Are Fixed Indexed Annuities More Efficient Than Bonds?

Advisor Perspectives

AUGUST 14, 2023

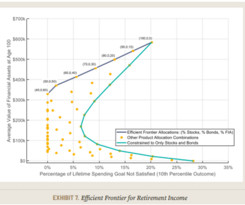

When adjusting for more realistic assumptions and considering the fact that the insurance company can change return caps and that inflation is both an unknown and deep risk, an FIA, along with most annuities, is not on the efficient frontier in either accumulation or decumulation phases.

Let's personalize your content