At the Money: Austan Goolsbee, Chicago Fed President on Tariffs, Inflation and Monetary Policy

The Big Picture

MARCH 6, 2025

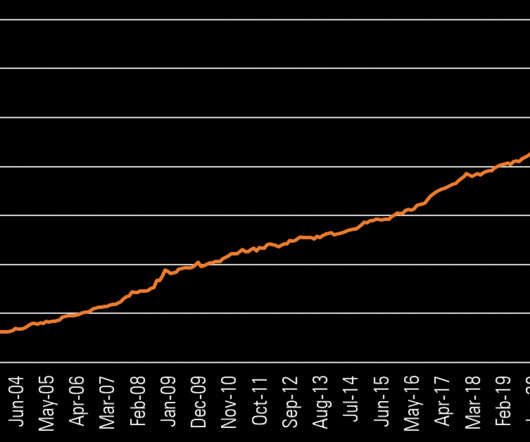

To help us unpack all of this and what it means for your portfolio, let’s bring in Austin Goolsbee. The supply side was healing on the supply chain, and there was a big surge of labor force participation from a number of groups. I think number one. Inflation as a driver of returns. It’s a very noisy series.

Let's personalize your content