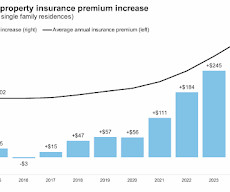

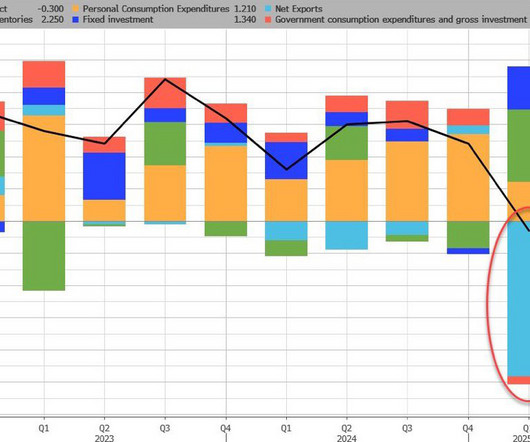

ICE Mortgage Monitor: Property Insurance Costs Rose at a Record Rate in 2024

Calculated Risk

MARCH 5, 2025

Today, in the Real Estate Newsletter: ICE Mortgage Monitor: Property Insurance Costs Rose at a Record Rate in 2024 Brief excerpt: Property Insurance Premiums Increased Sharply in 2024 Here is a chart from the Mortgage Monitor. These increases are largely being driven by losses due to natural disasters.

Let's personalize your content