Three Things – Exponential AI

Discipline Funds

MAY 28, 2025

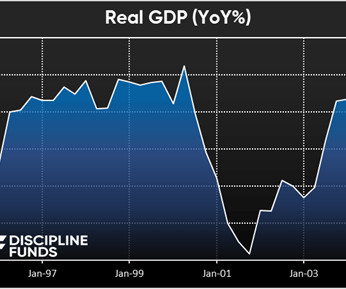

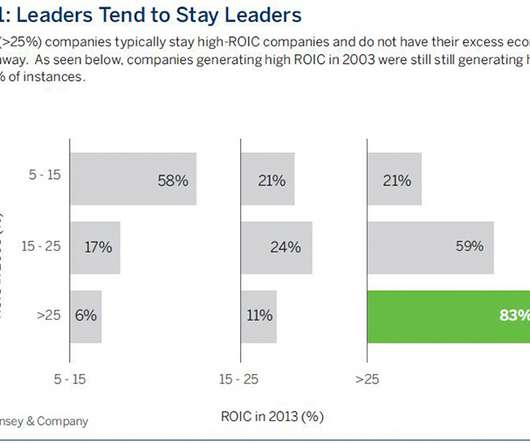

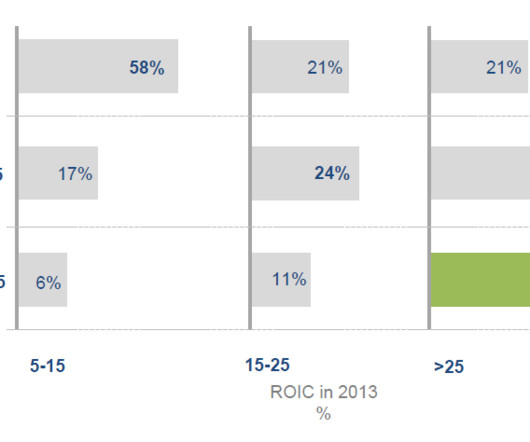

This means valuations could actually move even higher and owning capital is going to become increasingly important for financial well-being. We lost almost 3MM jobs and the rate of GDP growth slowed, but from 2000 until 2003 RGDP actually averaged 2.25%. The age of abundance is coming. Everything will become a technology firm.

Let's personalize your content