Are Bonds Safe During a Recession or Market Crash?

Darrow Wealth Management

FEBRUARY 26, 2025

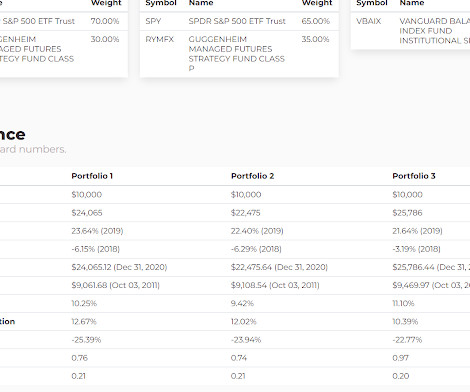

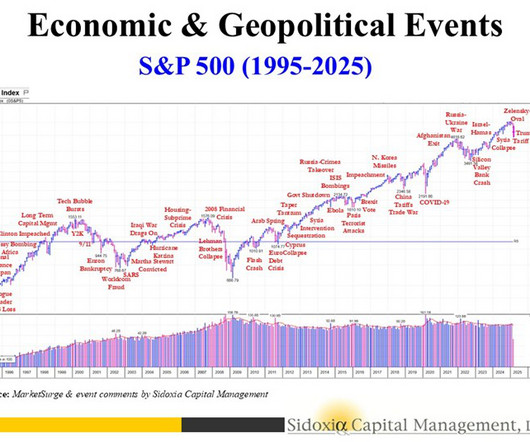

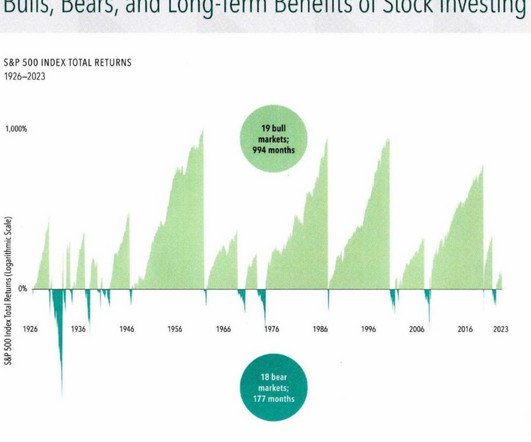

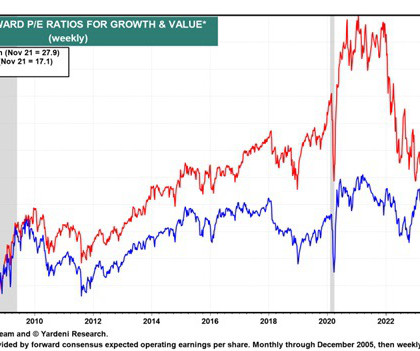

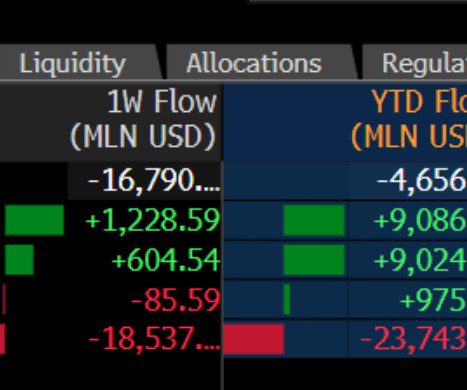

Swings in the financial markets also highlight the benefitsand limitationsof diversification. During times of economic, financial, and political uncertainty, investors often wonder where to invest or what changes to make to their portfolio. The chart below shows what happened to fixed income (bonds) in 2008.

Let's personalize your content