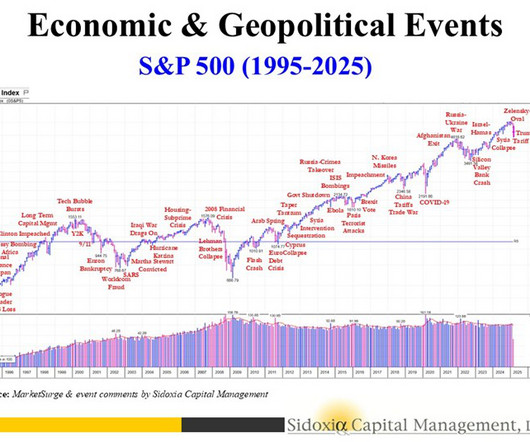

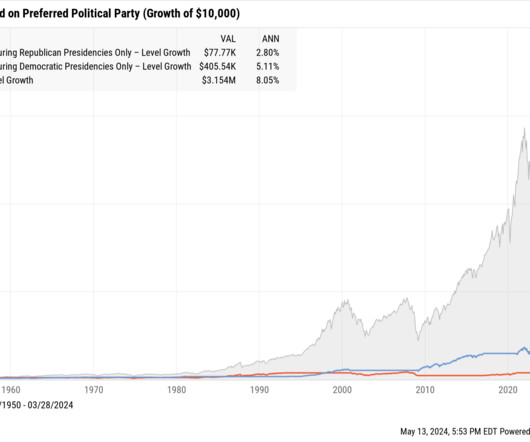

How Presidential Elections Affect the Financial Markets

Your Richest Life

NOVEMBER 1, 2024

presidential election, and while we can’t predict the outcome, we can predict that there will likely be a response from the financial markets. Exactly how the markets will react is less clear, but history has shown us that in times of great change or uncertainty, markets react. We are days out from the next U.S.

Let's personalize your content