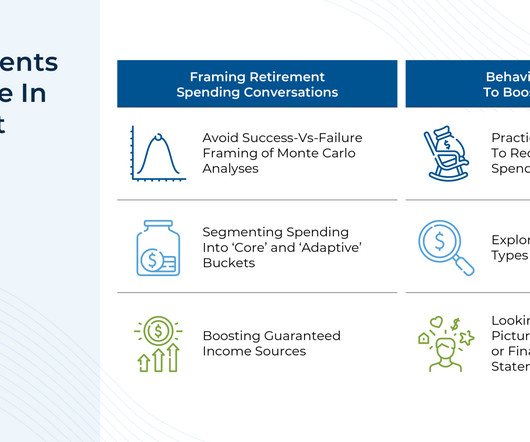

Helping Hesitant Clients Boost Their Retirement Spending

Nerd's Eye View

NOVEMBER 8, 2023

Retirement is often framed as one's "golden years", a time to enjoy the fruits of several decades of hard work. And for many retirees who have planned accordingly, this transition is not a problem as they might spend generously on travel, hobbies, or other pursuits. housing and food) or discretionary (e.g.,

Let's personalize your content