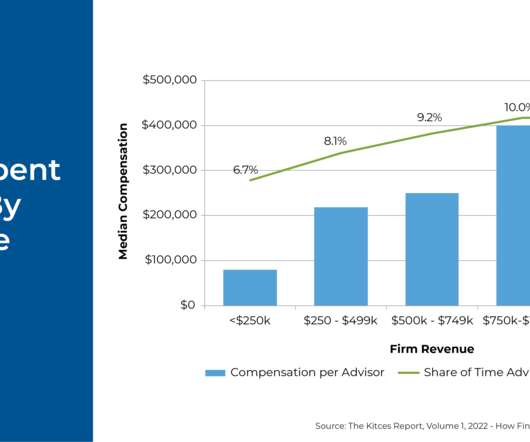

What Makes Financial Advisors Happier: More Time Or More Money?

Nerd's Eye View

JANUARY 9, 2023

While it may be easy to assume that having more money would make a person happier by opening consumption opportunities unavailable to those with less income, experienced advisors can likely identify many examples of high-income individuals who are unhappy with their lives. To provide a more holistic view, researchers have sought to assess whether increased income leads to greater happiness on two dimensions: emotional wellbeing (how an individual feels today) and evaluative wellbeing (how an ind

Let's personalize your content