Financial Market Round-Up – Jul’23

Truemind Capital

AUGUST 12, 2023

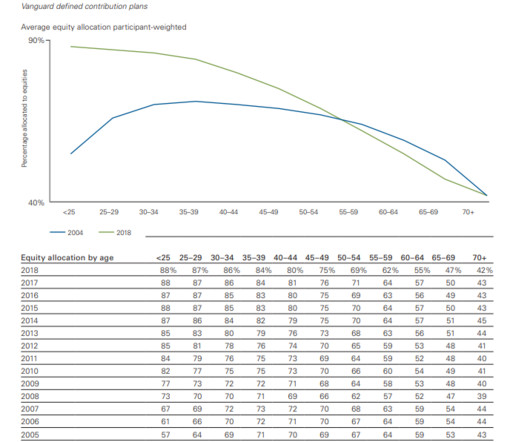

We continue to stay under-allocated to equity (check the 3rd page for asset allocation) at the current valuation levels. Debt Market Insights : The debt yields for the shorter duration came down a bit owing to expectations of relaxed monetary conditions with a better-than-expected decline in inflation numbers.

Let's personalize your content