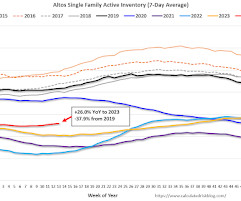

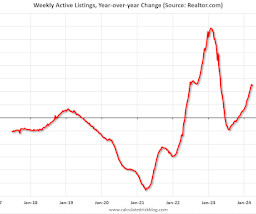

Housing April 1st Weekly Update: Inventory Up 0.9% Week-over-week, Up 26.0% Year-over-year

Calculated Risk

APRIL 1, 2024

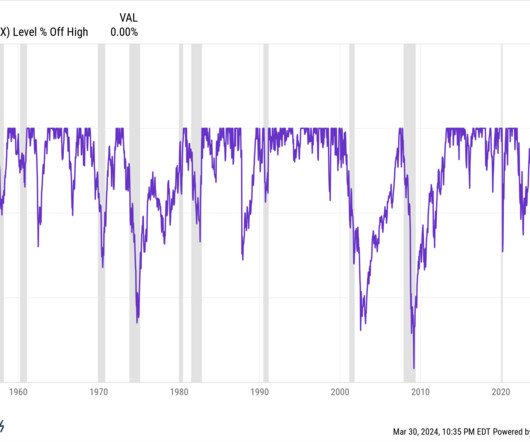

Altos reports that active single-family inventory was up 0.9% week-over-week. Inventory bottomed in mid-February this year, as opposed to mid-April in 2023, and inventory is now up 4.7% from the February bottom. Click on graph for larger image. This inventory graph is courtesy of Altos Research. As of March 29th, inventory was at 517 thousand (7-day average), compared to 513 thousand the prior week.

Let's personalize your content