AI and Ethics: A Double-Edged Sword for Wealth Management

Wealth Management

JULY 31, 2025

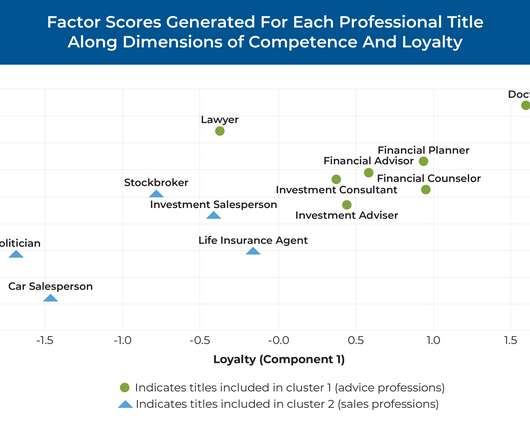

Yet, as AI becomes embedded in wealth management, ethical concerns around bias, transparency, and data privacy are surfacing that advisors and clients cannot afford to ignore. Wealth managers will play a considerable role in helping current asset holders plan and facilitate this unprecedented reallocation of wealth.

Let's personalize your content