David DeVoe on the State of RIA M&A and How to Maximize Your Firm’s Valuation

Steve Sanduski

JUNE 3, 2025

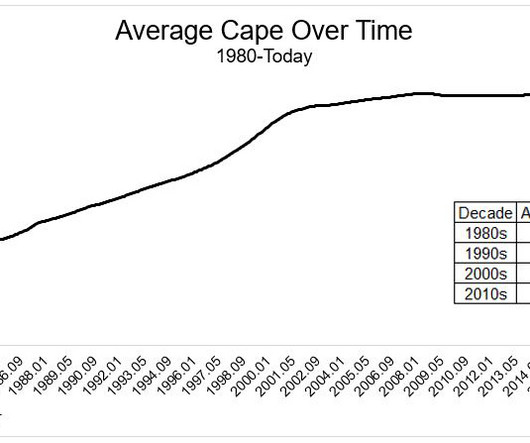

In a nutshell: RIA valuations are high. But the number one driver of these trends isn’t aging founders and succession planning. It should be growing at 9% or 10%, and was back in 2017, and that’s what I as a strategic person think should be happening for a model that’s so great. Private equity is everywhere.

Let's personalize your content