Weekend Reading For Financial Planners (November 30–December 1)

Nerd's Eye View

NOVEMBER 29, 2024

Read More.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Nerd's Eye View

NOVEMBER 29, 2024

Read More.

Nerd's Eye View

JANUARY 17, 2025

Also in industry news this week: A recent survey indicates that members of Generation X are struggling more with retirement planning compared to older Baby Boomers and younger Millennials, potentially offering opportunities for financial advisors to help Gen Xers create a plan to 'catch up' when it comes to both their retirement savings and their financial (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How to Streamline Payment Applications & Lien Waivers Through Innovative Construction Technology

Your Accounting Expertise Will Only Get You So Far: What Really Matters

FMG

MARCH 3, 2025

Financial advisors know that social media isnt just for posting updates; its for building connections. Social media for financial advisors doesn’t have to be challenging let’s dive into simple ways to encourage comments on your posts. For instance, many people feel overwhelmed by retirement planning.

Midstream Marketing

NOVEMBER 5, 2024

Key Highlights A strong presence on social media can help financial advisors meet potential clients and boost brand awareness. It’s key to develop a social media strategy that matches your target audience and has achievable goals. Understand why compliance, engagement, and tracking success are vital for your social media efforts.

FMG

MARCH 6, 2025

AI-powered search, social media algorithms, and Answer Engine Optimization (AEO) are transforming how potential clients find financial advisors. ” whether it’s Google, AI-driven platforms like ChatGPT, or social media channels. What social media platforms do you rely on most for financial information?

Wealth Management

JULY 15, 2025

Related: M&A Advisory Gladstone Launches $500 RIA Seller Connection Service NFP Buys Wealth and Retirement Firm Levine Group Aon-owned NFP has acquired a former Kestra Holdings-affiliated firm based in Brentwood, Tenn. Levine Group will join NFP, which does wealth management, retirement plan advice, insurance and benefits consulting.

Random Roger's Retirement Planning

JANUARY 6, 2025

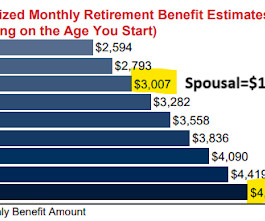

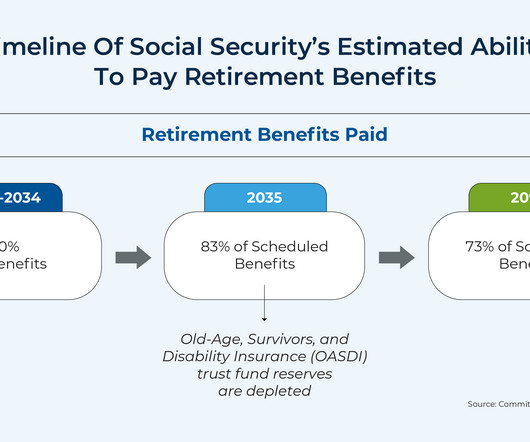

Something like 20-25% is what is thrown around in the media. In the past I worked through a process that led me to conclude that people born before 1975 won't have to actually confront a benefit reduction but plan for it anyway, where does that leave you? What's the risk to Social Security income?

Midstream Marketing

OCTOBER 29, 2024

Therefore, a complete digital marketing plan that includes social media posts is crucial. This plan should focus on social media, engaging content, and an easy-to-use website. Utilizing Social Media to Connect and Engage Social media platforms are very important for sharing financial advice with millennials.

Midstream Marketing

DECEMBER 6, 2024

Discover how digital strategies like AI-driven personalization and strong social media campaigns can help. This means having an easy-to-use website, interesting content, and being active on social media. Social media platforms, like LinkedIn and Facebook, are important too. Clients now want financial advice online.

Midstream Marketing

NOVEMBER 8, 2024

Learn to use social media, content marketing, SEO, and more. You will learn how to use social media, content marketing, paid ads, and referral programs. Utilizing Social Media Platforms for Engagement and Visibility Social media is important for financial advisors who want to reach potential clients.

Sara Grillo

DECEMBER 16, 2024

What if the local baker had a 401k plan? Small business retirement plans are the way to save the American middle class from retirement failure! Why are small business owners not offering 401k plans? This is how Brian approaches the conversation about small business retirement plans. Thats not it.

Indigo Marketing Agency

JUNE 12, 2025

An example of a solid specialty niche for a financial advisor would be “investing strategies for retirement income.” In this case, your target audience is in or near retirement and they want investment strategies that produce portfolio income. Read: How Often Should Financial Advisors Post to Social Media?

Midstream Marketing

OCTOBER 29, 2024

This guide offers helpful tips to create a good advertising plan in the financial services area. This includes using social media, improving your SEO, and designing effective email campaigns. These tools let you plan and automate your social media posts. We will look at different parts of digital marketing.

Midstream Marketing

NOVEMBER 6, 2024

A strong content marketing strategy involves setting clear goals, knowing your target audience, creating various types of content, and using social media and SEO effectively. When you share useful things, like white papers, blog posts, articles, and updates on social media, you can show that you are a thought leader in the financial industry.

Midstream Marketing

DECEMBER 28, 2024

Platform Example Website Dedicated testimonials page, client success stories Social Media Client testimonial graphics, video snippets of satisfied clients Email Marketing Incorporate client quotes into newsletters and email campaigns Genuine and relatable stories matter a lot. Use social media to share tips about money and finance.

Indigo Marketing Agency

FEBRUARY 8, 2025

Its true that scammers do nothing to help skeptical prospects decide who to trust their livelihood with, but the biggest challenge is cutting through all the noise of social media and other financial advisors targeting the same prospects as you. The common thread is that Im connected to these folks on social media and theyre seeing my posts.

Indigo Marketing Agency

MAY 31, 2025

Whether youre sharing a quick tax tip or answering a common financial question, short-form video helps you meet your audience where they already arescrolling on social media, looking for helpful content. Short-form videos are also shared 12x more often than text or image posts on social media. Show your real personality to stand out.

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. Zack is also skilled in presenting, emceeing, event planning, program management, and social media.

Harness Wealth

MARCH 6, 2025

Office supplies: Expenses for items like paper, pens, software, and other necessary office equipment Marketing and advertising: Costs incurred for promoting your freelance services, including website development, social media advertising, and business cards.

Indigo Marketing Agency

JULY 2, 2025

Good CTA Examples (And a Few to Avoid) Great CTAs: “Download Our Retirement Planning Guide” “Join Our Webinar on Investment Strategies” “Get Your Personalized Financial Plan” “Subscribe to Our Weekly Financial Tips” Each of these is clear, benefit-driven, and actionable.

FMG

MAY 19, 2025

Add keywords your audience might use, like Financial Advisor | Retirement Planning or “Wealth Management | Tax Planning.” Include Keywords for Discoverability People search Instagram like they do Google, so include keywords like retirement planning, wealth advisor, or student loan help to boost discoverability.

Indigo Marketing Agency

MARCH 19, 2025

The major media platforms, like Meta, LinkedIn, and Instagram, make money from advertisers. Instead of a headline like Optimize Your Wealth Portfolio for Maximum Returns, try something easier to comprehend like: Grow Your Retirement Savings Faster. Example: Instead of: We provide expert financial advice to help you plan for retirement.

Indigo Marketing Agency

JULY 29, 2025

Let me ask you this: what happens when somebody downloads your guide on your website or social media? I want a stable retirement with investments that grow in a meaningful way.” We explain why this matters for their retirement planning and how they should think about portfolio alignment moving forward.

Indigo Marketing Agency

FEBRUARY 19, 2025

Therefore, your content marketing plan , which includes articles, emails, social media posts, and more, should be laser-focused on aligning with the thoughts, concerns, and goals already on your audiences minds. Automated LinkedIn campaigns and strategic social media sharing can amplify referral reach.

Clever Girl Finance

APRIL 22, 2025

Demand is likely to continue as more and more people in the Boomer generation reach retirement. When people are unsure about how to manage their money, protect their investments, or plan for the future, they turn to experts for guidance. Thats why financial planning services are among the top recession-proof businesses to consider.

FMG

FEBRUARY 13, 2025

Bring in an expert to speak on topics like retirement planning, tax strategies, sustainable investing, or market insights. Repurpose Event Content : Edit and transcribe webinar recordings, then share snippets on social media or create blog posts summarizing key points. It’s a win-win for you and the experts.

Midstream Marketing

DECEMBER 10, 2024

Do you specialize in retirement planning for small business owners? Consistency is key: ensure your branding is uniform across your website, social media, emails, and marketing materials. Social Media Engagement Social media is a powerful tool for advisors to establish an online presence and reach potential clients.

FMG

FEBRUARY 13, 2025

Bring in an expert to speak on topics like retirement planning, tax strategies, sustainable investing, or market insights. Repurpose Event Content : Edit and transcribe webinar recordings, then share snippets on social media or create blog posts summarizing key points. It’s a win-win for you and the experts.

Indigo Marketing Agency

MARCH 5, 2025

By sharing knowledge on topics such as retirement planning, wealth management, and investment strategies, you demonstrate your expertise while attracting an audience already interested in your services. Unlock Your Retirement Potential Free Seminar) Keep the email short, focusing on benefits and a clear CTA.

Indigo Marketing Agency

MAY 13, 2025

Educational Marketing Webinars, seminars , and lunch-and-learns are still some of the most effective tools for attracting new clientsespecially in niches like retirement planning. Specialize in retirement income planning? Webinar Spotlight: Marketing to CPAs: Get Their Attention & Earn Trust 2. People crave education.

Wealth Management

JULY 18, 2025

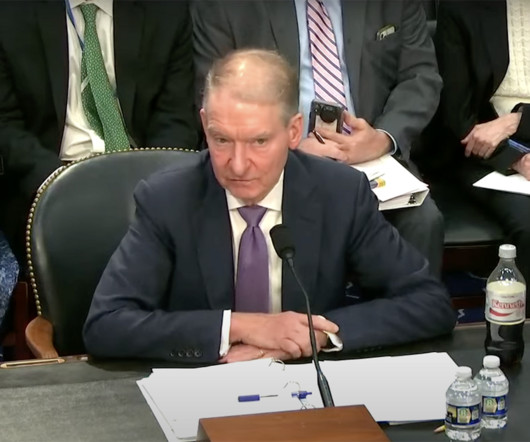

White July 18, 2025 1 Min Read SEC Chair Paul Atkins (Bloomberg) -- US Securities and Exchange Commission Chairman Paul Atkins says the agency will work closely with its counterparts at the Labor Department when considering potential changes to rules for retirement plans. “We I look forward to whatever may come out from the president.”

Random Roger's Retirement Planning

NOVEMBER 7, 2024

Of course, there are changes and tweaks that need to be made to any portfolio that goes narrower than three mutual funds/ETFs but far fewer changes need to be made than most media outlets would have you believe.

Abnormal Returns

MAY 15, 2025

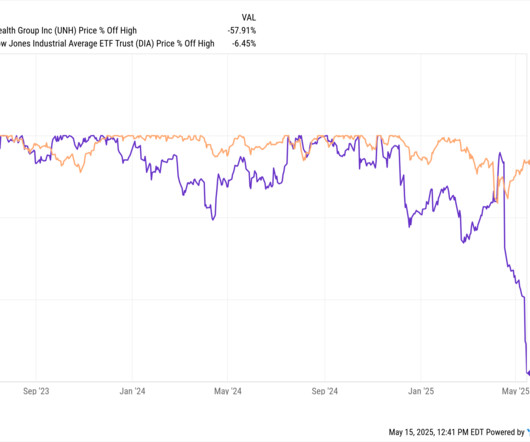

spyglass.org) Alternatives Private equity keeps popping up in retirement plans. rogersplanning.blogspot.com) Retirement plan provider Empower will start including private markets investments in its defined contribution plans. (cnbc.com) The path to a successful IPO is longer than you think.

Random Roger's Retirement Planning

JUNE 5, 2025

There was a fight that played out publicly on Social Media, that's it from me. Someone who is a long way from retiring doesn't really need to worry about sequence of return risk but someone retiring soon does and that would be true even if things were going great right now. It was both hysterical and horrifying at the same time.

FMG

JUNE 13, 2025

Advisors offer insights on retirement, long-term care, or market trends over lunch at a local café or conference room. One advisor noted that these events draw not only current clients but also curious prospects who are actively exploring retirement planning options.

Trade Brains

JULY 2, 2025

It reaffirms that life insurance should be the starting point of any secure financial plan—providing a strong foundation for long-term goals like children’s education, homeownership, and retirement. To ensure reach and recall, it will be executed across multiple media platforms including Television, Digital, Print, Outdoor etc.

The Big Picture

AUGUST 1, 2025

Verdadcap ) see also Foie Gras Retirement plan participants shouldn’t be force-fed private assets : Private equity and credit managers desperately want access to retirement plan participants. Bloomberg ) • Scapegoating the Algorithm : America’s epistemic challenges run deeper than social media.

Nerd's Eye View

JULY 14, 2023

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that while the new social media app Threads, designed to compete with Twitter, has surpassed 100 million users in its first week alone, its potential utility for advisors remains unclear and has raised compliance concerns for advisors (..)

Nerd's Eye View

OCTOBER 2, 2024

In this environment, financial advisors have the opportunity to add value for their clients not only by giving a clear explanation about the current status of Social Security and the potential legislative changes that could improve its solvency, but also by modeling what (realistic) changes would mean for their clients' financial plans.

Nerd's Eye View

MAY 17, 2024

Altogether, the study suggests that social media engagement is driven more by the quality (and originality) of the advisor's content, rather than the quantity of posts.

Nerd's Eye View

JANUARY 13, 2023

From there, we have several articles on retirement planning: The latest rules for 2023 Required Minimum Distributions from inherited retirement accounts. Why relying on Treasury Inflation-Protected Securities (TIPS) to support the bulk of retirement income needs could be risky. Enjoy the ‘light’ reading!

Nerd's Eye View

JULY 28, 2023

Also in industry news this week: The SEC released a proposal that would require firms to take steps to eliminate or neutralize conflicts of interest when using predictive data analytics tools with clients A recent study found that financial advisors remain the top source of financial advice for consumers, with social media coming in well behind From (..)

The Big Picture

NOVEMBER 27, 2023

When you get it wrong, it crushes your retirement plans. My own track record at making big calls is pretty damned good, but none of our clients wants me slinging around their retirement monies based on my gut instinct. But when they get market timing wrong, they lose subscribers. I sure as hell don’t want to either.

The Chicago Financial Planner

JUNE 13, 2022

Don’t get caught up in the media hype. I’m not discounting the great information CNBC and the rest of the financial media provides, but you need to take much of this with a grain of salt. This is a good time to lean on your financial plan and your investment strategy and use these tools as a guide. Be a smart investor.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content