Wealth Inequality Starts at the Top

The Big Picture

JUNE 22, 2023

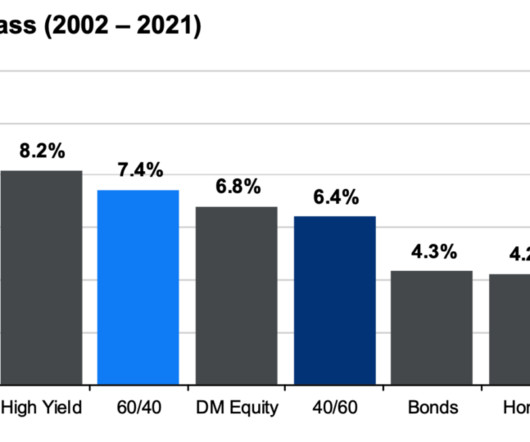

Source: FRED Wealth disparities get ever more lopsided the higher up the economic strata you climb; there is more disparity with the top 1% than the top 10%, but the biggest spreads are at the top 0.1% (and above). The top 0.01% of US households had at least $111 million in net worth in 2012, compared to $4 million for the 1 %.

Let's personalize your content