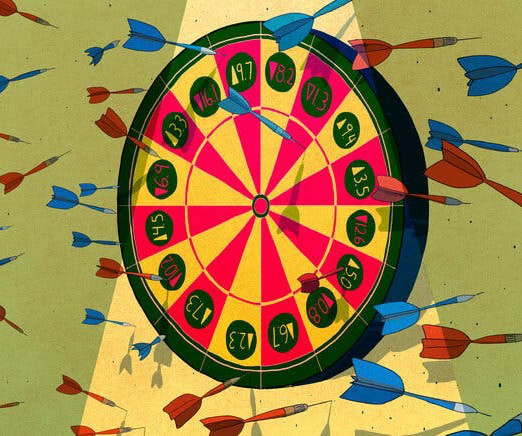

The “Art” of Market Timing

The Big Picture

NOVEMBER 27, 2023

Previously : The Timing Mistake: Thoughts & Pushback (August 26, 2020) Market Timing for Fun & Profit (August 28, 2020) The Art of Calling a Market Top (October 4, 2017) DOs and DONTs of Market Crashes (January 16, 2016) The Truth About Market Timing (March 13, 2013) Timing the Market? By Jeff Sommer New York Times, Nov.

Let's personalize your content