Why volatility matters when investing

Nationwide Financial

JANUARY 11, 2023

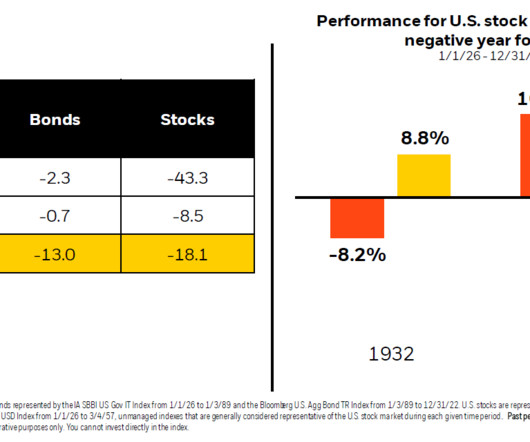

Two of the most significant developments in the financial markets during 2022 were the breakout of higher interest rates and the return of stock market volatility. For a glimpse of how volatile stocks were last year, consider the VIX Index, often used as a gauge of fear or stress in the stock market.

Let's personalize your content