Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

APRIL 5, 2023

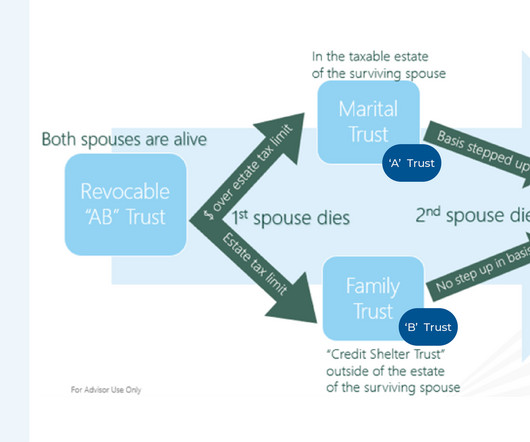

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. marknewfield.substack.com) How to look for holes in your financial plan. contessacapitaladvisors.com) Four steps to an estate plan. They aren't going up in value.

Nerd's Eye View

NOVEMBER 30, 2022

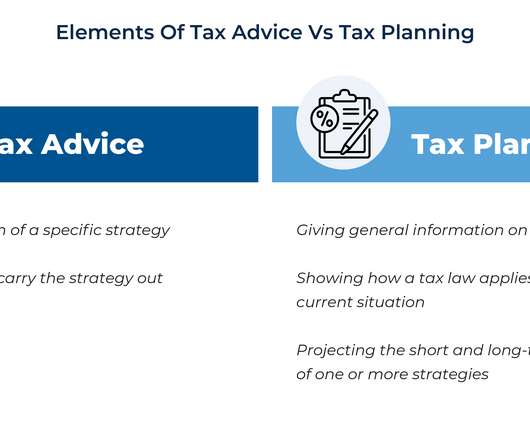

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. thinkadvisor.com) A year-end tax planning checklist. (standarddeviationspod.com) The biz Fidelity is crushing it. riabiz.com) What is the target market for MAGA-centric Strive Wealth Management?

Tobias Financial

JUNE 2, 2025

Estate planning is one of the most important steps in securing your financial legacy, but its also among the most complex. Understanding how assets will be distributed, navigating tax implications, and aligning these decisions with your personal goals can feel overwhelming.

Abnormal Returns

SEPTEMBER 4, 2024

(morningstar.com) Early in retirement is the time to do some tax planning. nextavenue.org) Estate planning Mistakes to avoid in your estate planning. theretirementmanifesto.com) If you have a valuable collection you need a plan for its eventual disposition.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year.

Nerd's Eye View

JANUARY 8, 2024

These changes all have the potential to change the industry by shifting the current focus on selling financial products (including financial plans themselves) to providing a more in-depth and personalized experience that helps anticipate future issues in a client's life and better help them identify the goals that will help them thrive.

Nerd's Eye View

OCTOBER 7, 2024

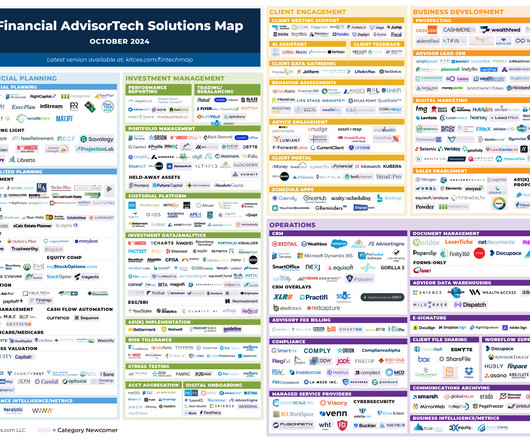

Welcome to the October 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

SEPTEMBER 6, 2023

While asset protection is a popular planning topic for High-Net-Worth (HNW) and ultra-high-net-worth clients, those who are not HNW are susceptible to the same threats to wealth. For instance, qualified plan assets (e.g.,

Nerd's Eye View

JUNE 21, 2024

million in assets to both retire and pass on a legacy interest (though many have yet to establish an estate plan), according to a recent survey. Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that affluent Americans believe they need an average of $5.5

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. investmentnews.com) On the importance of tax planning in the first few years of retirement. forbes.com)

Carson Wealth

JANUARY 8, 2025

Knowledge and Personalized Planning Financial advisors can bring a wealth of knowledge from extensive education and experience, helping enable them to craft tailored strategies that align with your unique financial goals. This personalized approach can help you make financial decisions that are well-informed and strategically sound.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Yardley Wealth Management

FEBRUARY 18, 2025

We’ll also explore the role of income tiers, provide real-world case studies, and highlight key considerations when implementing this strategy in your financial plan. Key benefits include: Ensuring essential financial obligations are met first – Taxes, estate planning, and retirement savings take precedence.

Carson Wealth

FEBRUARY 13, 2023

While there are certainly ways to do estate planning without a lawyer, for most people hiring an estate planning attorney makes the most sense. Estate plans can get complex fast, and even fairly straightforward estates can feel overwhelming if you’re not trained in the area. Do your research.

Million Dollar Round Table (MDRT)

JULY 21, 2022

This is the time to do comprehensive financial planning: retirement planning, investment planning, tax planning and estate planning. Discuss more advanced estate planning, charitable planning and special family issues.

Harness Wealth

APRIL 17, 2025

Floor plans, regular updates to your documentation, and a clear boundary between personal and business space help establish the legitimacy of your home office deduction. These variables can significantly impact the final deduction amount, necessitating strategic planning to optimize this benefit.

Yardley Wealth Management

FEBRUARY 4, 2025

In this comprehensive guide, we’ll explore proven strategies to help you minimize tax liability while staying compliant with current regulations. In this comprehensive guide, we’ll explore proven strategies to help you minimize tax liability while staying compliant with current regulations.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade. Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Darrow Wealth Management

APRIL 21, 2025

No required minimum distributions (RMDs) for the original account owner Unlike IRAs and qualified retirement plans, a Roth IRA is unique in that required minimum distributions are not required during the original account owners lifetime. A spouse may also elect to defer RMDs if they inherit the account.

AdvicePay

JUNE 13, 2024

Much like the maintenance of a car ensures its longevity and optimal performance, financial planning demands both one-time and ongoing attention. This approach allows you to engage these clients by charging a fee that’s covered through their monthly cash flow.

WiserAdvisor

AUGUST 31, 2023

They can also help you optimize your savings and investment plans, ensuring that you maximize your earning potential while minimizing risks. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income. Tax planning is not solely about federal taxes.

eMoney Advisor

FEBRUARY 9, 2023

If you are looking for opportunities to grow your business, expanding your services to clients at all stages of the financial planning lifecycle creates new opportunities for you to reach those households in search of professional advice. People in this stage may have just graduated from college and recently joined the working world.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens. You sell a business.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . Tax-Planning Possibilities.

Clever Girl Finance

MARCH 19, 2024

No one cares more about your financial well-being than you, so having a personal financial plan is important. Knowing how to make a financial plan will allow you to save money, afford the things you want, and achieve long-term goals like saving for college and retirement. Table of contents What is a financial plan?

Darrow Wealth Management

JULY 1, 2024

This tax benefit is scheduled to sunset at the end of 2026. Tax planning for 2026 Depending on your situation, income, and goals, your planning options will vary. As with anything in tax planning, it’s important not to let the tax-tail wag the dog. If you gifted the full $13.61

Integrity Financial Planning

MARCH 15, 2023

From financial plans to home remodeling, it’s common to be tempted to DIY your way there. Financial planning can be complicated. Have you thought about taxes or estate planning or when to withdraw and from where? Here’s what you’ll learn on today’s show: Why shouldn’t you plan retirement by yourself? (0:12)

Harness Wealth

SEPTEMBER 18, 2024

Only 26% of Americans have an estate plan. If you’re thinking, “But my clients are high-net-worth…many more have an estate plan.” These numbers show an opportunity for tax practices to build deeper, meaningful relationships with their clients, helping them to navigate some of life’s most challenging financial decisions.

WiserAdvisor

NOVEMBER 4, 2022

In addition to this, you can save more and plan for more significant purchases with greater ease. The tax liabilities for married couples filing their taxes jointly will differ from single individuals and those filing individually. Is financial planning for dual-income families different from others?

Inside Information

JANUARY 31, 2025

Depending on a firms tech strategy, she wrote, advisors may have to log in to the CRM, custodian, portfolio accounting, planning software, tax planning software, estate planning software, social security maximizer software, etc.,

International College of Financial Planning

DECEMBER 29, 2024

In today’s increasingly complex financial landscape, professional financial planning education has become more crucial than ever. The CFP certification stands as the gold standard in financial planning, offering professionals a comprehensive pathway to excellence in this dynamic field.

Harness Wealth

APRIL 16, 2025

Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement. The stakes became higher after the Tax Cuts and Jobs Act of 2017 eliminated recharacterizationthe ability to reverse conversions that did not work as planned.

Harness Wealth

MARCH 6, 2025

Determining the fair market value of stock options, for example, can be time-consuming, with a tax extension allowing individuals to make sure theyre maximizing the potential tax benefits of their equity compensation. Instead of a tax extension, you should explore IRS payment options and installment plans.

Yardley Wealth Management

FEBRUARY 15, 2022

Part 2: Tax-Wise Investment Techniques In our last piece, we introduced some of the tools of the tax-planning trade. In other words, your tax-planning techniques matter at least as much as the tools. Tax breaks come and go, and are beyond our control. It’s another to make best use of them.

Yardley Wealth Management

FEBRUARY 15, 2022

Part 2: Tax-Wise Investment Techniques. In our last piece, we introduced some of the tools of the tax-planning trade. These include tax-sheltered accounts for saving toward retirement, healthcare, and education, as well as tax-efficient tools for charitable giving, emergency spending, and estate planning. .

Carson Wealth

JUNE 4, 2025

Impulse giving and ad hoc donations may feel good in the moment, but the focus and planning of strategic philanthropy offer you an opportunity to make the scale of impact that can be effective and satisfying in a more enduring way. You dont have to stop rounding up at the cash register but dont think of that as your philanthropic plan.

Darrow Wealth Management

AUGUST 28, 2023

Sarah Grossman, Principal of BayState Business Brokers in Needham, MA, says this helps sellers “shape their timeline and any financial planning that needs to be completed prior to a sale.” On the personal side, your financial advisor , estate planning attorney, and CPA/tax advisor should be involved throughout the process.

Integrity Financial Planning

NOVEMBER 14, 2023

Gift Tax Exemptions Each year, you can give up to $17,000 to any number of people tax-free. This means that if you have two children, you can give each of them $17,000 without a tax penalty in 2023. [1] 1] This can be something you do as part of your estate plan.

Harness Wealth

JUNE 9, 2023

Recognizing the need for a financial plan is a significant first step toward the goal of achieving personal financial security. Table of Contents What is a Financial Plan? Table of Contents What is a Financial Plan? Why is Financial Planning so Important? Why is Financial Planning so Important?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content