Breaking the Chains of Time

Advisor Perspectives

NOVEMBER 20, 2023

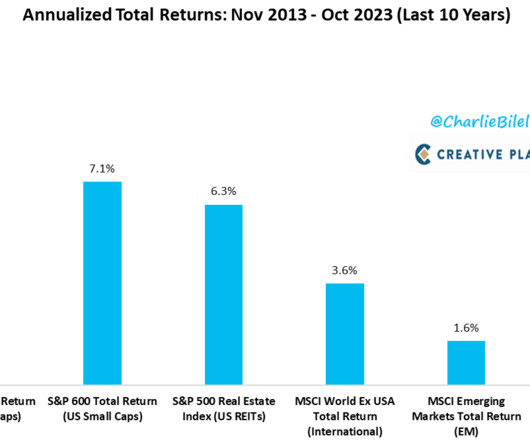

Investors should embrace a genuine long-term perspective, extending their time horizons to at least 20 to 30 years. The traditional notion of long-term investing (five to 10 years) may fall short of realizing the full benefits of long-term strategies.

Let's personalize your content