Helping Clients Grasp Abstract Retirement Income Strategies With Historical Market Visualization

Nerd's Eye View

APRIL 2, 2025

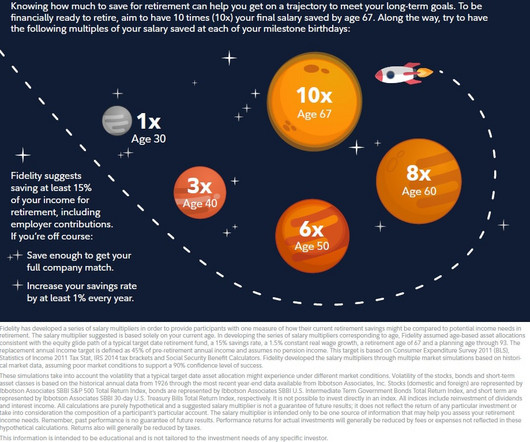

For many financial advisors, a core part of the retirement planning process involves simulating whether the client's assets will last through retirement. Yet while these tools offer mathematical metrics, they often fall short in helping clients connect the numbers to their real lives.

Let's personalize your content