DOL Opens Door for Crypto in 401(k)s

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 28, 2025

The Department of Labor rescinded its 2022 guidance cautioning against cryptocurrency in 401(k) plans, reaffirming a neutral stance on digital assets in retirement accounts.

Calculated Risk

MARCH 11, 2025

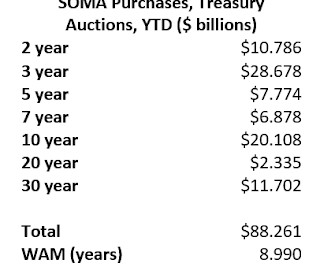

From housing economist Tom Lawler: From the beginning of 2020 to early June of 2022 the Federal Reserves balance sheet more than doubled to an almost inconceivable $8.9 Inquiring minds might want to know why the Federal Reserve did not achieve its balance sheet targets by selling longer maturity/duration assets it had previously purchased.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Calculated Risk

MARCH 4, 2025

The reason, of course, is that the Federal Reserve funded the bulk of these long-term fixed rate assets with increases in interest-bearing very short-term liabilities mainly depository institution deposits (reserves) and repos --with interest rates tied to the federal funds rate. release, and is available in the FRED database.

Calculated Risk

JUNE 12, 2025

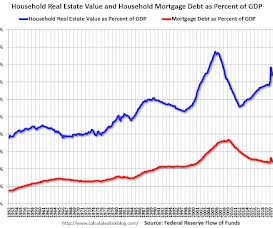

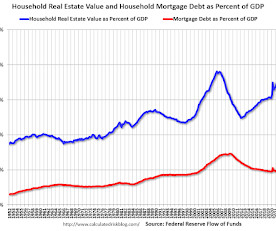

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. The first graph shows Households and Nonprofit net worth as a percent of GDP. Net worth decreased $1.6 trillion in Q1. Mortgage debt is up $2.78

The Big Picture

APRIL 28, 2025

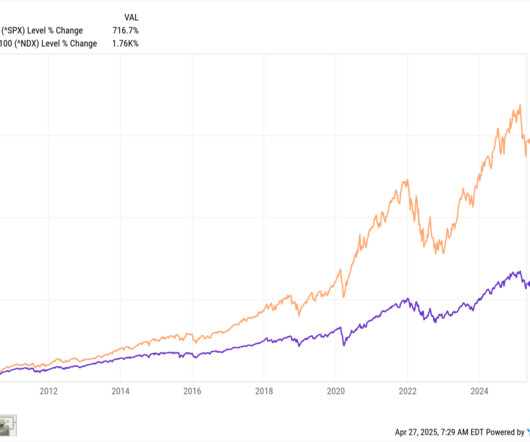

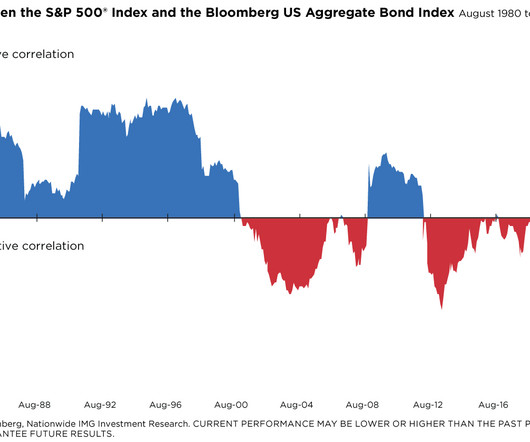

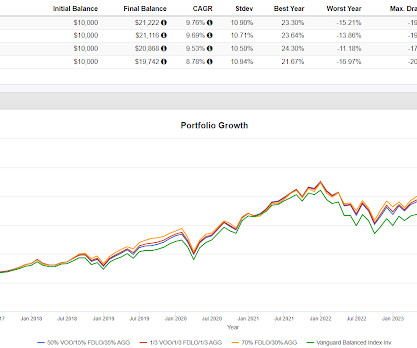

2022 down 18% for the year.4 What has developed over the entirety of the post-financial crisis era of rising equity markets and until 2022, falling or zero interest rates.The good news is that this is how you build wealth over the long haul. Plus bonds down 15% – the first double-digit drop for both asset classes in 4 decades.

Random Roger's Retirement Planning

FEBRUARY 8, 2025

Barron's had a very quick look at the recent popularity of private assets to try to figure out whether investors should wade into the space. Consumer discretionary is another one that pretty reliably outperforms for ten year periods, not the last couple though after getting whacked pretty hard in 2022 though.

Trade Brains

JUNE 29, 2025

The government just unveiled its second major digital asset policy statement. This includes digital asset service providers and exchanges. Building a Regulated Hub This move builds upon Hong Kong’s 2022 commitment. Officials explore asset tokenisation. It also promises incentives for tokenising real assets.

Calculated Risk

MARCH 13, 2025

This includes real estate and financial assets (stocks, bonds, pension reserves, deposits, etc.) The third graph shows household real estate assets and mortgage debt as a percent of GDP. Net worth increased $0.2 trillion in Q4 to an all-time high. As a percent of GDP, net worth decreased in Q4 and is below the peak in 2021.

The Big Picture

JANUARY 8, 2025

Fulltranscript below. ~~~ About this weeks guest: Matt Hougan, Chief Investment Officer at Bitwise Asset Management discusses the best ways to responsibly manage crypto assets. His firm runs over $10 billion in client crypto assets. He’s the chief investment officer at Bitwise Asset Management. What is Bitcoin?

Calculated Risk

FEBRUARY 25, 2025

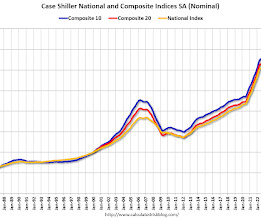

Luke, CFA, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. lower than its post-pandemic peak reached in May 2022. National home prices have risen by 8.8% annually since 2020, led by markets in Florida, North Carolina, Southern California, and Arizona. San Francisco is now 11.0%

Wealth Management

JUNE 20, 2025

CREDIT: Joey Corsica & SpotMyPhotos Founded in 2022, Fynancial is already used by some big RIA firms, like Sanctuary Wealth and is integrated with many top technology providers, including eMoney Advisor, Orion and Wealthbox. The audience was impressed by Mili's presentation and their vision of where AI notetaking is headed.

Nationwide Financial

AUGUST 21, 2024

The positive correlation between stocks and bonds, especially in 2022, hurt investors in balanced portfolios such as the traditional 60/40 stock/bond blended models. That’s why the traditional 60/40 portfolio suffered greatly in 2022, as stock and bond values correlated positively and declined in tandem.

Wealth Management

JULY 1, 2025

Boston-Area RIA by Diana Britton Jul 1, 2025 2 Min Read Investment Related Topics Alternative Investments Digital Assets Equities ETFs Fixed Income Investing Strategies Mutual Funds Real Estate SMAs Recent in Investment See All Alternative investment visualization with stacks of coins and percentage signs. Boston-Area RIA Mercer Acquires $1.1B

Random Roger's Retirement Planning

MARCH 5, 2025

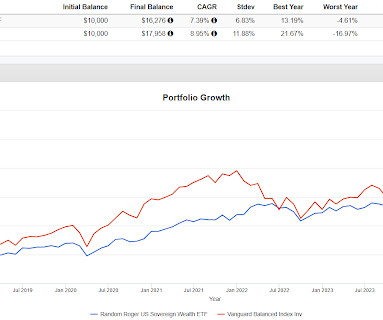

We have an oil reserve already as well as a gold reserve which are sort of "break glass in case of emergency" assets while a SWF is more of a pool of capital that is typically derived from some sort of byproduct, like oil in the case of Norway, where that byproduct creates a surplus for the country. but it was low in 2022 when it mattered.

Wealth Management

JULY 18, 2025

Cohen built the firm up over the years as a Kestra affiliate, eventually selling to Bluespring in 2022. Advisor Brennan said that, when he considered the strong client demand for wealth management in Colorado, he didn’t see a need to be with a larger firm or name brand to manage tens of millions of dollars in client assets in a short time.

Discipline Funds

APRIL 30, 2025

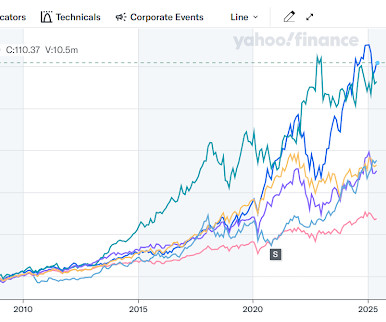

I wish I’d owned a lot more given that it’s up 84% since 2022 while the global stock market is up 15% and aggregate bonds are down -3.5%. So, when the Dollar ripped 28% in 2021 and 2022 I figured it might be beneficial to hedge that exposure since I consume everything in Dollars. It’s down 22% from its 2022 highs.

WiserAdvisor

JUNE 13, 2025

Below are some of the mistakes you should avoid making to secure your wealth: Mistake #1: Not diversifying your investments Investing too much of your money into one sector, one type of asset, or one region can expose your wealth to unnecessary risk. Take the year 2022, for example. That’s why diversification matters. The good news?

Random Roger's Retirement Planning

JUNE 2, 2025

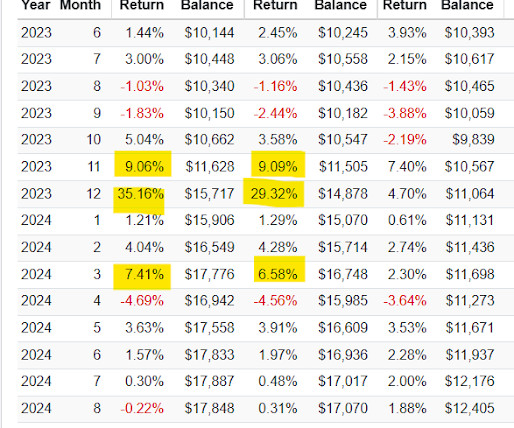

The Invenomic Fund (BIVIX) that we've looked at a few times is seriously skewed by two phenomenal years in 2021 and 2022 when it was up 61% and then 50%. If I had gotten a real answer I would have asked the same for 2022. Risk parity generally leverages up on bonds to even out the risk allocation of a multi asset portfolio.

Trade Brains

JULY 9, 2025

at the start of 2022, given an average inflation rate of 7.5% at the start of 2022, given an average inflation rate of 7.5% Real estate or rental assets – Income and property values often rise with inflation. Rebalance annually—markets shift, and your asset mix should too. over that period.

Harness Wealth

APRIL 4, 2025

During fiscal years 2022 through 2024, 87.3% During fiscal years 2022 through 2024, 87.3% billion in assets tied to criminal activity, and obtain $1.4 IRS-CI released FY24 Bank Secrecy Act metrics Friday, demonstrating how it uses BSA data to investigate financial crimes. IRS-CI also leveraged BSA data to identify $21.1

The Big Picture

JULY 1, 2025

She runs their private internal fund, about $108 billion that she manages primarily in fixed income, private credit, a variety of other assets. Here is the plan, here’s how you should go about in this deal or in, in this new asset class. What motivated the transition to full-time asset management?

Wealth Management

JULY 25, 2025

Summit Financial & Insurance Services, which manages about $280 million of client assets, joins from Osaic, which AmeriFlex departed last month. billion in client assets. based advisor with over $400 million in client assets, has joined Raymond James & Associates, the firm’s employee advisor channel. The Cheyenne, Wyo.-based

Wealth Management

JULY 15, 2025

True North Expands in SF by Alex Ortolani Jul 15, 2025 3 Min Read Investment Related Topics Alternative Investments Digital Assets Equities ETFs Fixed Income Investing Strategies Mutual Funds Real Estate SMAs Recent in Investment See All Alternative investment visualization with stacks of coins and percentage signs.

Carson Wealth

JUNE 9, 2025

The good news is we do anticipate the US may play catch up the rest of 2025, but big picture, this is a global bull market and investors are being rewarded for being in risk assets. Current levels are similar to what we saw in mid-2022, when recession risks were elevated but the economy never plunged into an actual recession.

Random Roger's Retirement Planning

NOVEMBER 28, 2024

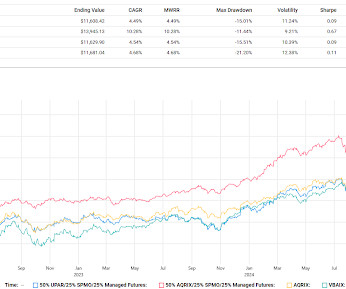

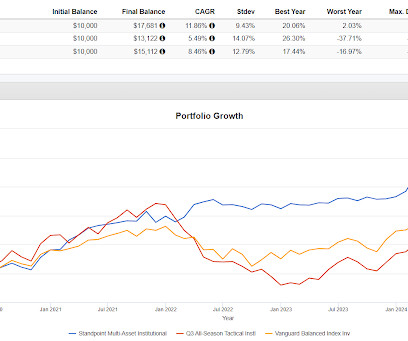

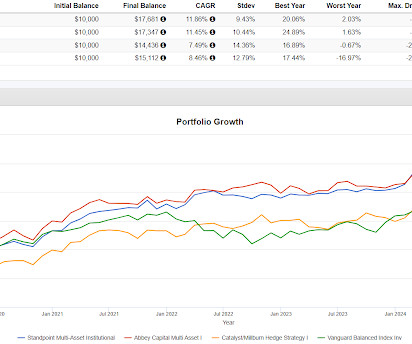

The first example to look at they call Leverage In The Strategic Asset Allocation via this table in the paper. All three were better than VBAIX in 2022 by 150-550 basis points. Somehow, it did worse than the S&P 500 by several hundred basis points in 2022. These are easy to model. The results are not skewed by one year.

Random Roger's Retirement Planning

JANUARY 26, 2025

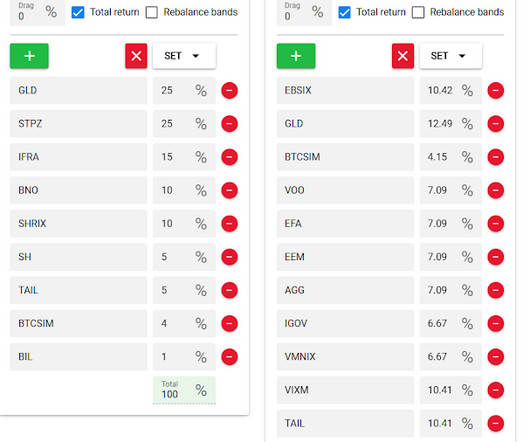

The article was thin but there was a reference to his "holy grail" of 10-15 uncorrelated assets in portfolio construction. We've looked at this a couple of times, it is interesting of course and actually having 10-15 uncorrelated assets in a portfolio would hit the mark for diversifying your diversifiers.

Harness Wealth

FEBRUARY 5, 2025

The Internal Revenue Service (IRS) adjusts FEIE exclusion amounts annually based on inflation, with the exclusion amounts for the past 5 years being as follows: Tax Year FEIE Amount 2025 $130,000 2024 $126,500 2023 $120,000 2022 $112,000 That said, the FEIE only applies to foreign earned income, with foreign passive income ineligible for exclusion.

Random Roger's Retirement Planning

FEBRUARY 20, 2025

The first question in the post was about how to categorize various types of alts which can be difficult, the article said, with the blending of strategies in one fund as well as the blending of assets classes in one fund. QAISX outperformed VBAIX by a good bit in every year except 2022. This is where the idea of expectations can help.

Random Roger's Retirement Planning

FEBRUARY 12, 2025

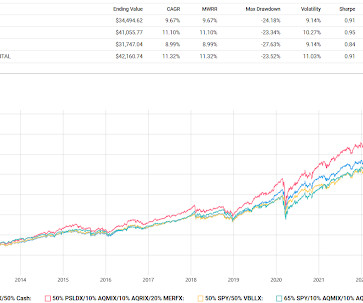

The starting point for the Man article is that defined contribution investors need exposure to risk assets for more years and portable alpha to add alternatives, they say, is a better way to do it. Also PSLDX is capable of some huge drawdowns, dropping 43% in 2022 and 33% in 2008. PSLDX is the PIMCO StocksPLUS Long Duration Fund.

Random Roger's Retirement Planning

MARCH 12, 2025

AQR Multi-Asset (AQRIX) used to be called Risk Parity and it also does some quadranty stuff. The max drawdowns of the backtested portfolios bottomed out in late 2022 as follows To the extent quadrant style might intersect with all-weather, you can decide for yourself whether any of them were all weather enough.

The Big Picture

MARCH 6, 2025

You’ll remember as I came into the Fed, I started the very beginning of, of 2023 in December of 2022. And the reason it’s that is because part of buying a house is a financial asset. And then go fast forward to June, 2022, just as inflation was peaking, they were really high. Yeah, Barry, thanks for having me on.

Carson Wealth

MAY 7, 2025

According to a report from the consultancy Altrata , charitable contributions from ultra-high net worth individuals increased by almost 25% between 2018 and 2022 , illustrating a growing trend of philanthropic engagement. But they must distribute at least 5% of the assets each year.

Random Roger's Retirement Planning

MAY 4, 2025

The more someone trades, the more they are fighting that natural inertia other than proper asset allocation targets and mitigating sequence of return risk when relevant. The purple line went through a nasty drop in 2022. They can get 6% or 7% yields in quality assets, without having to go out on the yield curve.

Meb Faber Research

JULY 20, 2025

Linkedin RSS Twitter Youtube Home About Books Data Resources Managed Assets White Papers Speaking Podcasts Contact Search Header style 1 --> Linkedin RSS Twitter Youtube Sign in Welcome! Log into your account your username your password Forgot your password? rara) Deploy mode: deploy uid: 687dca94d918f -->

Harness Wealth

MARCH 27, 2025

Other reasons involve changes in investment strategy, portfolio rebalancing, or a simple desire to exit a specific asset class. Capital gains can result from the sale or exchange of capital assets, such as fund interests or portfolio company stock. This separates the UBTI/ECI-generating activity from the tax-exempt or non-U.S.

Harness Wealth

APRIL 15, 2025

Data from the Federal Reserves 2022 Survey of Consumer Finances (SCF) (released in late 2023) offers the most recent comprehensive snapshot of American household wealth. Find Your Wealth Advisor at Harness How Net Worth Is Changing in America From 2016 to 2022, the median U.S.

Wealth Management

JULY 28, 2025

Another plaintiff’s attorney, Carl Engstrom of Engstrom Lee, noted that total 401(k) plan costs have declined 30% from 2009, when 5500 forms became publicly available, until 2022, with the steepest declines among mega plans, which are the most frequent litigation targets.

Trade Brains

JULY 15, 2025

The shares of India’s largest private sector bank by assets rose ahead of a key board meeting scheduled for Saturday, July 19, where the lender will consider its first-ever bonus share issue and a special dividend. In April 2022, HDFC Ltd merged with HDFC Bank, combining strengths in banking and housing finance.

Random Roger's Retirement Planning

DECEMBER 22, 2024

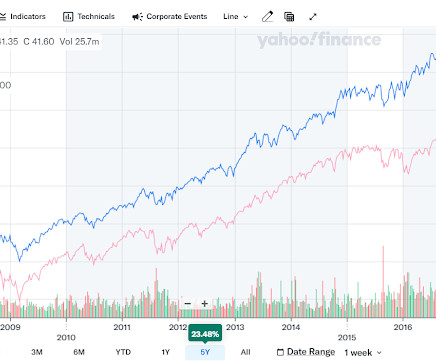

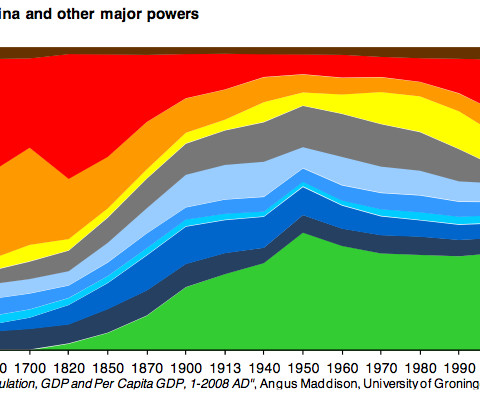

GAA stands for Global Asset Allocation and it has been lagging for 15 years. We spend a lot of time here on how to diversify to try to smooth out the ride and how to hold up better when markets have a year like 2022 or 2008. Here's a great chart to illustrate the point. GAA consistently had smaller drawdowns.

Random Roger's Retirement Planning

MAY 22, 2025

Apple and Microsoft alone often represent over 40% of the fund, with the top 10 holdings typically comprising 60-70% of assets. The 2022 tech selloff and subsequent recovery periods would have hit XLK particularly hard due to this concentration. There was a little more but the above gives you the general idea.

Nerd's Eye View

MAY 2, 2025

a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading! a ski chalet), assessing whether it will lead to greater overall wellbeing, or, alternatively, more stress, is more challenging Enjoy the 'light' reading!

Trade Brains

JULY 16, 2025

Aarti Pharmalabs Limited Aarti Pharmalabs Limited was established in 2022 following a demerger from Aarti Industries and is engaged in manufacturing active pharmaceutical ingredients (APIs), intermediates, and specialty chemicals, serving global pharmaceutical, biotechnology, and healthcare companies with integrated research-driven solutions.

Random Roger's Retirement Planning

FEBRUARY 1, 2025

The Abbey Capital Multi-Asset Fund (MAFIX) and the Catalyst Millburn Hedge Strategy Fund (MBXIX) both do something similar (MBXIX has a little more going on under the hood). It had a couple of terrible years this decade but was the best performer in 2022. And the year by year MBXIX is curious.

Truemind Capital

JULY 18, 2025

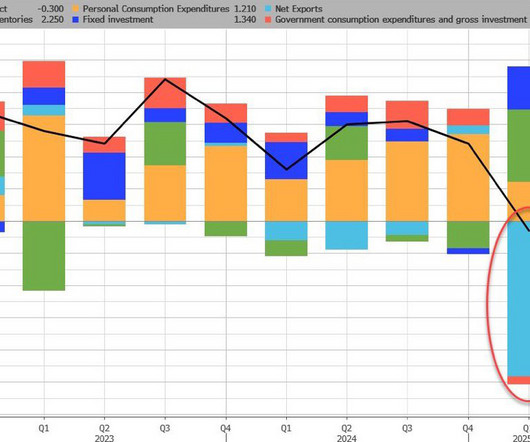

annual rate, the first negative reading since Q1 2022. Other Asset Classes: Gold as an asset class has delivered the highest returns month over month in 2025 so far, driven by global macro and monetary tailwinds. In Q1’25 US Economy contracted at a rate of 0.5% in May), making interest rate decisions tricky.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content