A Spectacularly Underappreciated 15 Years

The Big Picture

APRIL 28, 2025

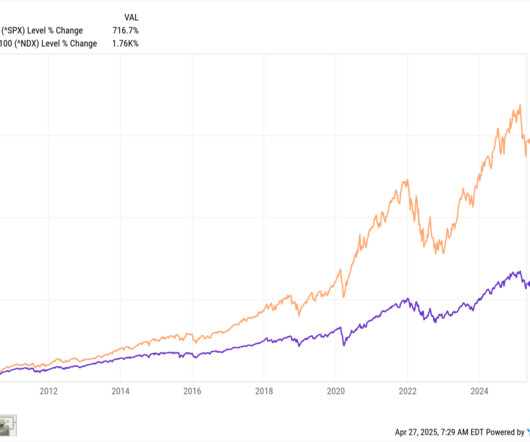

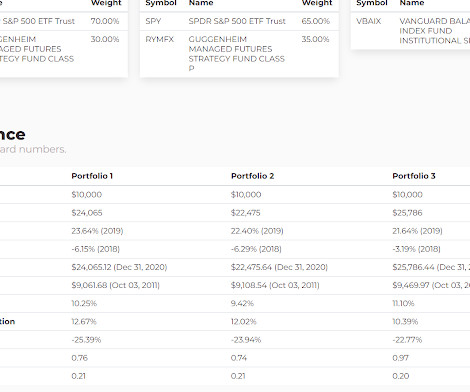

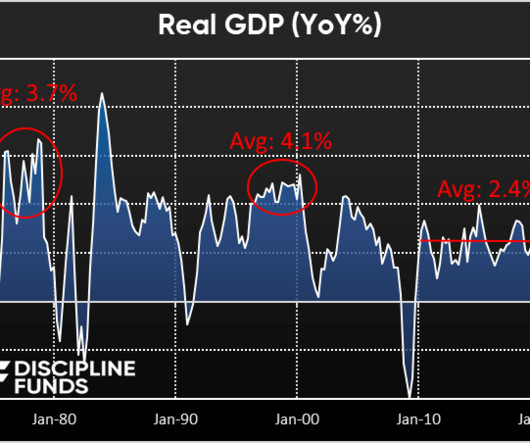

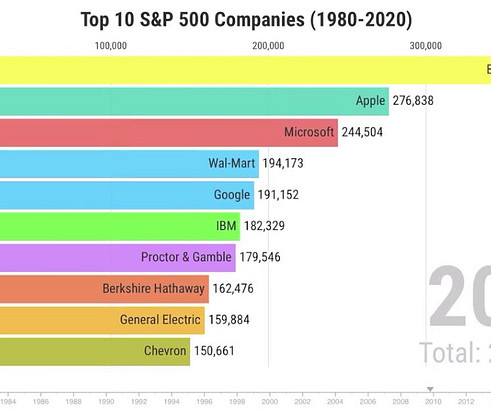

Starting January 1, 2010, the S&P 500 generated a total return (with dividends reinvested) of 566.8% , or 13.3% per year from the start of 2010 through the end of Q1 2025. And that spectacular run of post-financial crisis returns have come with only a few minor setbacks: -Flash Crash in 2010. 2022 down 18% for the year.4

Let's personalize your content