Inflation’s Impact on Retirement, Taxes and Estate Planning

Wealth Management

JUNE 24, 2024

Six ways to help clients gain peace of mind regarding inflation.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 24, 2024

Six ways to help clients gain peace of mind regarding inflation.

Abnormal Returns

NOVEMBER 6, 2024

Podcasts Christine Benz and Amy Arnott talk the state of retirement with Anne Tergensen of the WSJ. podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. humbledollar.com) How to retire without regrets. Quit playing.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

NOVEMBER 29, 2024

Also in industry news this week: While many financial advisors are paying close attention to the potential extension of sunsetting measures within the Tax Cuts and Jobs Act (TCJA) in the coming year, legislation related to retirement savings could be on Congress' agenda as well Fidelity is planning to change the default for its existing RIA non-retirement (..)

Abnormal Returns

NOVEMBER 20, 2024

(sites.libsyn.com) Frazer Rice talks with Christine Benz author of "How to Retire" (podcasts.apple.com) Carl Richards talks money and more with journalist Kara Swisher. 50fires.com) Retirement Gray divorce can have a huge effect on your retirement. nytimes.com) Taxes in retirement only get more complicated.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. kitces.com) What it means to be a great adviser to retired clients. thinkadvisor.com) A year-end tax planning checklist. (standarddeviationspod.com) The biz Fidelity is crushing it.

Abnormal Returns

MAY 21, 2025

morningstar.com) Dan Haylett talks with Fritz Gilbert about his 10 Commandments of Retirement. humbledollar.com) Who gets the education tax credit? nytimes.com) Personal finance 11 financial things to do in your 40s, including 'Doing an estate plan check up.' Financial History."

Carson Wealth

DECEMBER 20, 2024

Strategic charitable giving not only benefits the recipient but can also create significant tax advantages for the giver. While many people approach their financial planning with careful strategy, its easy to overlook the same level of intention when it comes to charitable giving. It just needs to be given to a qualified 501(c)(3).

Abnormal Returns

APRIL 10, 2024

(morningstar.com) Dan Haylett talks with Eric Brotman, who is the founder and CEO of BFG Financial Advisors, about retirement as 'graduation.' humansvsretirement.com) Estate planning Why you should update your estate plans periodically. wsj.com) Retirement Some reasons to go back to work after retiring.

Abnormal Returns

DECEMBER 4, 2024

Podcasts Christine Benz talks 2025 taxes with Ed Slott author of "The Retirement Savings Time Bomb Ticks Louder." morningstar.com) Dan Haylett talks with Christine Benz, author of "How to Retire: 20 Lessons For a Happy, Successful, And Wealthy Retirement." apolloacademy.com) Taxes Some things to know about doing a QCD.

Abnormal Returns

SEPTEMBER 4, 2024

(ritholtz.com) Rick Ferri talks with Christine Benz about her new book "How to Retire, 20 Lessons for a Happy, Successful, and Wealthy Retirement." morningstar.com) Sam Dogen talks in ins and outs of early retirement with Khe Hy. sites.libsyn.com) Retirement Why spending decisions in retirement are challenging.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Nerd's Eye View

NOVEMBER 30, 2022

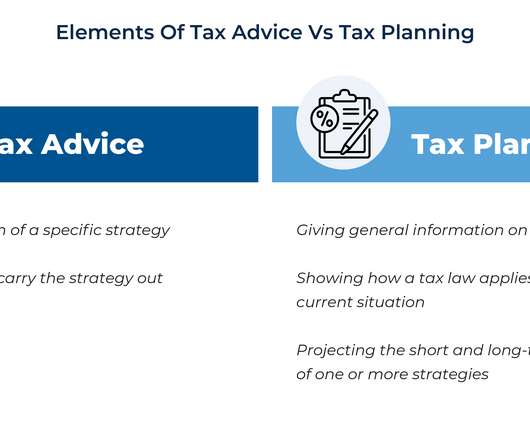

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Abnormal Returns

JUNE 5, 2024

(ritholtz.com) Dan Haylett talks with Stephanie McCullough, founder of Sophia Financial, about the challenges facing women planning for retirement. humbledollar.com) Gold is not taxed like stocks and bonds. wsj.com) Retirement When to collect Social Security is a complex decision, that you can't take back.

Abnormal Returns

NOVEMBER 27, 2024

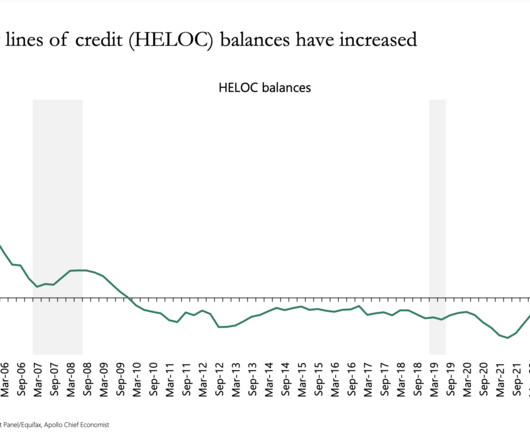

(apolloacademy.com) How higher property taxes would help unlock the housing market. msn.com) Aging Spending more money doesn't necessarily make for a more fulfilling retirement. nextavenue.org) Lessons learned from Warren Buffett's estate planning, including 'Tell your kids you are proud of them.'

Nerd's Eye View

JUNE 26, 2024

And so the conundrum of people with "too much" savings in their 529 plan – either because they overestimated how much they needed to save, or because they chose a different path entirely that didn't involve going to college – has been how to get funds out of the plan without sacrificing a large part of their value to taxes and penalties.

Abnormal Returns

MAY 8, 2024

(advisorperspectives.com) The 7 best retirement books including "More Than Enough: A Brief Guide to the Questions That Arise After Realizing You Have More Than You Need" by Mike Piper. morningstar.com) Retirement Three tips to improve your retirement including 'Pursue serendipity.' ft.com) Estate planning is all about tradeoffs.

Dear Mr. Market

DECEMBER 31, 2024

Maximize Retirement Contributions Contribute as much as possible to your 401(k), IRA, or Roth IRA. Optimize Tax Strategies Its not what you makeits what you keep. Meet with your tax advisor to discuss harvesting tax losses, Roth conversions, and charitable contributions that might save you money. A good rule of thumb?

Integrity Financial Planning

AUGUST 28, 2022

Understand the basics first, and then create an estate plan. Wills and trusts are both important estate planning tools with important differences. Many people may not know that their will does not control who inherits all of their assets, such as retirement accounts, life insurance, and annuities.

Abnormal Returns

SEPTEMBER 27, 2023

awealthofcommonsense.com) Why you should keep track of the tax basis of your house. morningstar.com) A first-hand account of the case for hiring a tax preparer. dariusforoux.com) Want to be happier in retirement? marketwatch.com) Why your estate plan should include this letter.

Nerd's Eye View

APRIL 18, 2025

Also in industry news this week: According to a recent survey, 40% of financial advisory clients would switch to an advisor who offers estate planning services, with help with specific tasks like beneficiary designations or tax strategies as the most sought-after service among respondents RIA M&A activity set a first-quarter record to start the (..)

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Nerd's Eye View

MARCH 24, 2023

Also in industry news this week: Top Democratic Senators are urging the Treasury Department to crack down on a range of estate planning strategies for high-net-worth individuals, including GRATs and IDGTs Amid fallout from recent bank failures, both Republicans and Democrats are considering whether current FDIC insurance limits should be increased (..)

Nerd's Eye View

NOVEMBER 21, 2022

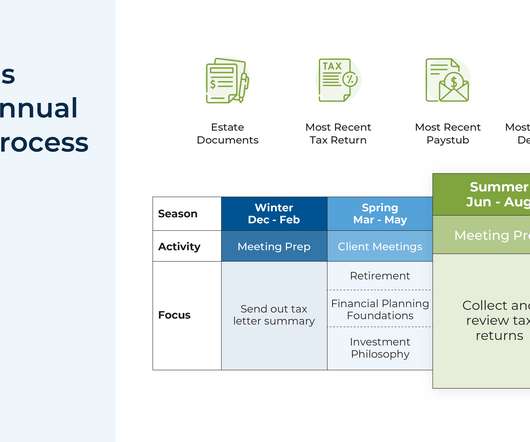

A common service model for many financial advisory firms is to schedule annual client meetings throughout the year where the advisor meets with each client in the month they started working with the firm, and conducts a comprehensive review of all planning topics for the client.

Nerd's Eye View

JUNE 21, 2024

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

Nerd's Eye View

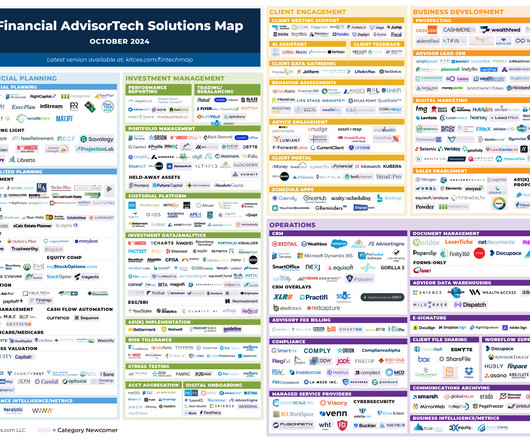

OCTOBER 7, 2024

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Yardley Wealth Management

FEBRUARY 4, 2025

The post Tax Strategies for High-Income Earners 2025 appeared first on Yardley Wealth Management, LLC. Tax Strategies for High-Income Earners in 2025. In this comprehensive guide, we’ll explore proven strategies to help you minimize tax liability while staying compliant with current regulations.

MainStreet Financial Planning

JANUARY 23, 2025

For 2024, the maximum taxable earnings subject to Social Security tax is $168,600. Review Your Estate Planning Documents Take some time to review the key documents in your estate plan, such as your will, power of attorney, and property deeds. If you notice any errors, you can easily request a correction online.

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. forbes.com)

Yardley Wealth Management

FEBRUARY 18, 2025

Key benefits include: Ensuring essential financial obligations are met first – Taxes, estate planning, and retirement savings take precedence. Strategic long-term planning – Provides a roadmap for surplus wealth allocation. Tier 2: Allocates funds to retirement accounts and family support.

Harness Wealth

APRIL 17, 2025

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

The Big Picture

MAY 29, 2024

Not just the stocks and bonds, but your taxes, your will, your estate, any trusts, insurance, credit line, real estate, and anything that affects your financial health. Appreciated stock is so much more attractive, no taxes paid]. Who’s in charge of that? I think it’s been broken for a long time.

Yardley Wealth Management

JANUARY 21, 2025

These professionals help you define clear financial objectives and create actionable plans to achieve them, whether you’re planning to buy a home, save for college, or prepare for retirement. Retirement Planning Retirement planning is one area where talking to a financial planner proves particularly worthwhile.

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Your current and projected future tax rate is often a main component of the decision, but there are other considerations and benefits as well.

WiserAdvisor

AUGUST 31, 2023

Financial advisors play a crucial role in assisting you before your retire. They can also help you optimize your savings and investment plans, ensuring that you maximize your earning potential while minimizing risks. Here are 5 benefits of hiring a financial advisor after you retire: 1.

Nerd's Eye View

SEPTEMBER 6, 2023

For instance, qualified plan assets (e.g., 401(k) and 403(b) plans) offer purportedly unlimited creditor protection for plan participants, meaning that if an individual were to be sued or file for Federal bankruptcy protection, balances in these accounts would not be at risk. tenancy by the entireties and community property).

Integrity Financial Planning

JUNE 27, 2023

However, it is a common goal for retirees to create and maintain generational wealth in retirement. Prior to your retirement years, diversifying your investment portfolio can be a good way to grow your wealth. This can include investing in stocks, bonds, real estate, and other assets. [3]

Integrity Financial Planning

NOVEMBER 14, 2023

We’re coming up on the end of the year, and while it’s a time to take a break and enjoy the holiday season, it’s also a good time to consider tax strategies that may benefit you. Gift Tax Exemptions Each year, you can give up to $17,000 to any number of people tax-free.

Abnormal Returns

SEPTEMBER 30, 2024

riabiz.com) Taxes How pre-tax retirement contributions provide flexibility down the road. kitces.com) Tax strategies if the TCJA expires in 2026. flowfp.com) Don't let the potential for estate law changes be an excuse to not do estate planning.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

WiserAdvisor

OCTOBER 4, 2022

Retirement planning can be a bit complex. There are multiple factors to weigh in, right from healthcare and inflation to estate planning, business succession planning, tax planning, and more. However, the main drawback to this can be the lack of foresight regarding what and how to plan.

MainStreet Financial Planning

MAY 17, 2023

We speak daily with clients who are contemplating where they might live in retirement. Now is the time to explore various retirement housing options and strategies for aging individuals. From aging in place to retirement communities, consider your individual preferences and needs when choosing the most suitable housing option.

Carson Wealth

DECEMBER 8, 2023

That must mean it’s time to roll up my sleeves and get to work on year-end financial planning – with an emphasis on 2023 income tax. One consideration this year is that we’re two years from the expiration of the Tax Cuts and Jobs Act of 2017 (TJCA). AGI impacts multiple other tax considerations.

Abnormal Returns

OCTOBER 10, 2022

(riabiz.com) Fidelity, Vanguard and Alight are rolling out a service to automate the transfer of retirement accounts between employers. riabiz.com) Taxes Why RIAs love to buy accounting firms. citywireusa.com) A look at the performance of automated tax-loss harvesting strategies. fa-mag.com) Risk is unavoidable. Panic is not.

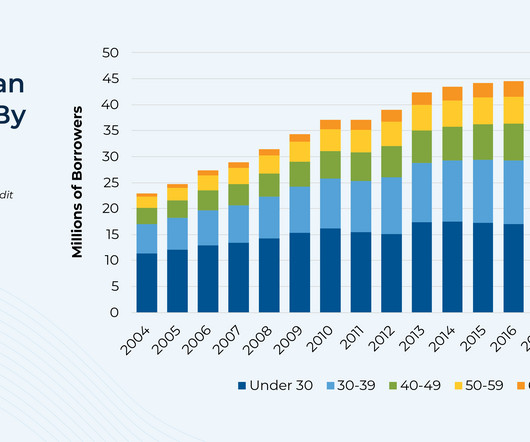

Nerd's Eye View

SEPTEMBER 27, 2023

Which not only cuts into a parent's current cash flow, but also limits their ability to save for their (potentially fast-approaching) retirement. Nonetheless, Parent PLUS borrowers (and their advisors) have an opportunity (until July 1, 2025) to access more generous IDR plans by using a "Double Consolidation" loan strategy.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content