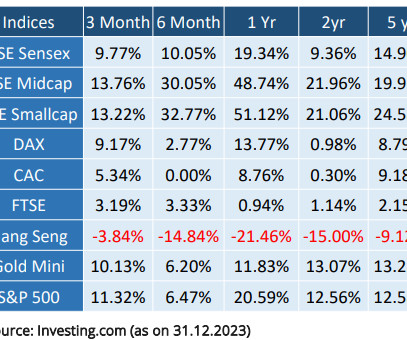

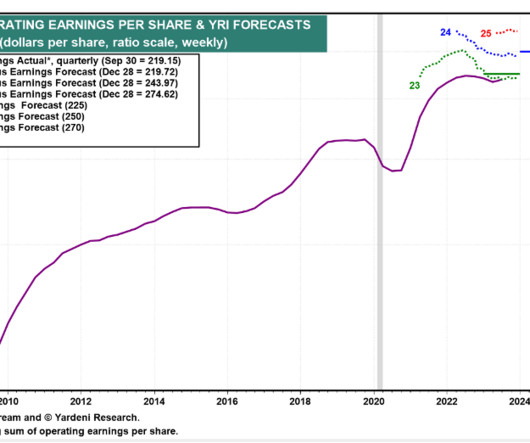

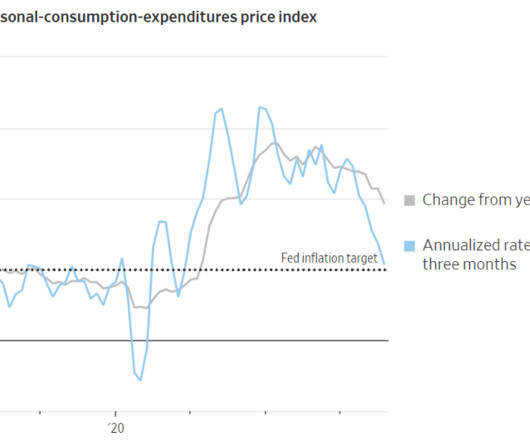

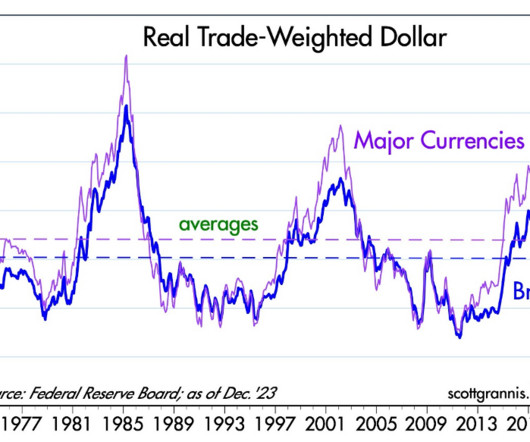

Macroeconomic Overview Our macroeconomic forecast for 2023 called for a year of disinflation and “muddle through” That means we expected the economy to remain sluggish and for inflation to show positive rates of change that were sequentially slower. Here’s our latest strategic update given recent changes for Q4 and beyond.

Let's personalize your content