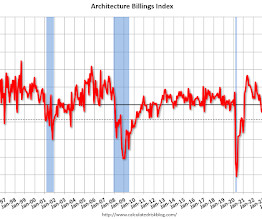

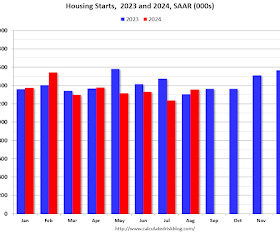

AIA: Architecture Billings Declined in August; Multi-family Billings Declined for 25th Consecutive Month

Calculated Risk

SEPTEMBER 18, 2024

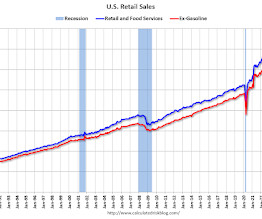

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment. From the AIA: Architecture firm billings remained sluggish in August, as the AIA/Deltek Architecture Billings Index (ABI) score declined to 45.7 It has now been nearly two years since firms saw sustained growth. However, clients are still expressing interest in new projects, as inquiries into work have continued to increase during that period.

Let's personalize your content