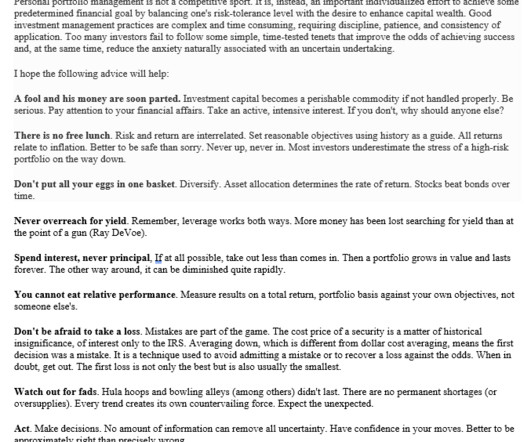

Avoid the Unforced Investment Errors Even Billionaires Make

The Big Picture

APRIL 17, 2025

In How Not to Invest , I showcase extreme examples of unforced errors to illustrate these behavioral mistakes. Chris Bloomstran, chief investment officer of Semper Augustus Investments Group, has tracked this. Decades as an investor and trader on Wall Street have taught me that panics come and go.

Let's personalize your content