The Future Of Financial Advice: How Tech and Approaches In 2030 Will Differ From Today

Nerd's Eye View

JANUARY 8, 2024

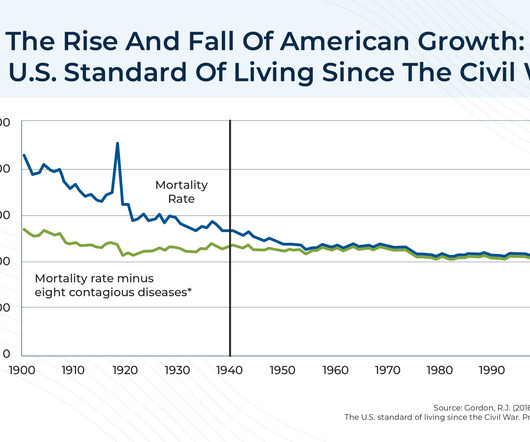

For instance, the financial advice industry has seen many changes to regulations (for both advisors and their clients), advisor business models, and the advisor technology landscape. The changing patterns in how financial advice is delivered can be compared to the similar trends seen in the evolution of medicine.

Let's personalize your content