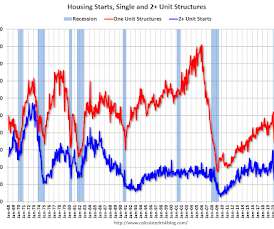

Realtor.com Reports Weekly Active Inventory Up 34% Year-over-year; New Listings Down 15%

Calculated Risk

OCTOBER 20, 2022

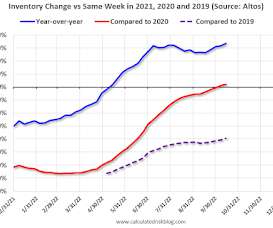

Realtor.com has monthly and weekly data on the existing home market. Here is their weekly report released today from Chief Economist Danielle Hale: Weekly Housing Trends View — Data Week Ending Oct 15, 2022. Note: They have data on list prices, new listings and more, but this focus is on inventory. • Active inventory continued to grow, increasing 34% above one year ago.

Let's personalize your content