Adjusted for Risk: State of the Financial Markets

Wealth Management

AUGUST 12, 2024

Rose Advisors' Patrick Fruzzetti details what advisors should consider when building investment portfolios for the current market environment.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 12, 2024

Rose Advisors' Patrick Fruzzetti details what advisors should consider when building investment portfolios for the current market environment.

Abnormal Returns

OCTOBER 25, 2023

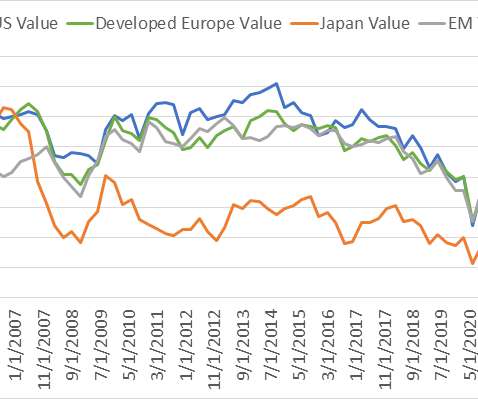

Strategy A big regime shift has happened in the economy and financial markets. investmenttalk.co) Finance Poor recent performance has put the IPO market back on ice. vox.com) Fund management Why the biggest money managers are updating their money market mutual fund prospectuses to allow for liquidity fees.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Your Richest Life

NOVEMBER 1, 2024

presidential election, and while we can’t predict the outcome, we can predict that there will likely be a response from the financial markets. Exactly how the markets will react is less clear, but history has shown us that in times of great change or uncertainty, markets react. We are days out from the next U.S.

Abnormal Returns

NOVEMBER 2, 2022

alephblog.com) Housing Higher land prices are holding back the housing market. abnormalreturns.com) Why rough edges remain in financial markets: people. abnormalreturns.com) Are you a financial adviser looking for some out-of-the-box thinking? thinkadvisor.com) How stable value funds work.

Advisor Perspectives

JUNE 13, 2025

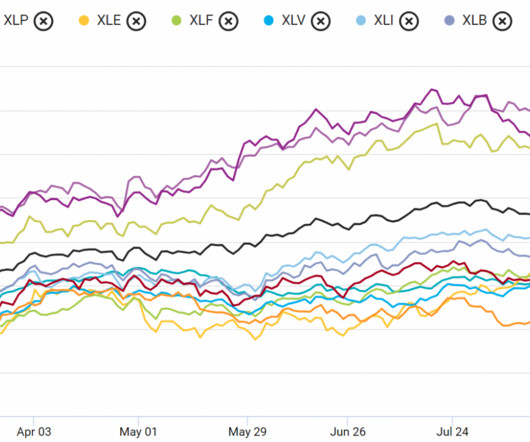

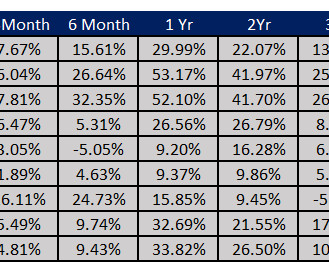

Financial markets have been experiencing some of their wildest trading days in history this year. With increased volatility, long-term investors might benefit from additional exposure to alternative strategies within their portfolio allocations.

Nerd's Eye View

MARCH 26, 2025

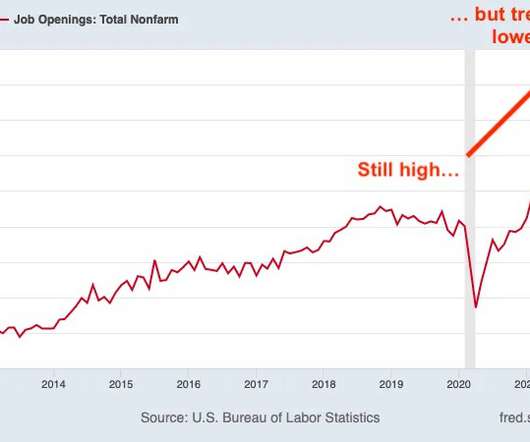

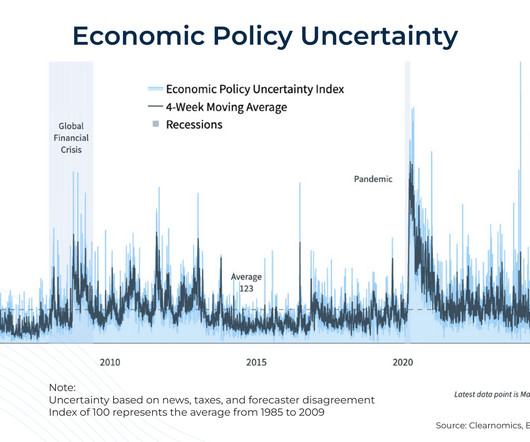

While financial markets tend to rise in the long run, short-term volatility can be alarming for investors. In this article, James Liu, CEO and founder of Clearnomics, and Lindsey Bell, the firm's Chief Market Strategist, present ten charts to help advisors contextualize the current market environment.

Abnormal Returns

OCTOBER 29, 2023

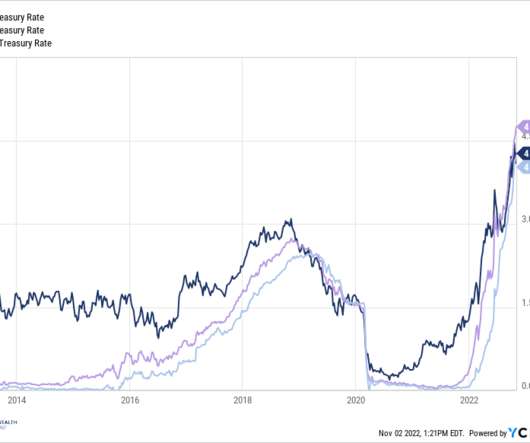

Top clicks this week A big regime shift has happened in the economy and financial markets. ritholtz.com) The bond market bear market is pretty epic. wired.com) Bond bear markets are different than stock bear markets. wired.com) Bond bear markets are different than stock bear markets.

Abnormal Returns

MARCH 31, 2024

sportico.com) Are index funds propping up the stock market? awealthofcommonsense.com) Which bonds prove as the best portfolio diversifier? wsj.com) Gary Stevenson’s book “The Trading Game” helps explain the past twenty years in the financial markets. (awealthofcommonsense.com) There's no alpha left in private equity.

Your Richest Life

FEBRUARY 24, 2025

2025 Markets and Economy Since November, the S&P 500, the Dow Jones Industrial Average and Nasdaq have all hit record highs. We know that market rallies dont last forever, and the potential for tariffs, layoffs and higher inflation in the coming months could lead to more market volatility.

Validea

NOVEMBER 25, 2024

This episode explores how passive investing has transformed markets, featuring insights from leading experts including Mike Green, Aswath Damodaran, Rick Ferri, Rob Arnott, and Cliff Asness.

Tobias Financial

APRIL 8, 2025

Recent headlines around escalating tariffs have rattled the financial markets, leaving many retirees understandably concerned. At Tobias Financial Advisors, were here to help you navigate times like these with clarity and confidence. Our mission is to provide clarity and support through all market conditions.

The Big Picture

JANUARY 25, 2023

The study mostly discusses differences between the bodies of knowledge active and passive investing are based upon; how the incumbent groups of players adapt to new themes and market interest.

Calculated Risk

APRIL 19, 2023

The financial market effects of a debt default would be highly uncertain , both because of its unprecedented nature, and because (as events in recent years have illustrated) we have only a limited understanding of the dynamics of the financial system when hit with a major shock.

Truemind Capital

NOVEMBER 8, 2024

Everyone loves a rising market. Like the circle of life, good times are followed by bad times, and bad times are followed by good times, stock markets also go through cycles of excessive greed/optimism to excessive fear/pessimism. For the sustainable long-term progress of financial markets, corrections are healthy and useful.

The Big Picture

SEPTEMBER 9, 2023

McAuliffe has a unique track record of successful innovation applying statistical methods to real-life prediction problems, particularly in the financial markets. We discuss his career in machine learning, from Amazon’s recommendation engine to using AI to manage portfolios.

Indigo Marketing Agency

MARCH 20, 2025

Recession Concerns & Market Volatility: How Financial Advisors Should Communicate With Clients As financial advisors , youre well aware that so far the 2025 financial market has been more unpredictable than a toddler. Thats where financial advisors come in! What Story Does History Tell? The wrong way?

Truemind Capital

APRIL 19, 2024

Equity Market Insights: A few themes are dominating the equity markets worldwide and in India. Falling interest rates make money cheaper and thus fuel equity market returns. Equity markets are riding on the expectations of the strong comeback of the NDA-led Government resulting in policy continuity.

Darrow Wealth Management

FEBRUARY 26, 2025

Swings in the financial markets also highlight the benefitsand limitationsof diversification. During times of economic, financial, and political uncertainty, investors often wonder where to invest or what changes to make to their portfolio. Yes, even though the stock market got all the headlines. treasuries.

Trade Brains

SEPTEMBER 17, 2023

Best Porinju Veliyath Portfolio Stocks: Investors are always on the lookout for small-cap companies which can lead to multi-bagger returns. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. In this article, we’ll read about such best Porinju Veliyath portfolio stocks. EPS ₹8 Stock P/E 196 RoE 3.2%

Pragmatic Capitalism

SEPTEMBER 19, 2022

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short [ … ]

Truemind Capital

NOVEMBER 8, 2024

Negative effects of a prolonged bull market. Everyone loves a rising market. Like the circle of life, good times are followed by bad times, and bad times are followed by good times, stock markets also go through cycles of excessive greed/optimism to excessive fear/pessimism. Be prepared for crazy when the markets are calm.

Yardley Wealth Management

AUGUST 20, 2024

The post Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility appeared first on Yardley Wealth Management, LLC. Staying Disciplined: How to Stick to Your Financial Plan Despite Market Volatility Introduction: Market volatility is a fact of life for investors.

Trade Brains

SEPTEMBER 17, 2023

Here are the 5 Indian stocks in which Goldman Sachs has highest holdings: Top Indian Stocks Held By Goldman Sachs Top Indian Stocks Held By Goldman Sachs #1 – Gokaldas Exports Particulars Amount Particulars Amount CMP 780 Market Cap (Cr.) Market Cap (Cr.) Market Cap (Cr.) Market Cap (Cr.) Market Cap (Cr.)

Trade Brains

SEPTEMBER 28, 2023

Market Cap (Cr.) Particulars Amount Particulars Amount CMP 781 Market Cap (Cr.) Operating Profit Margin 7.08% Net Profit Margin 2.52% Ashok Leyland partnership caters to the market for commercial vehicles. Particulars Amount Particulars Amount CMP 94 Market Cap (Cr.) Market Cap (Cr.) EPS (TTM) 11.66 EPS (TTM) 20.97

The Big Picture

SEPTEMBER 21, 2022

‘We must keep at it until the job is done.’ ( Wall Street Journal ) see also The “Data-Dependent” Fed and the Data Interpreting the mixed signals across the economy, with a focus on inflation, jobs, and market pricing. ( Don’t Take Financial Advice From Kanye West : Nothing fails quite like success. The Overshoot ).

Trade Brains

NOVEMBER 11, 2023

Market Cap (Cr) 45 EPS (TTM) 1.32 Zee Entertainment Enterprises Particulars Amount Particulars Amount CMP (Rs) 262 Market Cap (Cr) 24,954 EPS (TTM) 1.17 Its domestic broadcast portfolio includes over 48 channels. The Company’s 41-channel international broadcast portfolio is available in over 170 countries.

Trade Brains

AUGUST 18, 2023

Best Vijay Kedia Portfolio Stocks: Many investors keep a close eye on stock buys and sales of ace investors for ideas and inspiration. In this article, we’ll look at the best Vijay Kedia portfolio stocks and see if they can be an interesting opportunity for us as well. He got into the stock market at the early age of 19.

The Big Picture

FEBRUARY 24, 2023

They discuss AQR’s 60/40 portfolio strategy and the risks facing financial markets, with Sonali Basak and Guy Johnson on “Bloomberg Markets.” Sonali Basak interviews AQR Capital Management’s Cliff Asness.

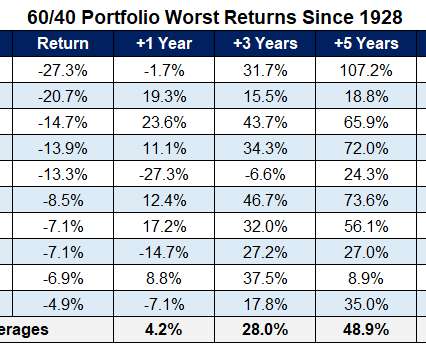

A Wealth of Common Sense

JANUARY 10, 2023

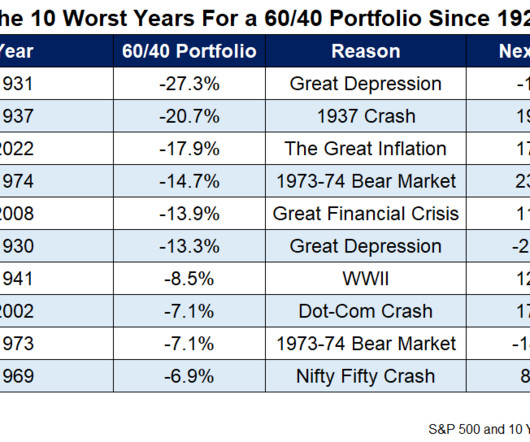

It’s now well-documented that 2022 is one of the worst years in history for financial markets. The logical next step is to look at what has happened next following the prior worst years for stocks, bonds and diversified portfolios. Last year was one of the worst years ever for stocks and the worst year ever for bonds.

Investing Caffeine

FEBRUARY 21, 2023

Slome, CFA®, CFP®, Founder of Sidoxia Capital Management, LLC, will share 10 crucial mistakes made by investors that can destroy your portfolio. Learn how to avoid these missteps and expand your wealth. Register Here To Attend Replay will also be made available and posted to Investing Caffeine.

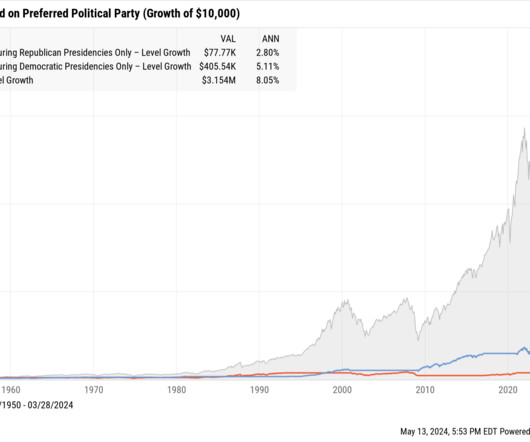

Darrow Wealth Management

JUNE 10, 2024

And they definitely shouldn’t let politics upend their long-term financial plans. Because historically, financial markets have rewarded investors who stay the course. These charts can help explain what investors should expect from the stock market this election cycle. But that’s no reason to panic.

The Big Picture

DECEMBER 23, 2023

His Monthly Chart Portfolio of Global Markets and Market Analysis Commentary are both widely read among professional traders. He is both a chartered market technician and CFA. Pring Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications by John J.

Trade Brains

OCTOBER 23, 2023

Market Cap (Cr) 4,651.91 Particulars Amount Particulars Amount CMP (Rs) 261 Market Cap (Cr) 2,608.67 The product portfolio includes rear axle shafts, spindles, and splined shafts, and rear axle shafts contributing to the majority of revenue. Market Cap (Cr) 1,971 EPS (TTM) 31.75 Market Cap (Cr) 9,563.78 ROE (%) 16.17

A Wealth of Common Sense

DECEMBER 31, 2023

2022 was one of the worst years ever for financial markets. Over the past 100 years: It was the third worst year for a 60/40 portfolio. It was the worst year ever for the Barclays Aggregate Bond Market Index. It was the seventh worst year for the S&P 500. It was the worst year ever for the 10 year Treasury bond.

The Big Picture

FEBRUARY 7, 2024

To find out more, I speak with Jeremy Schwartz, Global Chief Investment Officer of WisdomTree, leading the firm’s investment strategy team in the construction of equity Indexes, quantitative active strategies and multi-asset Model Portfolios. Jeremy Schwartz : You know, I think 1 of the big risks to the market are these major bubbles.

The Big Picture

MARCH 6, 2025

To help us unpack all of this and what it means for your portfolio, let’s bring in Austin Goolsbee. And if you go look at the market estimation from tips or from others, people believed it. And so it doesn’t have to be that the inflation rate of the Zillow market rents matches the owner equivalent rents.

Trade Brains

OCTOBER 4, 2023

International markets that the corporation has sold its goods to include those in North America, Europe, the Middle East, Africa, and Asia-Pacific. Market Cap (Cr) 12,124 EPS (TTM) 6.16 Market Cap (Cr) 1,587.9 Particulars Amount Particulars Amount CMP (Rs) 182 Market Cap (Cr) 4,302 EPS (TTM) 14.22 Market Cap (Cr) 1,387.6

Truemind Capital

OCTOBER 18, 2024

That’s exactly what we’ve seen in India’s financial markets in the quarter ending September 2024. Here is what’s happening currently- Stock markets are rising Bond Prices are increasing / Bond Yields are falling Gold is trending upwards Real Estate Prices are inching upwards ALL KEY ASSET PRICES ARE GOING NORTHWARDS!

Pragmatic Capitalism

SEPTEMBER 7, 2022

I joined Dr. Daniel Crosby on the Standard Deviations podcast for a wide ranging discussion about portfolio management and navigating the conspiracy theories of the financial markets. This one’s short [ … ].

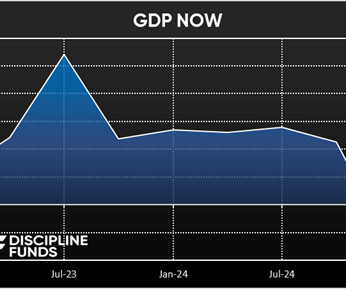

Discipline Funds

FEBRUARY 28, 2025

It was a wild week in the markets, but the biggest news of the week dropped on Friday when the Atlanta Fed revised their GDP Now estimate from +2.3% One of the investment strategies I wrote about in detail in my forthcoming new book was Buffett’s 90/10 stock/T-Bill portfolio. Yes, you read that correctly. NEGATIVE 1.5%.

Brown Advisory

SEPTEMBER 21, 2022

Resilience is Core to Sustainable Portfolio Construction. While the old adage “only time will tell” generally refers to a future outcome, it is apropos of our belief that a truly sustainable portfolio must consist of businesses that have proven to be resilient under a variety of macroeconomic circumstances. Wed, 09/21/2022 - 10:50.

The Big Picture

NOVEMBER 20, 2023

My firm RWM uses Canvas for those clients who want their portfolios to reflect their values. The most popular ESG application of direct indexing software has been to remove guns and tobacco from portfolios. It reflects the desire for investors to have their portfolios reflect their personal values. Oct 31, 2023) 4.

Darrow Wealth Management

NOVEMBER 14, 2022

Declines in the financial markets are an uncomfortable part of investing. Taking steps to plan ahead of a market decline is best, though what you do during a selloff is also crucial. But individuals sometimes make decisions that cause preventable financial losses. the stock market. Chasing the market.

Abnormal Returns

AUGUST 30, 2022

advisorperspectives.com) How financial markets respond to climate risks. alphaarchitect.com) Why ESG ratings are no way to run a portfolio. ft.com) Stock markets in autocratic countries experience lower returns and more risk. ESG Historically good companies to work for have been good investments.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content