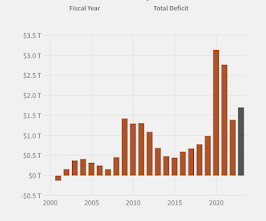

What Happened to "Paying off the National Debt"?

Calculated Risk

MAY 21, 2024

Here are a few excerpts from a speech by then Fed Chair Alan Greenspan in April 2001: The paydown of federal debt "Today I want to address a subject in which your group and the Federal Reserve share a keen interest--the paydown of the federal debt and its implications for the economy and financial markets.

Let's personalize your content