Retirement Visions Joins Redhawk Wealth Advisors

Wealth Management

JANUARY 8, 2024

The 10-person Retirement Visions team left Securities America to harness technology, compliance and administrative support by Redhawk Wealth Ventures.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

The 10-person Retirement Visions team left Securities America to harness technology, compliance and administrative support by Redhawk Wealth Ventures.

Wealth Management

JULY 3, 2025

California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B California RIA Deals & Moves: Focus Partners Wealth Merges in $5.6B

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JUNE 30, 2025

Will More Wealth Advisors Gravitate to 401(k) Plans? Equity Supremacy Ends About the Author David Bodamer Editorial Director, WealthManagement.com David Bodamer covers investments for WealthManagement.com , including hosting the Wealth Management Invest podcast.

Abnormal Returns

NOVEMBER 18, 2024

Podcasts Daniel Crosby talks with Christina Lynn about Motivational Interviewing in order to enhance the work of wealth advisors. kitces.com) Tax planning and wealth management go hand-in-hand. advisorperspectives.com) 7 areas where advisers may be falling short with retired clients.

Abnormal Returns

JUNE 9, 2025

podcasts.apple.com) Dan Haylett talks with Brendan Frazier about the art of spending money in retirement. riabiz.com) Wealth advisors are on notice: inheritors are likely to fire you. Podcasts Jess Bost and Mark Newfield talk with Phil Pearlman about the connection between health and executive function.

Wealth Management

SEPTEMBER 22, 2023

NFP grew its wealth and retirement business in Utah, R&R left Avantax for Commonwealth, tru Independence launched its 4th firm of 2023 and Johnson Financial, LPL and Kestra all made announcements this week.

Wealth Management

DECEMBER 18, 2023

Cerulli data shows what would entice wealth advisors to manage defined contribution retirement plans.

Nerd's Eye View

JULY 10, 2023

As owners of financial planning firms approach retirement, some may decide to sell to an external buyer, while others may plan for an internal succession. Gary Siperstein, Jason's father, had built a successful investment management firm exclusively focused on managing portfolios of small-cap value stocks.

Abnormal Returns

JULY 10, 2023

Podcasts Meb Faber talks with Blake Street is a Founding Partner and CIO of Warren Street Wealth Advisors. larrykotlikoff.substack.com) The biz Goldman Sachs ($GS) has snagged another custodian client, NewEdge Wealth. larrykotlikoff.substack.com) A real-life example of balancing differing wants in retirement. wsj.com)

International College of Financial Planning

JUNE 5, 2025

When I first stepped into the world of wealth management, we didn’t have fancy dashboards. These days, wealth is younger, faster, and more digital than ever – layered with complexities we didn’t even dream of back then. Lets be real for a moment. Clients were all about one thing: performance. It’s not just a certification.

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. youtube.com) Ted Seides talks with Jeff Assaf who is the founder and CIO of ICG Advisors.

Darrow Wealth Management

FEBRUARY 13, 2025

When starting to search for a financial advisor, investors may not realize the different types of advisors out thereand theyre not all trying to sell you something. If youre looking for a fee-only financial advisor or wealth manager, its probably because you know fee-only advisors don’t sell products.

Diamond Consultants

DECEMBER 16, 2024

By Allie Brunwasser & Jason Diamond Its no secret that the wealth management industry has a major impending crisis: A shortage of quality next gen advisor talent. After all, shouldnt the retiring advisors be compensated fairly for their lifes work? So, how do they decide whats best? But is that fair?

FMG

OCTOBER 14, 2022

Financial Freedom Wealth Management Group. Based out of Newport, Oregon the Financial Freedom Wealth Management website focuses on retirement planning services. Check out the site here: Financial Freedom Wealth Management. Peabody Wealth Advisors. Navis Wealth Advisors.

Darrow Wealth Management

JUNE 14, 2023

There are many different types of sudden wealth events, for example: Receiving an inheritance Stock options or equity compensation Sale of a business Winning the lottery Asset division in a divorce Proceeds from a lawsuit Professional athletes (signing bonus, performance, sponsorships, etc.)

Darrow Wealth Management

OCTOBER 28, 2024

Are you planning to retire? Going from running a company to suddenly retired can be a difficult transition for some people. After the transaction is complete, consider ways to protect and grow the wealth you’ve built. Will you retire after selling the business? This is the best way to stress-test a retirement plan.

Indigo Marketing Agency

APRIL 28, 2023

Remember that headlines are searchable by keyword, so you’ll want to spend some time thinking about what your prospects might type into a search when trying to find an advisor to help them with their particular plight. Should Job Title Be Included?

FMG

MAY 19, 2025

Add keywords your audience might use, like Financial Advisor | Retirement Planning or “Wealth Management | Tax Planning.” Examples of Winning Bios Retirement Ready? I help teachers plan their future Book a call Gen Z Money Coach Helping students crush debt & grow wealth.

Darrow Wealth Management

AUGUST 28, 2023

With many sellers relying on the sale to fund their retirement and lifelong financial goals, getting it right from the start is critical. Here are tips from sell-side business advisors on what to do (and not do) when selling a business. Be sure to involve your wealth advisor in discussions around deal terms too.

Indigo Marketing Agency

DECEMBER 19, 2022

He also hosts the Stay Wealthy Retirement Show , which has been ranked on Forbes Top 10 Retirement Podcasts. Taylor has also been named a Top 10 Financial Advisor by Investopedia for the last four years. Joshua Brown is a financial advisor and the CEO of Ritholtz Wealth Management. Taylor Schulte .

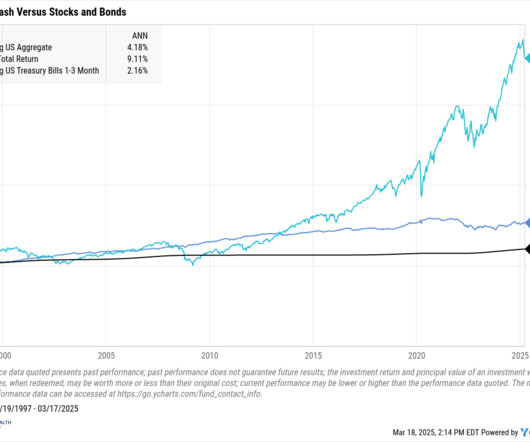

Darrow Wealth Management

MARCH 17, 2025

That’s often the difference between having enough money to retire, and not. Schedule a consultation with a wealth advisor to discuss investing extra cash The post Are You Holding Too Much Cash? appeared first on Darrow Wealth Management. For long-term investors, only stocks have reliably outpaced inflation.

Darrow Wealth Management

MAY 3, 2024

First Steps in Managing a Windfall: Delay major purchases until you have a plan Partner with a sudden wealth management advisor Develop your financial, tax, and estate plan Managing a Large Financial Windfall A sudden wealth event changes your life. Do you want to retire? Can you afford to?

Darrow Wealth Management

MAY 3, 2024

First Steps in Managing a Windfall: Delay major purchases until you have a plan Partner with a sudden wealth management advisor Develop your financial, tax, and estate plan Managing a Large Financial Windfall A sudden wealth event changes your life. Do you want to retire? Can you afford to?

Good Financial Cents

JUNE 11, 2023

You see, financial advisors that focus primarily on wealth management can be costly to keep around. They charge either a percentage of assets managed or a flat hourly rate that can run as high as several hundred dollars per hour, plus trading commissions and administrative fees. Personal Capital to the rescue.

WiserAdvisor

AUGUST 8, 2022

Additionally, high-net-worth individuals may also worry about continuing their lavish lifestyles throughout life, including retirement. If you want guidance on how to preserve your wealth to ensure you do not run out of money during the latter years of your life, consult with a professional financial advisor who can advise you on the same.

Darrow Wealth Management

OCTOBER 29, 2024

As you approach retirement, managing risk is even more important. If you have a target-date retirement fund in your 401(k), it will automatically rebalance. But depending on the investment options in the retirement plan, as the balance grows, it may be advantageous to customize your asset allocation.

Indigo Marketing Agency

JANUARY 11, 2021

About Investments & Wealth Institute Investments & Wealth Institute is a professional association, advanced education provider, and standards body for financial advisors, investment consultants, and wealth managers who embrace excellence and ethics.

Indigo Marketing Agency

MARCH 6, 2023

1:47 Here are some of these keywords: financial advisor, financial planner, retirement planning, and wealth management. For instance, many advisors call themselves wealth planners or wealth advisors. 2:19 So let me show you for the keyword wealth advisor.

Indigo Marketing Agency

MARCH 3, 2023

1:47 Here are some of these keywords: financial advisor, financial planner, retirement planning, and wealth management. For instance, many advisors call themselves wealth planners or wealth advisors. 2:19 So let me show you for the keyword wealth advisor.

Nationwide Financial

DECEMBER 8, 2022

Kristi Martin Rodriguez, SVP of the Nationwide Retirement Institute, and Mike James, Chief Sales Officer for NFP, discuss their financial services career journeys. In this Extraordinary Conversation, leaders from two FARE member firms are joined by an HBCU student and a young professional pursuing her CFP certification.

WiserAdvisor

JANUARY 27, 2023

Due to the complex and diverse range of their financial assets, these individuals also require specialized high-net-worth financial planners and personalized investment management tailored to meet their specific needs. 2023 may see several changes with respect to retirement plans, Social Security, etc., can be effective.

Indigo Marketing Agency

NOVEMBER 20, 2020

From 2013 to 2016, the median assets under management (AUM) grew 6% from $86 million to $92 million. If this trend continues, by 2021, the median AUM for financial advisors will hover around $97 million. . Edward Jones has 14,000 advisors, and Raymond James has 8,100 financial advisors. . Shifting Generations.

International College of Financial Planning

DECEMBER 29, 2024

The CFP Program Structure Comprehensive Curriculum Design The CFP program offers a unique 4-in-1 certification structure that covers all essential areas of financial planning: Investment Planning: Understanding market dynamics, portfolio management, and asset allocation strategies Retirement and Tax Planning: Mastering retirement solutions and tax-efficient (..)

FMG

JANUARY 11, 2023

As stated in the original showcase , “The second you open the New Lantern Advisors website, you’re instantly drawn in with a unique and interesting animated set of videos along with a CTA. They let you know what they’re all about at New Lantern the second you click the site; Embracing Your Retirement. Makers Wealth Management.

FMG

FEBRUARY 3, 2023

Rx Wealth Advisors Right away, you see that Rx Wealth Advisors is an advisory firm that specializes in working with physicians and those that work in the medical field. Only 1% of the population in America serves in the military, and we like their tagline, “100% Focused on the Other 1%.” They serve their purpose.

FMG

FEBRUARY 3, 2023

and marketing your advisor firm. Retirement Security Planners, Inc. has included keywords that clearly stand out on their homepage and tell search engines and visitors what they do, which is comprehensive income planning, wealth preservation and implementation. You can tell by working with C.L.

Indigo Marketing Agency

JUNE 20, 2024

From 2013 to 2016, the median assets under management (AUM) grew 6% from $86 million to $92 million. If this trend continues, by 2021, the median AUM for financial advisors will hover around $97 million. Edward Jones has 14,000 advisors, and Raymond James has 8,100 financial advisors. Are You Ready For 2021?

International College of Financial Planning

OCTOBER 26, 2023

Their wisdom extends to suggesting tax-efficient avenues for pivotal life moments, be it education or the golden years of retirement. While many financial advisors find their niche in investment firms, banks, and insurance sanctuaries, some trailblazers opt for independence, establishing their advisory havens. Where Do They Shine?

FMG

APRIL 6, 2023

But there has been a recent shift, as family offices begin to incorporate similar marketing strategies to standard wealth management firms. CONSTELLATION WEALTH ADVISORS: Constellation Wealth Advisors website pays special attention to layout and style choices by using a minimalist layout for the sake of clarity and user attention.

Sara Grillo

DECEMBER 12, 2022

pay me for investments, for the easy work that I can outsource to a third party manager, and I’ll give you all this hard stuff for free…I don’t believe that., Matt founded Exhale Wealth Management to provide comprehensive financial planning to individuals with complex lives, most notably technology employees with equity compensation.

Sara Grillo

AUGUST 14, 2023

Helping parents send their kids to college, care for an aging parent and retire with financial independence are literally what gets him up every day. Prior to joining EP Wealth Advisors in 2021, Scott worked for a number of the largest Wall Street firms, including UBS, Prudential and Wells Fargo. Lee holds a Ph.D.

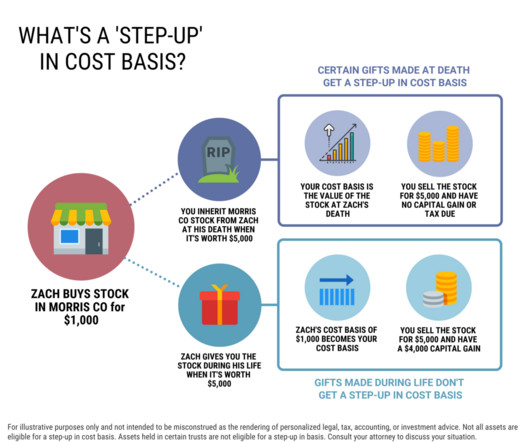

Darrow Wealth Management

JANUARY 16, 2025

Non-retirement assets like stocks in a brokerage account, inherited home , antiques/art/collectables, or other real estate, are generally eligible for a step-up in cost basis. Retirement accounts and IRAs do not receive a stepped up basis. Darrow Wealth Management does not provide tax or legal advice.

Zoe Financial

NOVEMBER 9, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA November 9, 2023 Watch Time: 3 minutes Transcript : All right, so let’s start with the first one here: President Biden’s junk fee crackdown. In the past, the rule was held more on retirement accounts like 401(k)s, etc.

The Big Picture

MAY 9, 2023

He is the Chief Investment Officer of Asset and Wealth Management at Goldman Sachs. He’s a member of the management committee. He co-chairs a number of the asset management investment committees. JULIAN SALISBURY, CHIEF INVESTMENT OFFICER OF ASSET AND WEALTH MANAGEMENT, GOLDMAN SACHS: Thanks, Barry.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content