Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

NOVEMBER 30, 2022

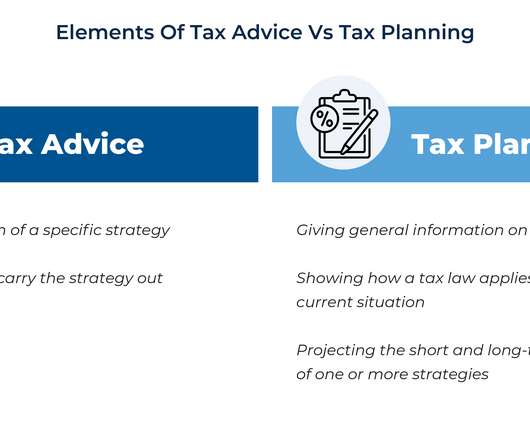

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. marknewfield.substack.com) How to look for holes in your financial plan. contessacapitaladvisors.com) Four steps to an estate plan.

Nerd's Eye View

APRIL 5, 2023

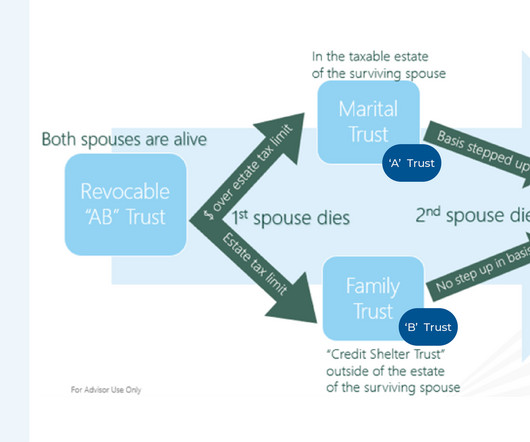

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

Wealth Management

JULY 2, 2025

Handler is a partner in the Trusts and Estates Practice Group of Kirkland & Ellis LLP. The October 2011 edition of Leading Lawyers Magazine lists David as one of the "Top Ten Trust, Will & Estate" lawyers in Illinois as well as a "Top 100 Consumer" lawyer in Illinois.

Wealth Management

JULY 2, 2025

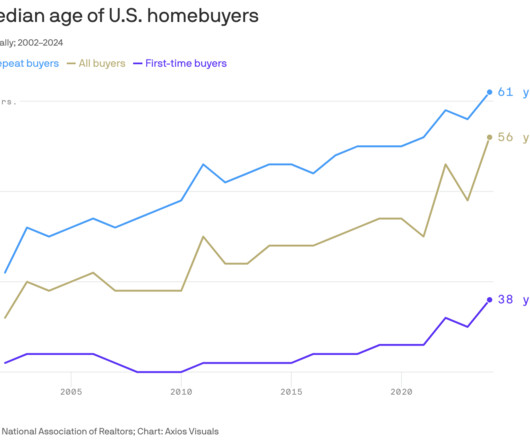

As a result, financial advisors should start honing the services Gen X members will likely benefit from the most, including retirement planning, estate and tax planning and mortgage refinancing. trillion annually over the next decade as part of the great wealth transfer, a new report finds. trillion annually.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. thinkadvisor.com) A year-end tax planning checklist. (standarddeviationspod.com) The biz Fidelity is crushing it. riabiz.com) What is the target market for MAGA-centric Strive Wealth Management?

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Wealth Management

JUNE 11, 2025

Ratner June 11, 2025 2 Min Read A client whose estate will remain non-taxable after 2025 has a policy in an irrevocable life insurance trust (ILIT) that was presumably purchased for estate tax liquidity. Ratner is a commentator on life insurance and estate planning based in Cleveland, Ohio. Ratner Charles L.

Wealth Management

JUNE 10, 2025

RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth RIA Edge Podcast: Schwab’s Jalina Kerr on How Resilient RIAs Can Turn Market Volatility Into Growth Jalina Kerr of Charles Schwab shares how the most adaptive firms are expanding beyond portfolio management, into areas like estate and tax planning.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Abnormal Returns

SEPTEMBER 4, 2024

morningstar.com) Early in retirement is the time to do some tax planning. nextavenue.org) Estate planning Mistakes to avoid in your estate planning. theretirementmanifesto.com) If you have a valuable collection you need a plan for its eventual disposition.

Tobias Financial

JUNE 2, 2025

Estate planning is one of the most important steps in securing your financial legacy, but its also among the most complex. Understanding how assets will be distributed, navigating tax implications, and aligning these decisions with your personal goals can feel overwhelming.

Nerd's Eye View

JANUARY 8, 2024

improves on the previous iterations of planning by involving a more thorough technical analysis of a client's unique situation than it did before and drilling deeper to reveal more planning opportunities to present to clients. Specifically, Financial Advice 3.0

Nerd's Eye View

JUNE 21, 2024

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

Harness Wealth

APRIL 17, 2025

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

Nerd's Eye View

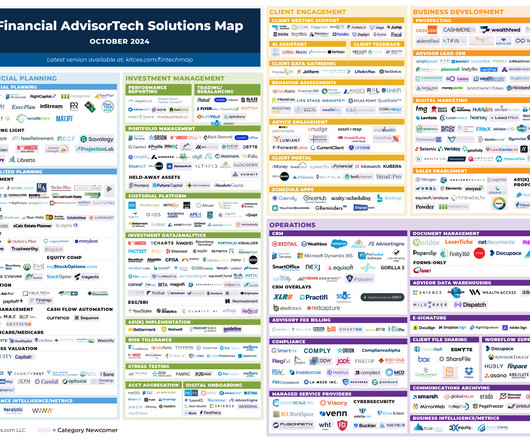

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Yardley Wealth Management

FEBRUARY 4, 2025

The post Tax Strategies for High-Income Earners 2025 appeared first on Yardley Wealth Management, LLC. Tax Strategies for High-Income Earners in 2025. In this comprehensive guide, we’ll explore proven strategies to help you minimize tax liability while staying compliant with current regulations.

Abnormal Returns

AUGUST 5, 2024

kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. investmentnews.com) On the importance of tax planning in the first few years of retirement. papers.ssrn.com) Four steps to create a digital estate plan. (riabiz.com) The SEC Onsite SEC examinations are ramping up. forbes.com)

Carson Wealth

JUNE 27, 2025

Unexpected events can derail your progress toward your goals and even your financial security if you don’t have a plan for managing them. Financial planning should ideally involve every area of your financial life because they are all interrelated. Tax planning. Estate planning. Tax planning is crucial.

Harness Wealth

MARCH 6, 2025

As is traditional, the 2025 IRS tax filing deadline is April 15th. In this guide, well explore the 2025 tax extension process, the reasons for requesting an extension, and how a tax advisor from Harness can help you. Table of Contents What is a tax extension? Why do I need a tax extension? This is not the case.

Nerd's Eye View

SEPTEMBER 6, 2023

Beyond insurance, advisors and their clients can also consider options such as the use of corporate entities such as Limited Liability Companies (LLCs) for business interests, and estate tax planning tools such as Spousal Lifetime Access Trusts (SLATs) that can offer both estate planning and asset protection benefits for married couples.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Carson Wealth

JANUARY 8, 2025

Holistic Financial Management Beyond investment advice, financial advisors offer comprehensive services such as tax planning, estate planning, and risk management. This support can be important in maintaining discipline and making rational decisions amidst market fluctuations.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Tobias Financial

JUNE 16, 2025

These events may affect your investment approach, tax planning strategies, insurance needs, and estate planning documents. Without periodic evaluations, it’s possible for parts of your plan to become misaligned with your current circumstances.

Yardley Wealth Management

FEBRUARY 18, 2025

Key benefits include: Ensuring essential financial obligations are met first – Taxes, estate planning, and retirement savings take precedence. Strategic long-term planning – Provides a roadmap for surplus wealth allocation. Consider tax implications, liquidity of assets, and personal values in financial planning.

WiserAdvisor

JUNE 16, 2025

Additionally, you also need to consider domestic disputes and estate planning issues related to property. These accounts typically offer stronger privacy protections as well as favorable tax regimes that can enhance your wealth preservation strategy. So, consult with a qualified tax professional before executing it.

Integrity Financial Planning

NOVEMBER 14, 2023

We’re coming up on the end of the year, and while it’s a time to take a break and enjoy the holiday season, it’s also a good time to consider tax strategies that may benefit you. Gift Tax Exemptions Each year, you can give up to $17,000 to any number of people tax-free.

Zoe Financial

JUNE 20, 2025

For high-net-worth individuals, continuously refining your strategy over time is what keeps your plan efficient and aligned with evolving goals. This guide consolidates what we’ve learned to help you refine, update, or pressure-test your current retirement and estate strategy with confidence.

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Your current and projected future tax rate is often a main component of the decision, but there are other considerations and benefits as well. 4 key benefits.

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” These numbers show an opportunity for tax practices to build deeper, meaningful relationships with their clients, helping them to navigate some of life’s most challenging financial decisions.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade. Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. Discuss more advanced estate planning, charitable planning and special family issues.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens. You buy a business.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . Tax-Planning Possibilities.

Yardley Wealth Management

AUGUST 27, 2024

The post Tax-Free Transfers from Your IRA to Charity: A Smart Financial Strategy appeared first on Yardley Wealth Management, LLC. Tax-Free Transfers from Your IRA to Charity: A Smart Financial Strategy At Yardley Wealth Management, we understand that many clients want to make a difference while also securing their financial future.

Carson Wealth

FEBRUARY 13, 2023

While there are certainly ways to do estate planning without a lawyer, for most people hiring an estate planning attorney makes the most sense. Estate plans can get complex fast, and even fairly straightforward estates can feel overwhelming if you’re not trained in the area. Do your research.

International College of Financial Planning

JULY 2, 2025

Rising incomes, complex tax rules, countless investment options, and growing aspirations have made personal finance decisions more challenging than ever. Here’s the pathway under the current education structure: Investment Planning Specialist – Focuses on asset classes, portfolio strategies, and wealth accumulation.

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help with maximizing your retirement income through tax planning After retirement, your income sources may become limited to pensions, Social Security benefits, and investment income. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income.

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Yardley Wealth Management

FEBRUARY 15, 2022

The post Part 2: Tax-Wise Investment Techniques appeared first on Yardley Wealth Management, LLC. Part 2: Tax-Wise Investment Techniques. In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools.

Harness Wealth

APRIL 16, 2025

Roth IRA conversions present a significant challenge for retirement planners: pay taxes now or later? Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement. One of the Roth IRA’s most compelling features?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content